Equity Bulls Probably Eyeing Wed’s CPI To Give Additional Boost To Weary Indices

If Wednesday’s CPI for April cooperates, equity bulls will try to use it to build on last three weeks’ momentum. Major US equity indices have rallied back to just under their all-time highs from March but are giving out signs of fatigue.

The S&P 500 rallied 1.9 percent last week to 5223. From the low of April 19th through last Friday’s high, it is up 5.8 percent, which just about recovered the 5.9-percent drop from the March 28th peak of 5265.

The large cap index has now rallied for three consecutive weeks. At Friday’s close, it is 0.8 percent from the March peak. In late March and early April, bulls were rejected at 5260s in three sessions over seven before coming under pressure (Chart 1). They would obviously try hard to test those highs again, even as signs of fatigue are showing up.

Last week, on the daily, a couple of sessions ended with a doji, and volume has been nothing to write home about.

At this point, with handsome gains the last three weeks, bulls are desperate for a catalyst. It is most probably not going to be earnings.

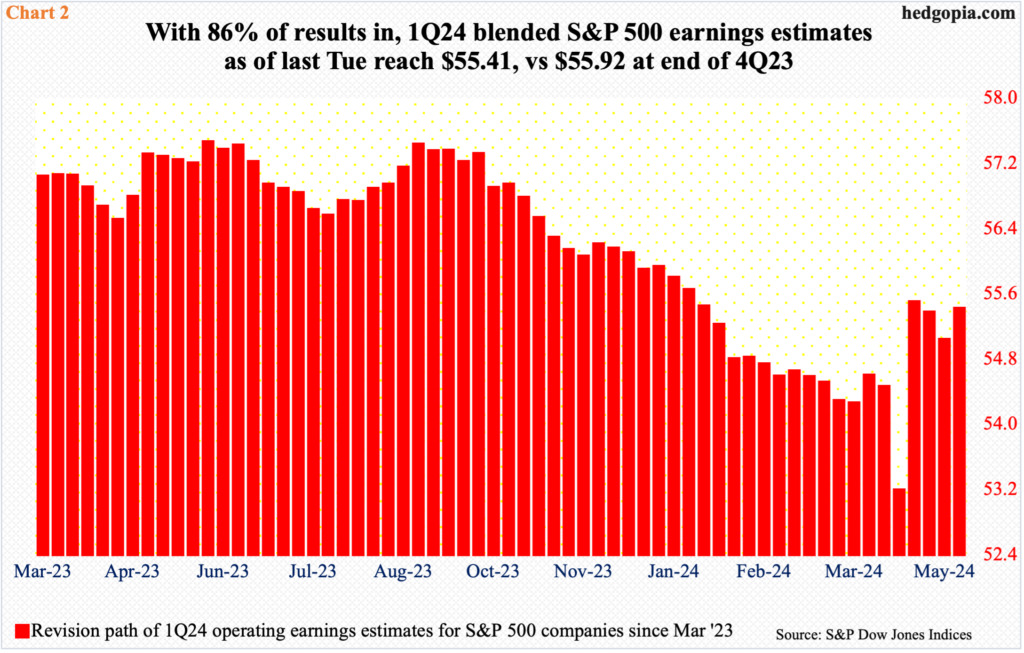

The March-quarter earnings season is just about done. As of last Tuesday, 85.6 percent of S&P 500 companies had reported their numbers, with blended operating earnings coming in at $55.41 (Chart 2), which witnessed a nice bump from mid-April’s $53.18, aided primarily by big tech. That said, when the March quarter began, the sell-side was expecting $55.92, and $57.45 last May.

Speaking of which the consensus this year is $241.74, which will have registered a growth rate of 13.2 percent from last year. In 2023, earnings grew 8.4 percent and fell 5.4 percent in 2022. Next year, for whatever it is worth, this year’s momentum is expected to continue with growth of 13.9 percent. If past is any guide, these analysts customarily bring out the scissors as the year progresses. At its height in September 2022, earnings were expected to jump 14.7 percent in 2023.

Bulls are probably eyeing something else to potentially provide a fillip to the latest momentum in equities.

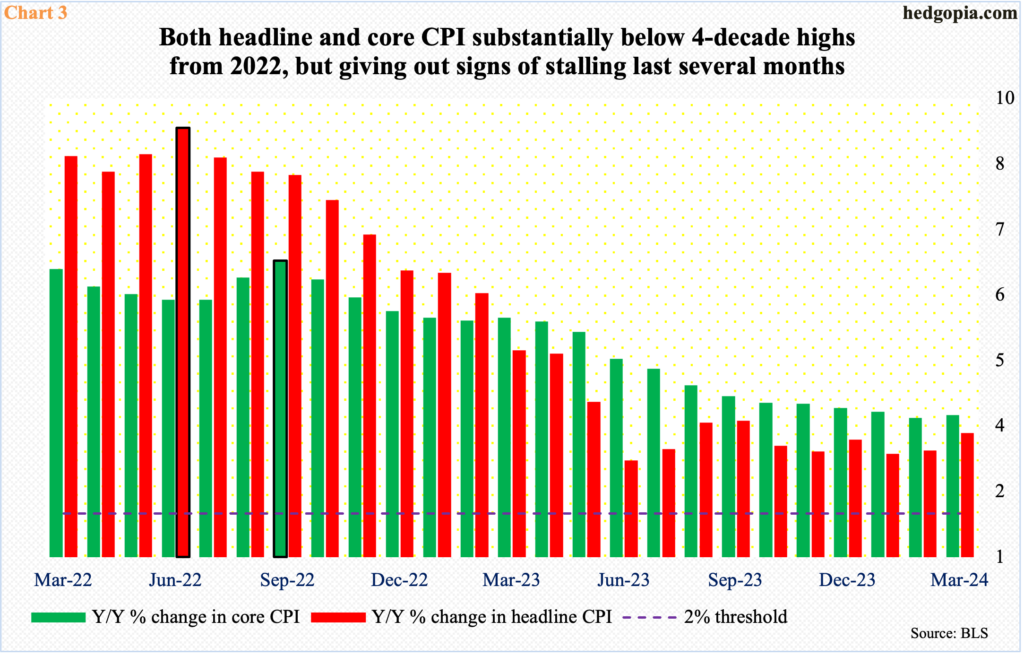

The consumer price index for April is due out Wednesday. Going into this, both headline and core CPI are meaningfully lower from four-decade highs recorded nearly two years ago but are showing signs of stalling in recent months.

In the 12 months of March, headline and core CPI grew 3.48 and 4.80 percent respectively. In 2022, they were rising at 9.06 percent and 6.63 percent in June and September, in that order (bars with blue border in Chart 3). This is a tremendous progress toward the Federal Reserve’s two-percent goal.

However, the disinflation trend has stalled recently. Headline CPI has risen since recording 3.09 percent this January, while the core grew 3.75 percent in February. Further, the core has been above the headline since March last year. Any relief in these trends is likely to ignite risk-on. It remains to be seen if this should to enough to push the indices to new highs.

Equity bulls have two potential problems currently: (1) overbought condition and (2) vanishing bears.

On the daily, the Nasdaq 100, for instance, is way extended, having rallied 7.5 percent in the last three weeks. Of course, it gave back 8.1 percent over four weeks after peaking at 18465 on March 21st – peaking a week before the S&P 500. The tech-heavy index, in fact, failed to sustainably break out of 18300s for seven weeks before going the other way.

Last Friday – a spinning top session – tech bulls rallied the index to 18248 before they ran out of steam (Chart 4). This is taking place just above the 50-day (17943), with the index staying above the average in all five sessions last week; earlier, the Nasdaq 100 remained under the average for 15 consecutive sessions.

Irrespective of what happens post-CPI Wednesday, odds favor a breach of the average in due course – if nothing else just to unwind the overbought condition the index finds itself in.

The Nasdaq 100 is up 7.9 percent year-to-date. Last year, it surged 53.8 percent. This was facilitated by the non-believing bears, among others.

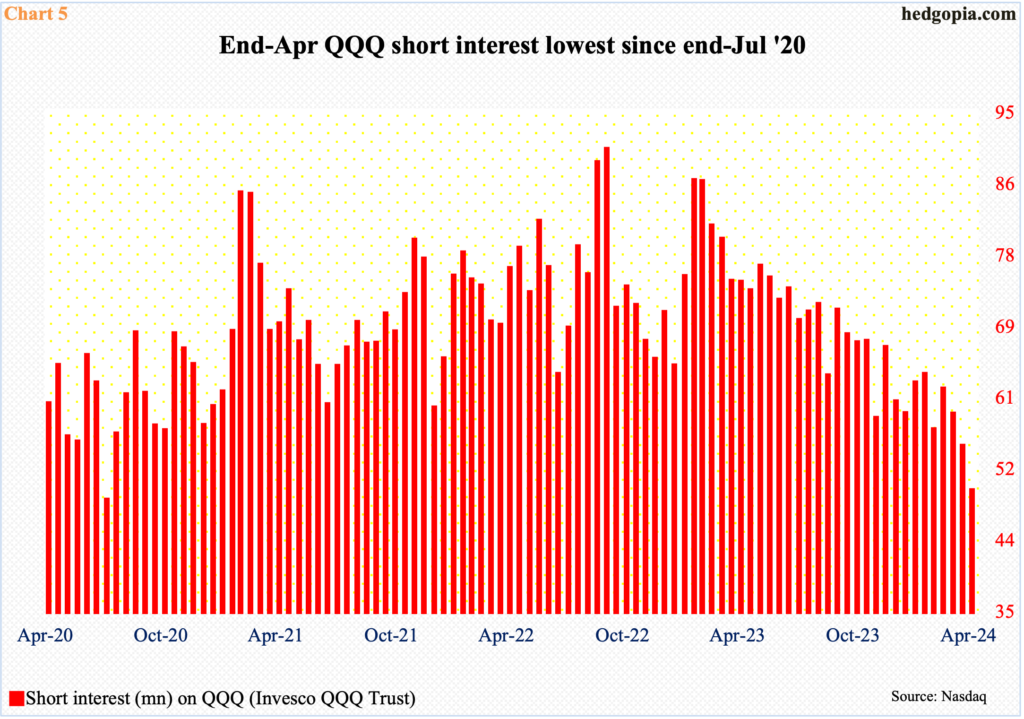

At the end of September 2022, short interest in QQQ (Invesco QQQ Trust) stood at 90.1 million. It ended last year at 60.1 million. By the end of April (this year), this had further shrunk to 49.5 million, which is the lowest since end-July 2020 (Chart 5).

Persistent covering by the bears provided a sustained tailwind to QQQ/Nasdaq 100 in the past. This is disappearing fast, as short interest languishes at a multi-year low. This is also a reason why a post-CPI rally – should there be one – is unlikely to sustain itself.

More By This Author:

This Week's Noncommercial Trader Action, According To CoT Report

After 2 Up Weeks, Major US Indices End Last Week Right On 50-DMA

What Are The Noncommercials Doing? Insights From The CoT Report

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more