FCX: A Core Copper Play In This Era Of Rising Demand

Image Source: Pixabay

When BHP Group Ltd. (BHP) walked away from its $49 billion bid for Anglo American earlier this year, Wall Street treated it as just another M&A soap opera — antitrust risk, deal structure, board politics. But that’s the sideshow.

The main event is this: the world’s largest miners are scrambling for long-term copper supply. And they’re doing it before most investors have even woken up to the problem.

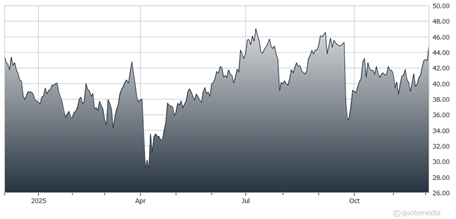

Freeport-McMoRan Inc. (FCX)

Copper doesn’t have the meme glamour of AI or the cocktail-party appeal of crypto. Yet if you believe in the electrification and digitization of the global economy, betting against copper today is a lot like betting against the internet in 1995.

So how do you actually put this thesis to work in a portfolio? You have four main routes, each with its own profile of risk, leverage, and complexity. Owning copper producers gives you operating leverage to the metal price. When copper rises, well-run miners can see profits grow much faster than the underlying commodity.

FCX is one core name, the flagship US-listed copper producer. It has globally diversified assets, a strong balance sheet, and significant leverage to copper pricing.

Recommended Action: Buy FCX.

More By This Author:

Midterm Elections: What History Suggests About Trading Stocks In 2026

Canadian Banks: How Earnings Looked At Three Top Institutions

Generac: Ignore Short-Term Weather Impact, Focus On Long-Term Opportunity