Fall Down Friday – China Strikes Back With 34% Tariffs On ALL US Goods

Who needs who more?

As President Trump heads off to play golf, China remains at work, swiftly (instantly) retaliating against US Exports ($150Bn) with a 34% ($50Bn) tariff in response to Trump’s 54% (20% “Fentanyl Penalty” plus 34% newly announced) tariff on $450Bn ($243Bn) Chinese goods.

Of course that means China is taxing their people $50Bn if they continue to buy high-priced US goods (spoiler: they will not) while the US consumers will be penalized $250Bn if they continue to buy low-priced Chinese goods (spoiler: they will) and, already this morning, the VIX is at 40 and the Futures are down another 3-4% (so far).

(Click on image to enlarge)

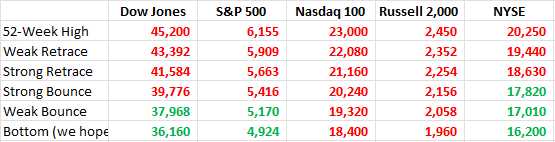

This is a “Long Squeeze” which is the opposite of a Short Squeeze in that too many people were long (not us, thank goodness!) due to ostrich-like behavior in which they ignored our continuous warnings not to be (see: “PhilStockWorld Q1 2025 Review – Making Sense of the Market Madness Before Taking our Next Step“) and now we are getting the 20% (total, HOPEFULLY) drop we expected since last year. In fact, here are our bounce chart predictions:

The Nasdaq and the Russell, who were our leaders going up are now our leaders going down – breaking below a 20% correction from their Nov/Dec highs – when they were all so happy that Trump was elected (and weren’t we all?). It is still Lent (through April 17th) and I have promised not to pick on President Trump because people said I was being too mean and not giving him a chance to ruin the country so – challenge accepted!

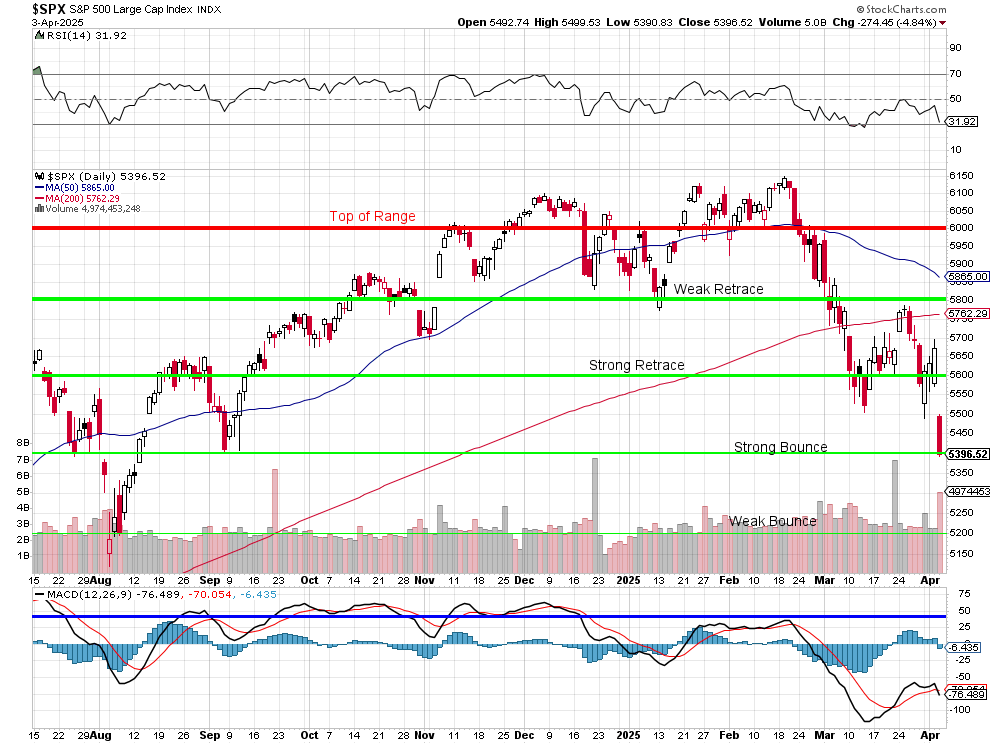

Don’t be deceived by our S&P chart either as it’s the BLUE line at S&P 5,000 that is our base for the S&Ps valuation BUT that was WITHOUT this F’ing madman’s Trump’s tariffs which are not just ensuring runaway inflation and a Recession (Stagflation for short), but is also brining the end to the Renaissance of Global Free(ish) Trade that has been driving the economic boom we’ve been enjoying since the 1990s – literally over Ross Perot’s dead body! (he got 19.7M votes in the 1992 election)

And don’t be fooled by the red line on the S&P at 5,396 as China’s rebuff already has the Futures down ANOTHER 180 points so we’re already at the weak bounce line at 5,200 and look how close we are now to forming a DEATH CROSS where the 50-day moving average goes below the 200 dma, which is a powerful technical signal for a downtrend AND don’t forget what I’ve been saying: Those RSI and MACD readings aren’t going to save you because the FUNDAMENATALS (no tariffs/tariffs) have DRASTICALLY changed – which renders those indicators meaningless.

More By This Author:

Stopping the Slide?Monday Market Outlook: Consumer Confidence, Fed Announcement And Non-Farm Payrolls

Weakening Wednesday – Markets Down Ahead of the Fed

Click here to try Phil's Stock World free. Try PSW's ...

more