“Enjoy A Dry, Quiet Summer”, Says VIX

The Cboe Volatility Index, aka VIX, is designed to measure the market’s expectation for volatility over the ensuing 30 days. By that measure we can expect very little to happen over the coming months.

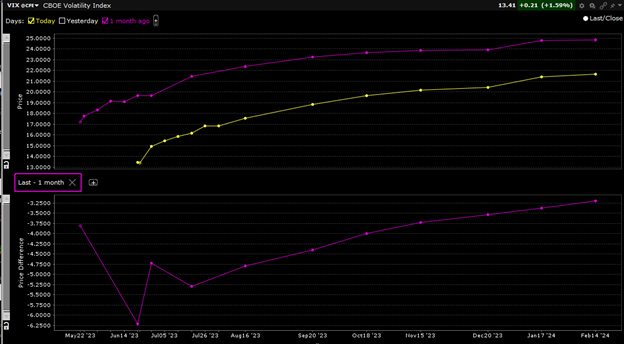

If you don’t want to take my word for it, let’s take a look at the VIX futures curve. We see VIX futures in contango, with a large parallel shift lower over the past month:

VIX Futures Curves, Current (yellow, top), 1 Month Ago (magenta, top), with 1 Month Point Changes (bottom)

Source: Interactive Brokers

It shouldn’t be too surprising to see VIX falling over the past month. The S&P 500 Index (SPX) upon which it is based has risen over 5% in that span. In general, when the market goes up, VIX goes down. By definition, when prices go up people are less fearful. When they are less fearful, VIX declines.

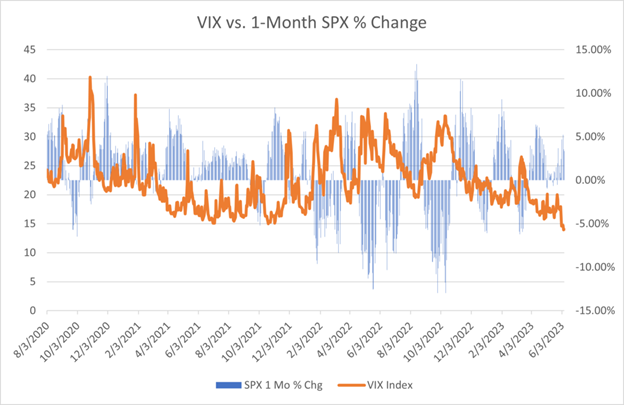

Earlier this month we noted that VIX is often more reactive than proactive, as evidenced by the graph below. We attributed that mainly to recency bias. It’s human nature to place greater weight on recent events when extrapolating into the future. If markets have been up over the past month, VIX tends to be lower – and vice versa.

Source: Interactive Brokers

It is important to keep the use case for VIX and the shape of the futures curve in perspective.VIX is a key tool for portfolio managers who want to hedge their risks. The low level of VIX tells us that there is not much demand for protection from institutions. Furthermore, a futures curve that is upward sloping (from left to right) is in contango, which implies that the commodity in question is relatively plentiful. The upward slope reflects positive interest rates rather than excessive demand.

Currently, we see spot VIX falling even faster than its futures, steepening the contango. Even after a brief pullback, institutions clearly feel sanguine about their equity market risk over the near term. We have put another FOMC decision and semi-annual testimony by the Fed Chair in the rearview mirror. At the same time, we have roughly another month until the 2Q earnings season begins in earnest and few “known unknowns” in the ensuing weeks. Smooth sailing, right?

Remember, it is not unusual to see the VIX futures curve invert when markets are dicey. The inversion reflects a sudden rush for volatility protection, which is then in relatively short supply. That behavior reinforces the reactive, rather than proactive nature of VIX. It implies that managers were caught with too much risk on their hands after assuming that all would be copacetic.

I’ve often compared my former role as an options market maker to that of an umbrella salesman. When there has been a long stretch of dry weather there is little demand for raingear. If the vendor is caught long of rain protection during a drought, he will need to cut his prices to move the merchandise. Yet if there is a sudden storm his customers will clamor for an umbrella, boots, raincoats, and the like. Assuming he has a relatively fixed inventory, the vendor will have the opportunity to raise prices quickly. Might that be considered price gouging? Possibly. But it’s standard operating procedure in financial markets – especially in volatility products.

From the point of view of VIX, we’ve had that long stretch of sunny days. The clouds that have appeared recently are judged to be high and fluffy, not concerning. Unfortunately, market prognosticators have even worse track records than weathermen.

More By This Author:

Three Days Of Selling – Oh My!

Optimism Vs. Pessimism; Or, Stocks Vs. Bonds

Treasury Yields Jump on Hawkish Waller, Barker

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more