Everyday High And Higher Prices

Joel Bowman, checking in today from Buenos Aires, Argentina...

“You’re going to be reluctant to buy the two stocks I’m introducing in today’s letter.” So began Bonner Private Research’s Investment Director, Tom Dyson in his weekly update to paying members on Wednesday. “This idea might even seem a little crazy...”

We’ll get back to Tom in a second. First, the week in review...

It was a rough one for stocks. First came Jerome Powell, with a much-anticipated 50-basis point rate hike. The Fed Head insists more data is needed before it changes tack on its quest to quell inflation. Here he is, in his own words, courtesy of Fox..

"The largest amount of pain, the worst pain would come from a failure to raise rates high enough and from us allowing inflation to become entrenched in the economy."

~Jerome Powell, Dec 14, 2022

Fed policymakers said interest rates will likely rise to 5.1% in 2023, higher than initial forecasts, in the fight to bring the 7.1% inflation rate down. Astute readers of these pages are cautioned to “mind the gap” between these two figures. Even in the hypothetical situation described above, the Fed still lags inflation by 200-basis points.

If Bill and Dan are right, and the Fed (historically) needs to be 200-basis points ahead of inflation... that leaves a 400-basis point shortfall. (More from Dan on the Fed’s fight, below.) As it happened, the Dow fell as much as 400 points during the session, before dusting itself off and staggering to its feet.

Lag and Fizzle

Then came Thursday’s news that manufacturing was beginning to lag and retail sales were starting to fizzle. From Reuters:

Production at U.S. factories dropped more than expected in November as a decline in the output of motor vehicles offset gains elsewhere, according to data on Thursday, which showed manufacturing retaining some momentum.

Manufacturing output fell 0.6% last month, the Federal Reserve said on Thursday. Data for October was revised higher to show production at factories gaining 0.3% instead of the previously reported 0.1%. Economists polled by Reuters had forecast factory production would dip 0.1% last month.

The Mighty American Consumer, too, appears to be tapping out. Apparently the “Everyday High and Higher Prices” served up to him by his spendthrift government are not exactly inspiring confidence at the Christmas gift counter. Ho-hum.

Markets fell for a third consecutive day on Friday, with the Nasdaq slipping below its 50-day moving average and the S&P 500 dropping to its lowest level since November 9. The S&P 500 was 2.1% lower on the week, the Dow down by 1.7% and Nasdaq off 2.7 %.

It appears Dan was right when he guessed that November might be “the grinch that stole December’s Santa Claus rally.” The October-November bounce off the September 30 lows for the year appears to have run out of puff.

In the face of markets turning to the downside and growing consensus around a deepening 2023 recession, might the Fed be tempted to ease up a little?

First, let’s go back to Dan for some key insights he shared with BPR members in yesterday’s market note...

Even after Wednesday’s Fed rate hike–the seventh this year–there are still some investors who believe the central bank won’t or can’t hike nominal rates higher than 5%. The target rate for the Fed is now between 4.25% and 4.50% after Wednesday’s 50 basis point hike. Is the Fed done?

Not according to Jerome Powell and other Fed governors. They all promised more ‘pain’ from higher rates, including higher unemployment and falling house prices. But Powell himself said there’s no chance the Fed will move its inflation target to 3-4%, instead of 2%. And he pointed out that the long-term damage of entrenched inflation is worse than the short-term damage of a recession.

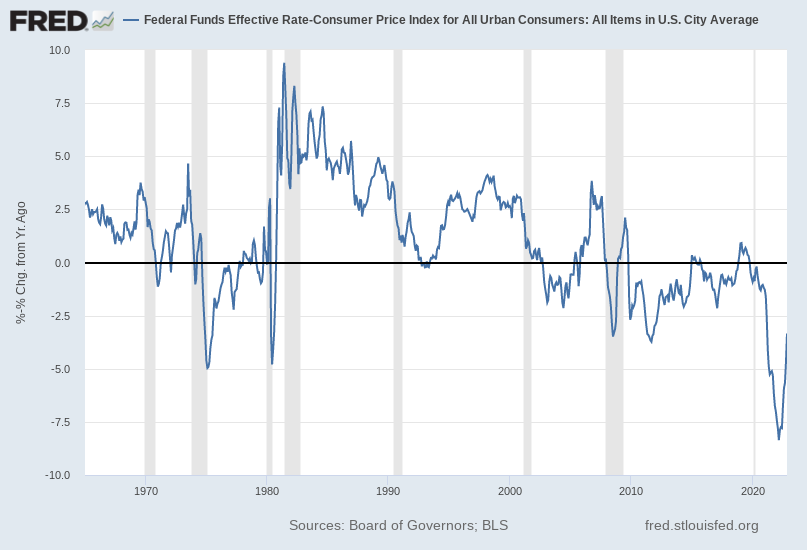

(Click on image to enlarge)

(Source: US Federal Reserve)

Then there’s the chart above to consider. I’m showing it to you (again) because when adjusted for inflation, real interest rates are still negative. The ‘policy’ rate would have to rise another 333 basis points just to get to zero. The Fed isn’t done yet. Even if inflation is slowing down, it’s still at 7%!

One other observation about the chart. Two actually. First, there are three previous instances where rate hike cycles took rates from negative, in real terms, to positive. It happened between 1971 and 1975, between 1975 and 1980, and between 1980 and 1981 (this last was necessary because the Fed declared victory over inflation too soon in 1980, only to see inflation come roaring back).

The total trough-to-peak increase in real rates was 578 basis points in the first instance, 800 basis points in the second, and 1,419 basis points in the third. At present, this rate hike cycle has seen around a 500 basis point rise from the trough in March, when real rates were -8.35%. My point? If this cycle is more like the 1980-81 cycle, real rates (and nominal rates) will go much higher.

The second point is also one I’ve made before but it bears repeating. For stocks, the real pain doesn’t kick in until AFTER the Fed starts cutting rates. First recession. Then rate cuts. At this point, it looks like a recession in the first or second quarter of 2023 and then MAYBE rate cuts. And you wonder why stocks had a shocker the last few days...

Meanwhile, long time readers have no doubt heard the old Wall Street adage, “Don’t fight the Fed.” Despite Mr. Powell’s assurance that he will not waiver, investors continue to be suckered into bear traps. The question, then, is what to do?

Tom Dyson offered some clarity in Wednesday’s weekly update. Here, he is, summing up his own approach in a nutshell:

Our strategy is simple. We think we’re at the end of an epic era of falling interest rates and we’re at the beginning of a new epic era of rising interest rates. We think interest rates are the most important variable determining general returns on investment. So, in its most simple terms, our strategy is to do less of what worked between 1981 and 2021 and more of what didn’t work between 1981 and 2021.

In other words:

Less investing, more saving

Less offense, more defense

Less buy-and-hold, more opportunistic trading

Less growth, more value

Less paper assets, more real assets

Less diversification, more concentration

As for the “opportunistic trading” component, Tom offered a couple of ideas this week, a pair of “cheap, 'golden goose' stocks that pay dividends, too.”

“It’s a great way to play the Trade of the Decade,” wrote Tom, “with a shorter window and with more immediate benefit. Plus these stocks are VERY cheap, their stocks have fallen 44% and 53% over the last eight months, and they’ll likely combine to pay more than 20% a year in dividends over the next couple of years.”

The last “tactical trading” position Tom closed out was a microcap foreclosure specialist. The play returned 52% in around 3 months. Obviously not ALL trades work out so well, and past performance is no guarantee of future results... but you can see for yourself the basic strategy Tom’s going for. Priority #1, preserve capital. Meanwhile, be alert to market distortions that may deliver exceptional capital gains and/or dividend income along the way.

If that makes sense to you, find a subscription plan that works for you below and become a Bonner Private Research member today.

More By This Author:

The Fed's FalloutInflation Nation

End. The. Fed.