Treasury Yields Jump On Hawkish Waller, Barker

After bond yields fell following Federal Reserve Chairman Jerome Powell’s remarks on Wednesday, comments from two Federal Reserve members this morning regarding persistent core inflation and the need for additional tightening are reversing an equity rally and driving yields higher. The comments from Fed Governor Christopher Waller and Richmond Fed President Thomas Barkin appear to be receiving validation from this morning’s consumer sentiment report that shows shoppers are likely to continue fueling economic growth. This consumer optimism underscores the challenges that the central bank faces in halting inflation by curtailing demand for products and services.

Speaking this morning in Oslo, Norway, Waller said prices excluding food and energy have barely declined during the past eight or nine months and the labor market is still strong. He maintained that additional monetary tightening will probably be required to battle core inflation. Also this morning, Barkin told an audience in Ocean City, Maryland, that he isn’t convinced that slowing demand can quickly bring inflation down to the Fed’s 2% target. He said nearly $1 trillion in savings from increased home values and equity gains is supporting elevated demand. Barkin acknowledged that excessive tightening can trigger a recession, but he is more concerned that backing away from monetary tightening too soon can cause inflation to bounce back, similar to what occurred in the ‘70s.

While still low from a historical point of view, the preliminary overall Index of Consumer Sentiment for early June increased from 59.2 in May to 63.9, up 7.9%. On a year-over-year (y/y) basis, the index jumped 27.8%. The results were boosted by the resolution of the debt-ceiling conflict and moderating inflation, but survey respondents’ weakening expectations for income prevented the index from climbing higher. Nevertheless, Current Economic Conditions for early June increased 4.8% from May, climbing from 64.9 to 68.0. On a y/y basis, the results increased 26.4%. The Index of Consumer Expectations also gained, climbing from 55.4 in May to 61.3 in early June, up 10.6%. It also climbed 29.1% y/y.

While a majority of survey respondents anticipate economic difficulties over the next year, the outlook score was supported by year-ahead inflation expectations declining from 4.2% in May to 3.3% this month. Inflation expectations over the long-term, however, achieved modest progress, coming in at 3.0% from the previous period’s 3.1%. Consumer sentiment has jumped significantly and cemented an optimistic view of that shoppers may help fuel the economy even as the Fed works to kill inflation with its hawkish monetary policy.

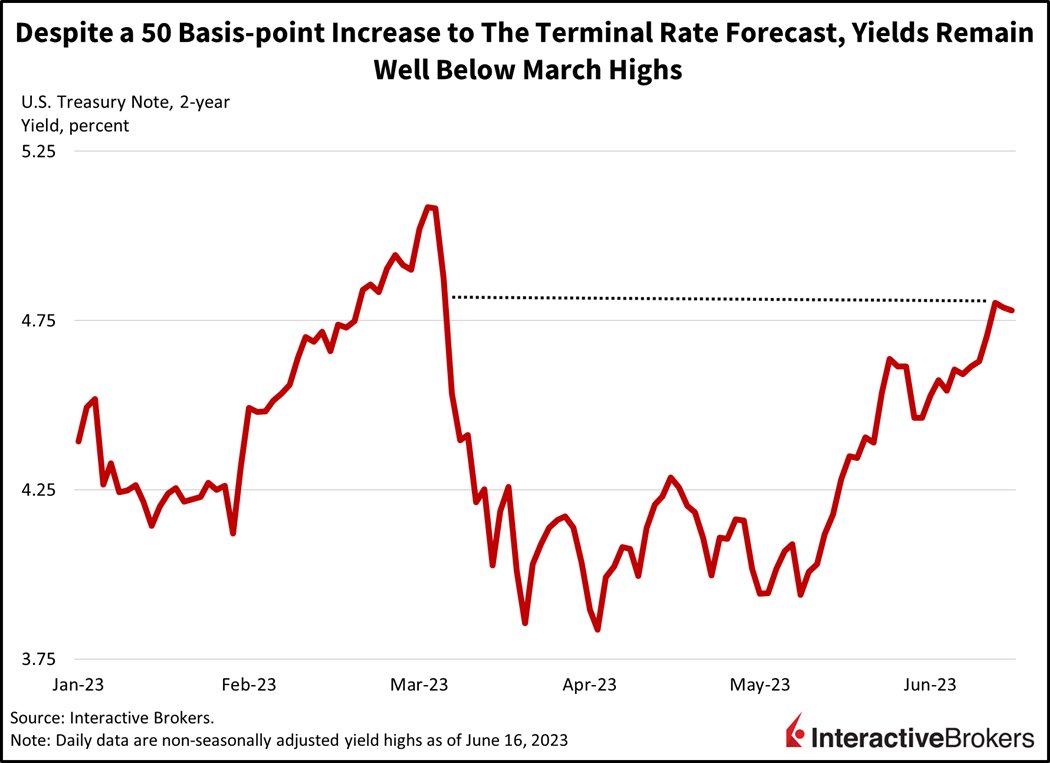

Markets are cautious this morning following an impressive winning streak for equities. Following six consecutive green days, the S&P 500 Index is down 0.1% as hawkish Fed commentary reiterating the need for more rate hikes sent yields soaring. The small-cap Russel 2000 Index is performing the worst out of major indices this morning since it’s comprised of some vulnerable companies that are sensitive to rising rates. The Russell 2000 Index is down 0.8% while the Nasdaq Composite and the Dow Jones Industrial Index are near the flatline. Among S&P 500 sectors, action has been mixed with real estate, utilities, consumer discretionary, health care, consumer staples, industrials and home builders up while the others are down. Yields are up across the curve with the 2- and 10-year Treasury maturities up 9 and 5 basis points (bps) to 4.74% and 3.78%. Hawkish Fed rhetoric is extending to the dollar, with the Dollar Index up 26 bps to 102.41. WTI crude oil has recovered from Monday’s steep selloff throughout the week and is up 0.3% to $70.80.

Momentum is exhilarating on the way up, but particularly achy on the way down.

Yields are beginning to reprice as investors evaluate liquidity conditions that require further monetary policy curtailment, although they’re still well below March highs despite a 50-bp increase to the terminal rate forecast. The recent rally in equities is emblematic of an abundance of money in the system that is inconsistent with 2% inflation over the long-term. With the Fed’s Summary of Economic Projections expecting a rate at year end of 5.63% for this year and 4.63% for next, yields are costly at these levels and are likely to move higher in the near-term. Such a move will coincide with the refill of the Treasury General Account and continued quantitative tightening, further constraining market liquidity at a time of a historic equity rally. Such an event is likely to serve as a headwind to stocks, with major indices likely to end the year at lower levels due to overly optimistic earnings expectations, market euphoria, valuation expansion and a shrinking money supply. Momentum is exhilarating on the way up, but particularly achy on the way down.

(Click on image to enlarge)

More By This Author:

The Inertial Market Yawns At Powell’s PresserLast Minute Thoughts Ahead Of The FOMC Meeting

I Don’t Want To Spoil The CPI Party

Disclosure: FOREX

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences ...

more