Ethereum Outperforms The Market… For Now

Crypto Market Musings

Can August please come back? On August 1, bitcoin was trading around $23,000. On August 31, it was trading around $20,000. As of this writing, it’s trading around $19,360. I like August’s numbers better.

My general approach to bear markets is summed up pretty nicely by this meme:

But this past week, I’ve been feeling that this will be the best way to describe the crypto market for the next few months:

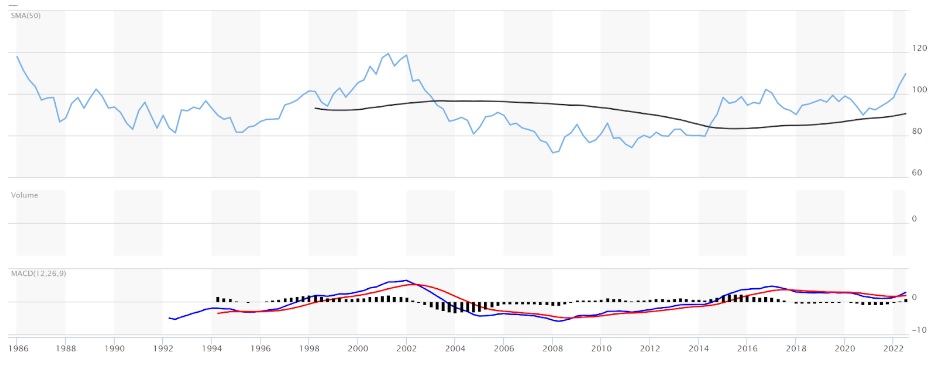

I believe we’re going to be in for a bumpy ride the rest of the year. The crypto markets won’t bottom out until the dollar softens and the equity markets bottom out. And that won’t happen until interest rate hikes slow down and it looks like the Fed has inflation under control. The charts below nicely sum up the problems facing the crypto markets.

(Click on image to enlarge)

The chart above (from MarketWatch) shows the rising strength of the dollar index (DXY). If the Fed continues to raise rates as expected, the dollar will approach historical highs in terms of strength.

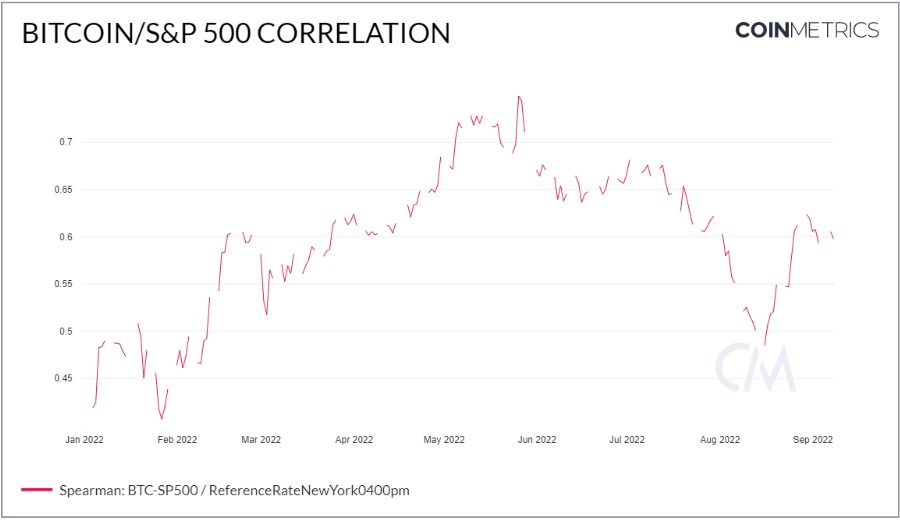

(Click on image to enlarge)

This chart shows the correlation between S&P 500 and bitcoin prices. As I wrote back in July, here’s how correlation works:

Correlation is measured on a scale from -1 to 1. The closer you are to 1, the more positive the correlation. A correlation coefficient of more than 0.4 is considered statistically significant. Correlations ranging from 0.5 to 0.7 indicate a moderate correlation. Correlations ranging from 0.8 to 1 are considered strong correlations. Two assets with a strong correlation means they will track each other closely in the same direction. So if asset A goes up, asset B will go up. And if asset A goes down, asset B will go down in a similar fashion.

Right now, the correlation between the S&P 500 and bitcoin is in the 0.6 range. So the combined pressure of dollar strength and higher interest rates driving the stock markets down will likely send the crypto markets tumbling down even further.

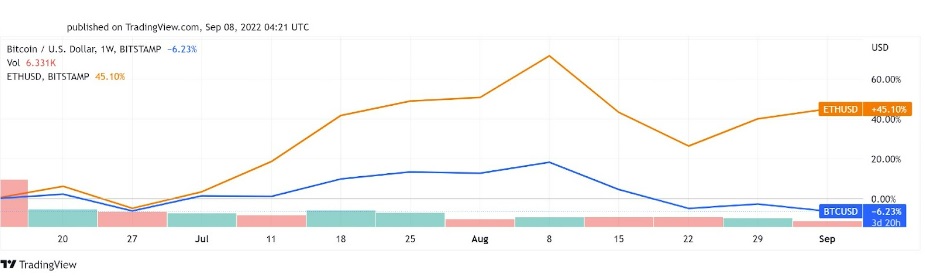

Ethereum is outperforming the market thanks to the upcoming September 15 Merge (Ethereum’s shift from a proof of work protocol to a proof of stake protocol). As of this writing, ethereum is trading around $1,600. Here’s how ETH compares to BTC since mid-June.

(Click on image to enlarge)

The big question is, how long will ETH outperform the markets? Right now, pre-Merge excitement is fueling ethereum’s surge while the broader markets suffer. But what happens after the Merge is a big unknown.

There are two forces at play here. The macro environment for crypto is terrible. But the micro environment for Ethereum is terrific. The shift from proof of work to proof of stake is a major technical achievement. And if the shift works as planned, Ethereum will be dramatically faster and more scalable. So the real question is, can Ethereum’s Merge momentum overcome the larger downward pressure of the crypto markets?

My best guess is Ethereum will hold its own in the near term. But the bear markets will catch up with it eventually — possibly a few weeks after the Merge — and ethereum’s price will track more closely with the broader crypto markets.

And Finally…

Some people love themed weddings. Some people hate them. I really don’t care. As long as the two people getting married are having fun, I’m game for anything. And I have to admit, I really would have (I think) enjoyed attending this bitcoin-themed wedding. Guests were given a tiny amount of bitcoin as a thank you for attending — which makes sense given one of the people getting married runs a bitcoin-themed escape room in Lebanon. Looks like everyone had some fun and he brought some new people into the bitcoin universe. Sounds like a successful wedding to me.

More By This Author:

The Three Eras Of The Collectibles Market

How Startups Can Help The Inflation Reduction Act

The Search Engine Market Is Waiting to Be Disrupted