Facebook: Buy The Dip Before The Stock Goes Much Higher

It's hard to believe, but this is now my 500th public article on Seeking Alpha. Before we begin discussing Facebook (Nasdaq: FB) and why I think the stock is a strong buy here, I want to express my gratitude to all my readers and the folks at Seeking Alpha for making this experience possible. Thank you all very much, I wish you all the best, and I sincerely hope that you continue enjoying reading my articles.

Now, About Facebook

Facebook's stock cratered by 17%, while the S&P 500 (SPX) only declined by roughly 7% during the recent pullback. Moreover, since the correction began in early September, Facebook has been down by a significantly higher margin than its mega-cap tech counterparts. Some market participants may blame the massive data leak, and some say it was the overheated market dynamics that brought Facebook down this far. However, regardless of the catalysts, I am grateful for this buying opportunity. Facebook remains the dominant social media conglomerate on the planet, and the stock looks very tractive right now.

At roughly 20 times forward EPS estimates, the stock is relatively cheap. Also, the negative news flow that helped bring the shares lower is fading and should continue to resolve with time. Moreover, Facebook should continue to grow revenues and increase EPS in future years, and the company's stock price will likely continue to move notably higher from here.

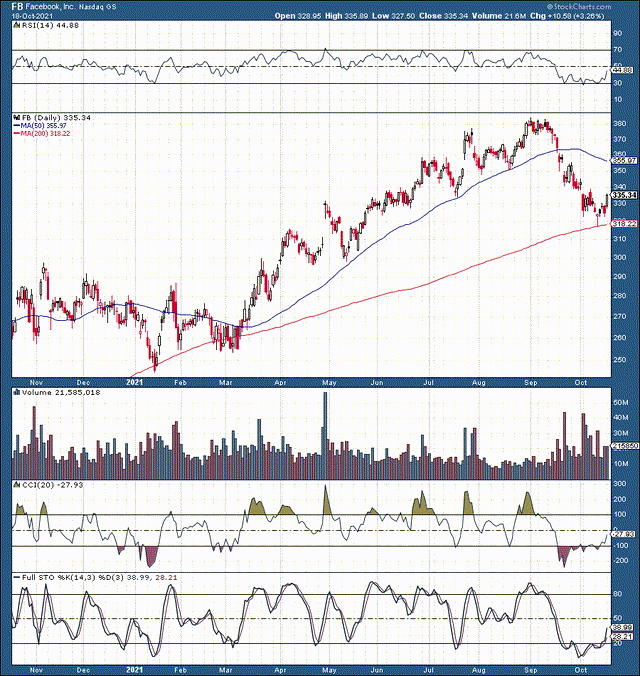

The Technical Image is Turning Bullish

Source: stockcharts.com

Facebook declined by approximately 17% from its recent ATH peak to a low of around $318, right at the company's 200-day moving average. We see that the Relative Strength Index ("RSI") dipped below 30 for the first time in over a year. The last time the RSI was close to 30 was at a low point in early 2021. The CCI was also down at a comparable low point back then. The stock relied by about 50% to the recent ATH off that shallow level in early 2021.

Facebook may be set up for another significant rally into year-end and early 2022 now. We also see the full stochastic turning positive, implying that momentum is now shifting in Facebook's favor. Generally, Facebook's technical image is quite bullish and suggests that notably higher prices are likely coming in soon.

Data Breach News Fading

Facebook is not immune from data leaks and bad press. The company experienced a severe breach relatively recently, where the personal information of hundreds of millions of people got hijacked. The company also caught a great deal of bad press due to this incident, and the stock price suffered. However, this period of increased scrutiny around Facebook is a transitory phenomenon. Many market participants may not even remember this disturbance a year from now. Also, I don't think that Facebook lost many users due to the breach. On the contrary, the company continues to grow its user base, revenues, and EPS perpetually.

Facebook Keeps On Growing

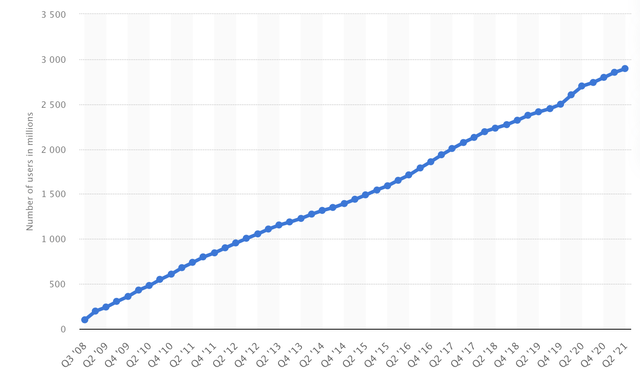

Monthly Active Users ("MAUs") Worldwide

Source: statista.com

Facebook continues to grow, as the company's MAUs are around 3 billion now, roughly 10% higher than last year. While user growth may continue to slow down, Facebook should continue to become increasingly more profitable.

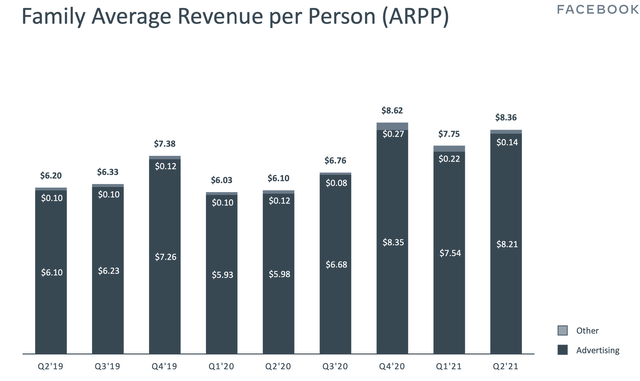

Source: Facebook

If we look at Facebook's average revenue per user, there is apparent growth here. We see massive growth of about 37% on a YoY basis. Inflation and other variables likely impacted the growth figures, and we should continue to see a positive dynamic as we advance. Naturally, the company won't show stellar growth every year, but we can expect the upward trend to continue in the ad revenue per user segment, in my view.

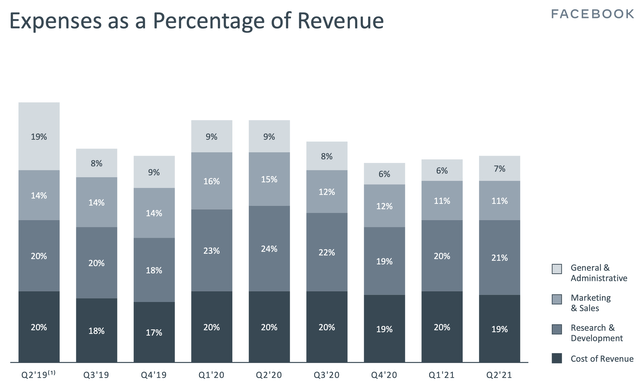

Source: Facebook

On the other side of the equation, Facebook's expenses as a percentage of revenues are down to 7% from the 9% mark a year ago. So, we see that Facebook continues to look at costs as a priority as the company strives to become more efficient.

Source: Facebook

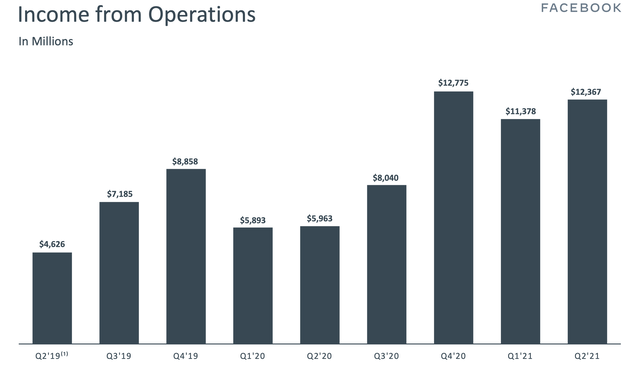

Therefore, we see massive gains in the company's operating income. In Q2, operating income rose by about 107% on a YoY basis. The company's operating margin increased to 43%, significantly higher than the 32% in the same quarter a year ago.

Source: Facebook

Source: Facebook

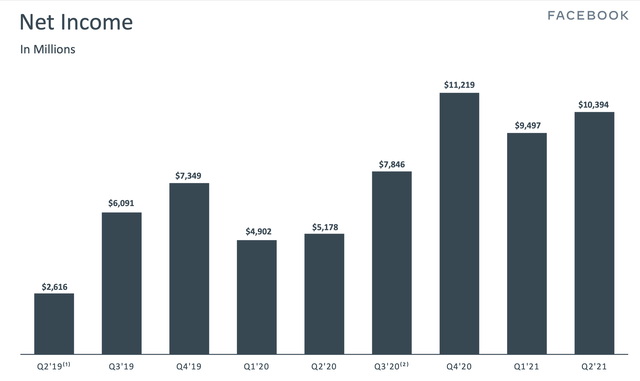

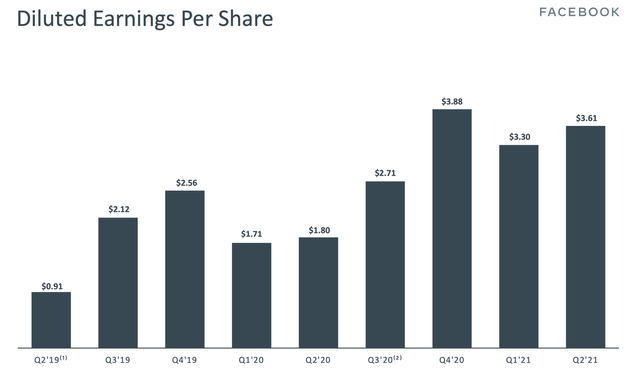

Thus, we see the positive operational dynamic translate into substantially higher net income and EPS over last year. Net income and EPS rose by about 100% over the same quarter the previous year. Simultaneously, if we look at the company's share price, we see that the stock is only about 20% higher than it was one year ago.

The Bottom Line: Facebook's Valuation is Too Low

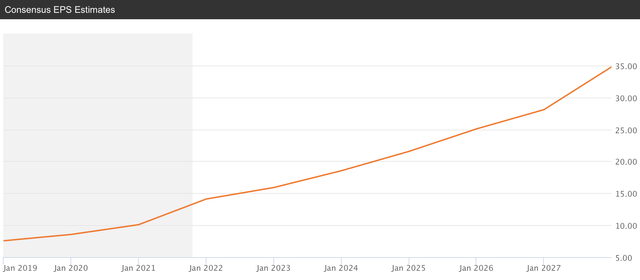

Facebook sports a very low valuation for a dominant, market-leading growth name. With roughly $16 in EPS expected in full-year 2022, Facebook's forward P/E ratio is only around 20. This ratio is remarkably low given the company's anticipated revenue growth of roughly 18% this year. Moreover, Facebook has a strong growth runway ahead, as the company should continue to produce double-digit growth for many years as the company moves forward.

EPS Forecasts

Source: seekingalpha.com

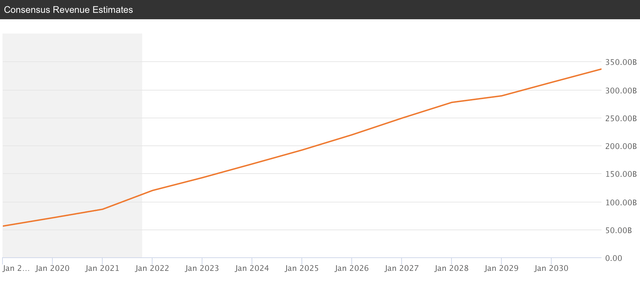

Revenue Projections

Source: seekingalpha.com

We see that the company's EPS should more than double to roughly $35 by around 2028, and the company's revenues should reach about $350 billion by around 2030. While these estimates may seem robust, Facebook hasn't experienced any difficulties surpassing analysts' expectations recently.

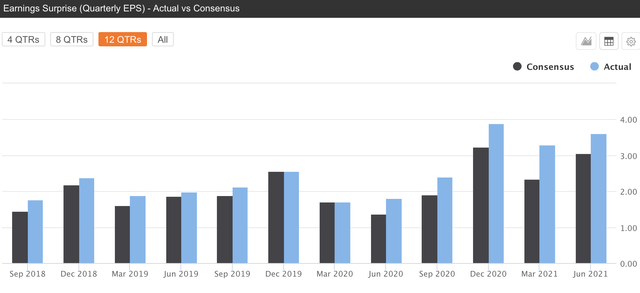

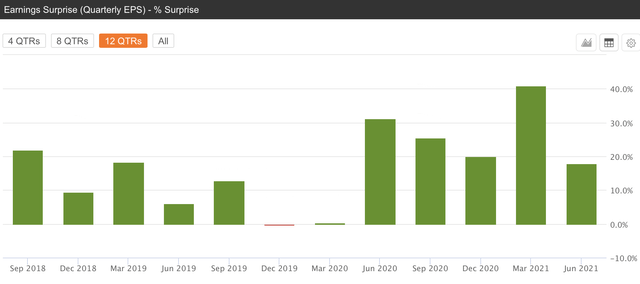

Earnings Surprises

Source: seekingalpha.com

Source: seekingalpha.com

Moreover, Facebook has a tenacity for surpassing analysts' expectations continuously. Looking back on the company's past 12 quarters, we see that Facebook has beat in all except one quarter. The average beat in its last three years of operations is roughly 17% per quarter. Therefore, I am confident that Facebook can continue to outperform analysts' expectations in future quarters and years as we advance.

Here is what Facebook's valuation could look like going forward:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue growth | 20% | 18% | 15% | 14.5% | 14% | 13% | 10% | 8% | 7% |

| EPS | $16 | $20 | $24 | $28 | $32 | $36 | $40 | $44 | $50 |

| Forward P/E ratio | 25 | 24 | 24 | 23.5 | 23 | 22.5 | 22 | 21 | 20 |

| Price | $500 | $576 | $672 | $752 | $828 | $900 | $968 | $1,050 | $1,200 |

Source: Author's Material

I want to point out that Facebook currently trades at a lower P/E relative to its mega-cap tech counterparts. For instance, while Facebook trades at a forward P/E of just 20 right now, its closest competitor, Alphabet (Nasdaq: GOOG) (Nasdaq: GOOGL), trades at about 26 times forward earnings estimates. Microsoft (Nasdaq: MSFT) has a choppy growth trajectory ahead but trades at about 35 times forward EPS estimates. Apple (Nasdaq: AAPL), a company with questionable future growth, sells at a whopping 26 times forward EPS estimates right now.

Therefore, relative to its peers, Facebook is cheap right now and deserves a higher P/E multiple, in my view. Thus, we should see Facebook's P/E multiple expand to at least around 25 next year, and then we could see the P/E multiple persist around the mid-twenties for a while as revenue growth remains above 10% in the future years. I expect Facebook's upward trajectory to continue from here. The stock should hit $500 sometime next year and should continue to march higher after that.

Disclosure: I/we have a beneficial long position in the shares of FB, GOOG either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses solely my ...

more