Enphase Energy - Stock Of The Day

Summary

- 100% Technical buy signals.

- 12 new highs and up 34.30% in the last month.

- 498.19% gain in the last year.

My first pick for the New Year and the Barchart Chart of the Day belongs to the solar technology company Enphase (Nasdaq: ENPH). I found the stock by using Value Line to screen for stocks expected to have a compounded annual revenue growth rate of at least 20% over the next 5 years, then used Barchart to determine which stock had the most frequent number of new highs in the last month.

Enphase Energy, Inc., together with its subsidiaries, designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally. The company offers a semiconductor-based microinverter, which converts energy at the individual solar module level, and combines with its proprietary networking and software technologies to provide energy monitoring and control services. It also offers AC battery storage systems; Envoy communications gateway; and Enlighten cloud-based monitoring service, as well as other accessories. The company sells its solutions to solar distributors; and directly to large installers, original equipment manufacturers, strategic partners, and homeowners, as well as directly to the homeowners and the do-it-yourself market through its legacy product upgrade program or online store. In addition, it offers online and in-person training resources for solar and storage installers and Enphase system owners through its Enphase University. Enphase Energy, Inc. was founded in 2006 and is headquartered in Fremont, California.

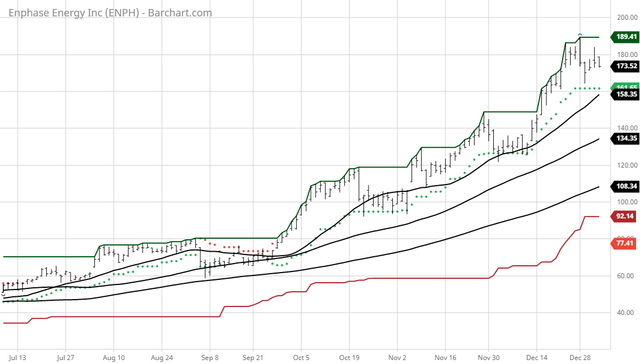

(Click on image to enlarge)

Barchart technical indicators:

- 100% technical buy signals

- 408.49+ Weighted Alpha

- 498.19% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50, and 100 day moving averages

- 12 new highs and up 34.30% in the last month

- Relative strength index 70.00%

- Technical support level at 170.92

- Recently traded at 173.83 with a 50 day moving average of 134.38

Fundamental factors:

- Market Cap $22.17 billion

- P/E 240.18

- Revenue expected to grow 22.70% this year and another 62.30% next year

- Earnings estimated to increase 33.70% this year, an additional 45.70% next year and continue to compound at an annual rate of 36.61% for the next 5 years

- Wall Street analysts issued 10 strong buy, 1 buy, and 5 hold recommendations on the stock

- The individual investors following the stock on Motley Fool voted 213 to 24 that the stock will beat the market

- 34,360 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Disclosure: None.

Renewable energy in general is doing good in expectation of a Democratic president. It may be a little late to add to positions until we see what happens. In reality what would do them good is higher oil prices not from higher taxes and regulation but by increased demand for energy.