Fannie And Freddie: The Next Crisis Is Coming

Last week, Dick Bove of Raffety Capital put out a research note stating that Fannie Mae (FNMA) and Freddie Mac (FMCC) could be reformed sooner rather than later. His justification for this was the fact that the companies may be forced to take losses due to new corporate tax law changes. In this matter Fannie and Freddie would be forced to take money from Treasury again if their capital dipped below zero.

Here's the reality of the deferred tax asset mess. Fannie and Freddie lost billions of dollars during the subprime mortgage melt down crisis. This is partly due to congressional mandates that they purchase non-qualifying mortgage back securities from private label issuers. The mortgage meltdown was so intense, though, that it also affected their conforming mortgages.

Ironically, when a company loses money they build what's called a deferred tax asset. This deferred tax asset is simply the net operating losses times the corporate tax rate with a few more details mixed in. So contractually a company should be allowed to retain this DTA and use it towards a future earnings. In the case of Fannie and Freddie, in 2012, the company's were forced to change the way they accounted for earnings. Instead of keeping earnings for future periods of potential loss, the earnings were then swept to the government to pay for deficit reduction.

Thus, the contractual right to defer taxes was stripped by Treasury action. Indefinitely. Unilaterally. No other company has received treatment like this. (Well, there are some historical comparatives, but not exactly the same. The Supreme Court ruled in favor of shareholders in those cases.)

So this makes an interesting situation because they've sent all this money back treasury. Yet they have a DTA on their books. It just has no value because the equity has been swept away. Now if the corporate tax rate was to change from, let's say, 35% to 30%, then 5% of that DTA would be worthless. The impact of making that asset worthless would be that a net loss which flow through the income statement to the balance sheet. Not ideal.

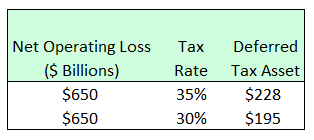

The calculation shown here is a hypothetical example. Actual figures are not being used because the model to calculate the deferred tax asset is more complicated than this simple example. To illustrate how a loss can be generated through a change to the tax code, this should suffice. If a company had net operating losses of $650 billion and the corporate tax code rate was 35%, then the resulting DTA would be about $228 billion. If the tax rate dropped to 30%, then the DTA would also drop in value to $195 billion. The difference between the two values would be recorded on the income statement as a loss of $33 billion. After flowing through the income statement, the asset on the balance sheet would be reduced by the same amount, give or take. Tax law is much more complicated than this example. So, do your own due diligence.

Fannie and Freddie currently rely on treasury for all capital draws in excess of the retained earnings. So, if their net worth slipped into negative territory, taxpayers will be on the hook yet again. Meanwhile, there appears to be no reasonable way of reforming these companies fast. Treasury would have to change the contract with the companies again. This might mean that instead of issuing those warrants at less than a penny, they might have to issue them with a strike price. In this way they could issue the warrants so that capital is raised by the issuance as opposed to simple dilution with no positive effect.

There may be additional capital also hiding on the balance sheet. Several years ago, on Seeking Alpha I did an analysis of the loss reserves and it showed that the companies were significantly over reserved for losses in comparison to companies like Bank of America. So there may be another $40 billion sitting on the balance sheet that is not recognized as equity.

I've also covered the fact that guarantee fees may be a potential asset for the company to use going forward. In fact that guarantee fee asset could be as much as $80 billion. So in a best case scenario, if they did end the net worth sweep and corporate tax law changes were to occur, the company still could have $100 billion in equity. Best case. That's assuming the auditors and accountants aren't doing a great job. More realistically the companies are going to need to take a withdrawal from Treasury to cover any losses.

Disclosure: Long Impac Mortgage (IMH), Fannie Mae (FNMA), and Freddie Mac (FMCC), primarily in the form of preferred stock shares.

Thanks David I enjoyed your articles. As far as the DTAs are concerned another possibility is that the equity already taken by the Government can be deducted out of the potential value of Gov't stock warrants. To me it seem the warrants are the big elephant in the room; they can make everything and everyone whole: FnF, the upcoming administration, and investors.

Agree. The government has been paid back. The warrants provide dilution but no additional value. It would make more sense to issue a portion of them with a strike price. If capital is successfully raised, then another round could be issued to the market.

Also, update to the disclosure, I do not hold any GSE equity and have no financial interest in the stock. This issue is important to me. We need an equity backstop in the housing finance market.