FedEx And CarMax Are Canaries In The Coal Mine

There are a number of companies on a different fiscal year whose quarter ended at the end of August rather than September, and they therefore give us a preview of what to expect when Q3 earnings season swings into full gear in a couple of weeks. In this post, I will focus on FedEx (FDX) and CarMax (KMX) because I believe they are canaries in the coal mine.

FDX reported earnings on Sept. 21. It gave the first clear indication that something is amiss in the macro economy, as it badly missed earnings estimates due to supply chain issues and inflation. COO Raj Subramaniam said:

"The impact of constrained labor markets remains the biggest issue facing our business as with many other companies around the world and was a key driver of our lower than expected results in the first quarter… Labor shortages have had two distinct impacts on our business. The competition for talent, particularly for our frontline workers have driven wage rates higher and pay premiums higher.

"While wage rates are higher the more significant impact is the widespread inefficiencies in our operation from constrained labor markets. To illustrate this, I’d like to share a brief example from FedEx Ground. Our Portland, Oregon hub is running with approximately sixty five percent of the staffing needed to handle its normal volume. This staffing shortage has a pronounced impact on the operations, which results in our teams diverting twenty five percent of the volume, that would normally flow to this hub because it simply cannot be processed efficiently to meet our service standards.

"And in this case, the volume that’s diverted must be rerouted and processed, which drives inefficiencies in our operations and in turn higher costs. These inefficiencies included adding incremental line haul and delivery routes, meaning more miles driven and a higher use of third party transportation to enable us to bypass Portland entirely."

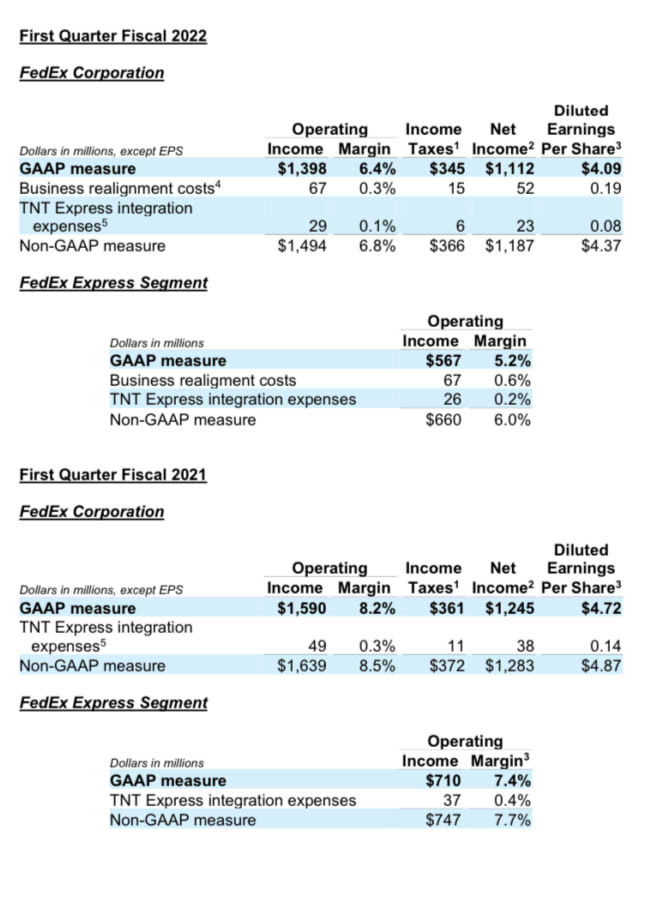

These supply chain issues affected FDX’s top line and increased its costs. The increased difficulty shipping packages constrained FDX’s volume while inflation squeezed its adjusted operating margin to 6.8% from its year-ago reading of 8.5%, as you can see in the above graphic. The result was a huge earnings miss and a 9% selloff in shares on huge volume the following day. Shares have continued to drift lower in the following days.

Sept. 30, KMX’s quarter showed similar issues with the supply chain and inflation. CEO Bill Nash said:

"[Inventory is] probably about 30% off of where we would normally target. In addition to the inventory headwind, we were understaffed and we still are understaffed, but not to the degree. We were understaffed pretty much across the board, and that’s important not only because it hinders our ability to hit our SLAs, but in some cases we just weren’t able to get back with customers, which is never a good thing, and so we’re working on that.

"Then I think also just a broader macro thing is just the used car valuations. I mean, year-over-year the acquisition prices are up about $6,000, and that may push some used car customers just out of the market."

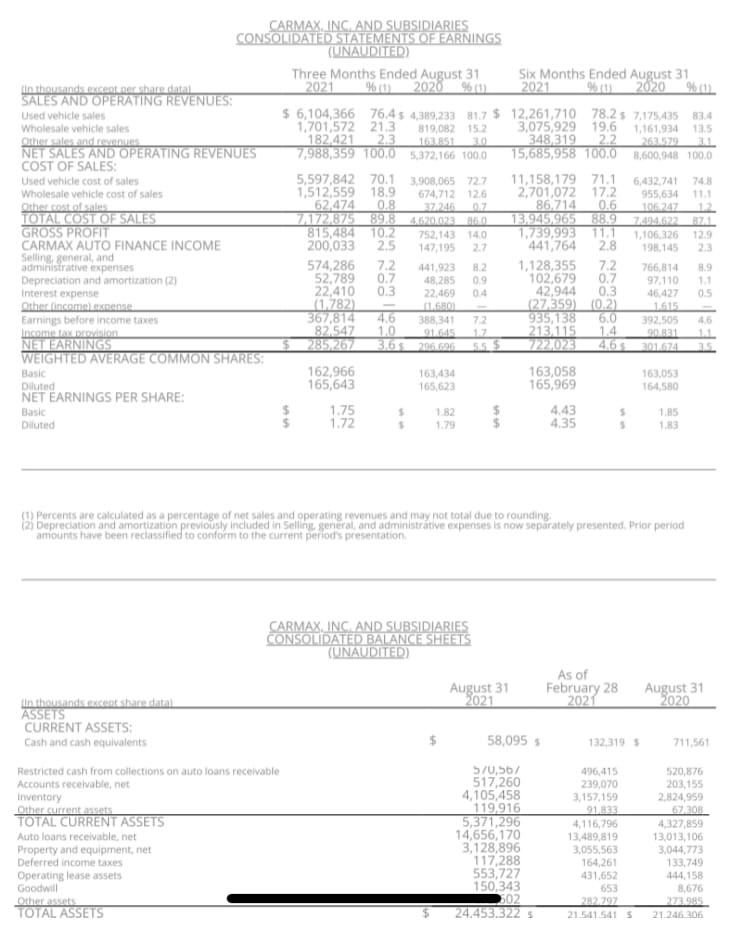

Lower inventory means lower sales, and used car vehicle COGS increased 43%, or almost $1.7 billion, resulting in a contraction of KMX’s gross margin to 10.2% from the year-ago reading of 14.0%, as you can see in the graphic above. Like FDX, these issues resulted in an earnings miss, sending shares down almost 13% on huge volume.

The crucial point I want to make is that these are not isolated issues specific to FDX and KMX. Many other reports I have looked at show similar issues with the supply chain and inflation. FDX and KMX are just very stark cases. Therefore, we can expect this to be an issue for many companies during Q3 earnings season, and the market reaction to FDX and KMX shows that this is not priced in.