Fabless Semiconductor Stock, MPWR, Was Up 17.5% In August - Here's Why

Image Source: Unsplash

Introduction

Semiconductor companies that design their own semiconductor chips but outsource the fabrication of them to specialized manufacturers as opposed to doing so themselves (i.e., are fabrication-less or "fabless") to avoid the massive capital costs of owning a fabrication plant and this market is projected to more than double by 2034.

The AI Hardware Sector

The AI hardware sector consists of 6 distinct sub-segments, each with its own unique dynamics and growth trajectories. The first 4 sub-segments are referred to as the semiconductor value chain and consist of the 4 stages in the pure-play design, production and testing/packaging of semiconductor wafers (chips), namely:

- software design companies that are involved exclusively (i.e. pure-play) in the custom design of complex semiconductor chips using sophisticated electronic design automation (EDA) software.

- production equipment and material companies that provide essential equipment for manufacturing chips such as lithography machines, and production materials such as chemicals and gases.

- manufacturing companies, called foundries in industry jargon, that concentrate all their efforts in the fabrication of chips based on the designs provided by other semiconductor companies.

- assembly/testing/packaging companies that assemble chips into finished semiconductor components, tests for defects and do the very specialized packaging of the chips for shipping.

The 5th sub-segment consists of hardware companies that design their own semiconductor chips but outsource the fabrication of them to specialized manufacturers (i.e., are fabrication-less or "fabless") as opposed to doing so themselves to avoid the massive capital costs of owning a fabrication plant and this market is projected to more than double by 2034.

August Catalysts

Monolithic Power Systems (MPWR), one of the 6 largest pure-play fabless semiconductor companies trading on U.S. stock exchanges and a constituent in our Pure-Play Fabless Semiconductor Stocks Portfolio, is contributing significantly to that growth as reflected by its stock price that was UP 17.5% in August (and UP 44% YTD). Below are catalysts for the surge in August:

- Aggressive Q2 Revenue Growth: Q2 revenue was up 4.2% vs. Q1.

- Optimistic Q3 Guidance: management projects a 7% to 10% increase in Q3.

- Favorable Analyst Ratings/Price Targets: 7 of the 13 analysts that cover MPWR issued new ratings in August of which 3 had "Strong Buy" ratings, 2 had "Buy" and 2 had "Hold" with 2 of the analysts targeting a 12% increase in MPWR's stock price over the next 12 months.

- AI Infrastructure Tailwinds: MPWR is a key supplier of power management chips for AI data centers, a sector exploding with demand, and investors recognized its mission-critical role in next-gen AI hardware, driving speculative and institutional buying.

Pure-Play Fabless Semiconductor Stocks Portfolio

As mentioned above, there are 6 constituents in our Pure-Play Fabless Semiconductor Stocks Portfolio and below are their performances in August, in descending order:

- Monolithic Power Systems (MPWR): UP 17.5% in August

- Qualcomm (QCOM): UP 9.5%

- Broadcom (AVGO): UP 1.3%

- Nvidia (NVDA): DOWN 2.1%

- Advanced Micro Devices (AMD): DOWN 7.8%

- Marvell Technology (MRVL): DOWN 21.7%

The Portfolio was UP 6.8% in August and is now UP 26% YTD.

Portfolio Performance Chart

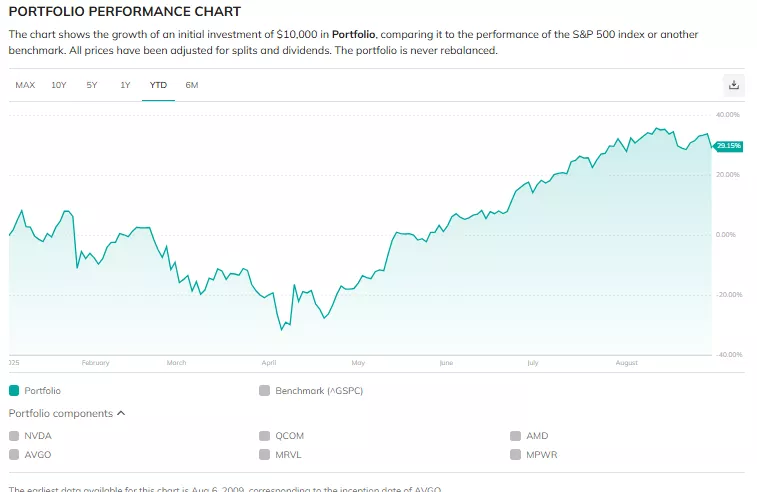

To my knowledge PortfoliosLab.com is the only site that enables an investor to create a chart of the performance of a portfolio and below is a chart snapshot of the portfolio's performance since the beginning of 2025.

(Click on image to enlarge)

Source: PortfoliosLab.com - the only site that enables an investor to create a chart of a portfolio, not just an individual stock or ETF. Go here to create your own portfolio chart. The steps are clear so it's fast and easy.

More By This Author:

AI-Focused Drug Discovery Stock ABSI Was Down 16% In August - Here's Why

American Cannabis MSO Stocks Portfolio Was Up Dramatically In August - Here's Why

Psychedelic-Compound Based Stock, Atai, Went Up 12% In August - Here's Why

Please note that I have no financial interest in PortfoliosLab. I am just a very impressed subscriber who finally found a way to provide charts of my frequent articles posted on ...

more