Canadian Banks: How Earnings Looked At Three Top Institutions

Image Source: Unsplash

The stock market has been betting it is a done deal that interest rates will be cut next week by the Federal Reserve. Meanwhile, in Canada, we have banks guiding the tape after earnings, highlights Amber Kanwar, host of the In the Money with Amber Kanwar podcast.

Canadian Imperial Bank of Commerce (CM) beat profit expectations – but analysts have been flagging some credit quality concerns. On the positive side, CIBC’s profit rose 16%, which was higher than expected. It also boosted its dividend by 10% (more than expected), margins were up across most units, and capital markets profit surged 62% from last year.

On the negative side, performance at its Canadian banking unit was mixed. Profit was up 14% from last year, but down sequentially as provisions for credit losses came in higher than expected and impaired loans rose.

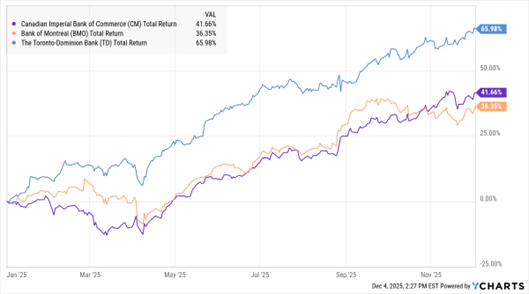

Canadian Banks Chart (Year-to-Date Percentage Change)

Data by YCharts

Bank of Montreal (BMO) beat profit expectations, boosted its dividend 2.5%, and surprised investors with lower-than-expected provisions for loans that could go bad. Recall that credit quality concerns, particularly in the US, hampered the stock in 2024. Bank of Montreal is releasing some of those reserves for its US business in a sign of recovery, while increasing them in Canada.

Toronto Dominion Bank (TD) beat profit expectations, aided by strong capital markets growth and lower-than-expected provisions for credit losses. It also boosted its dividend (although it was less than expected), and showed robust growth in the US despite its asset cap.

Toronto Dominion Bank cannot grow its asset base in the US beyond $434 billion as a result of penalties from regulators due to its anti-money laundering lapses last year. It still managed to grow profit more than in the US – and noted that it still has room to grow under the asset cap as assets sit at $382 billion.

About the Author

Amber Kanwar hosts the investing podcast "In the Money with Amber Kanwar." Throughout her 15-year career, she has interviewed hundreds of portfolio managers, CEOs, political leaders, and newsmakers from around the world, becoming one of Canada’s most trusted and recognizable business journalists.

For over a decade, Ms. Kanwar was a familiar face on Canada’s flagship business channel, BNN Bloomberg. She has also appeared as a contributor on CTV and Bloomberg.

More By This Author:

Generac: Ignore Short-Term Weather Impact, Focus On Long-Term OpportunityEveryone Reacts To Volatility, But Smart Investors Do This

Retailers: Three Reads On Consumer Spending Ahead Of The Holidays