End Of The World History Chart Updated…

This is what I wrote exactly one year ago today.

I’m headed out to do my civic duty and vote. I have no idea how long it will take so I’m going to post this chart now.

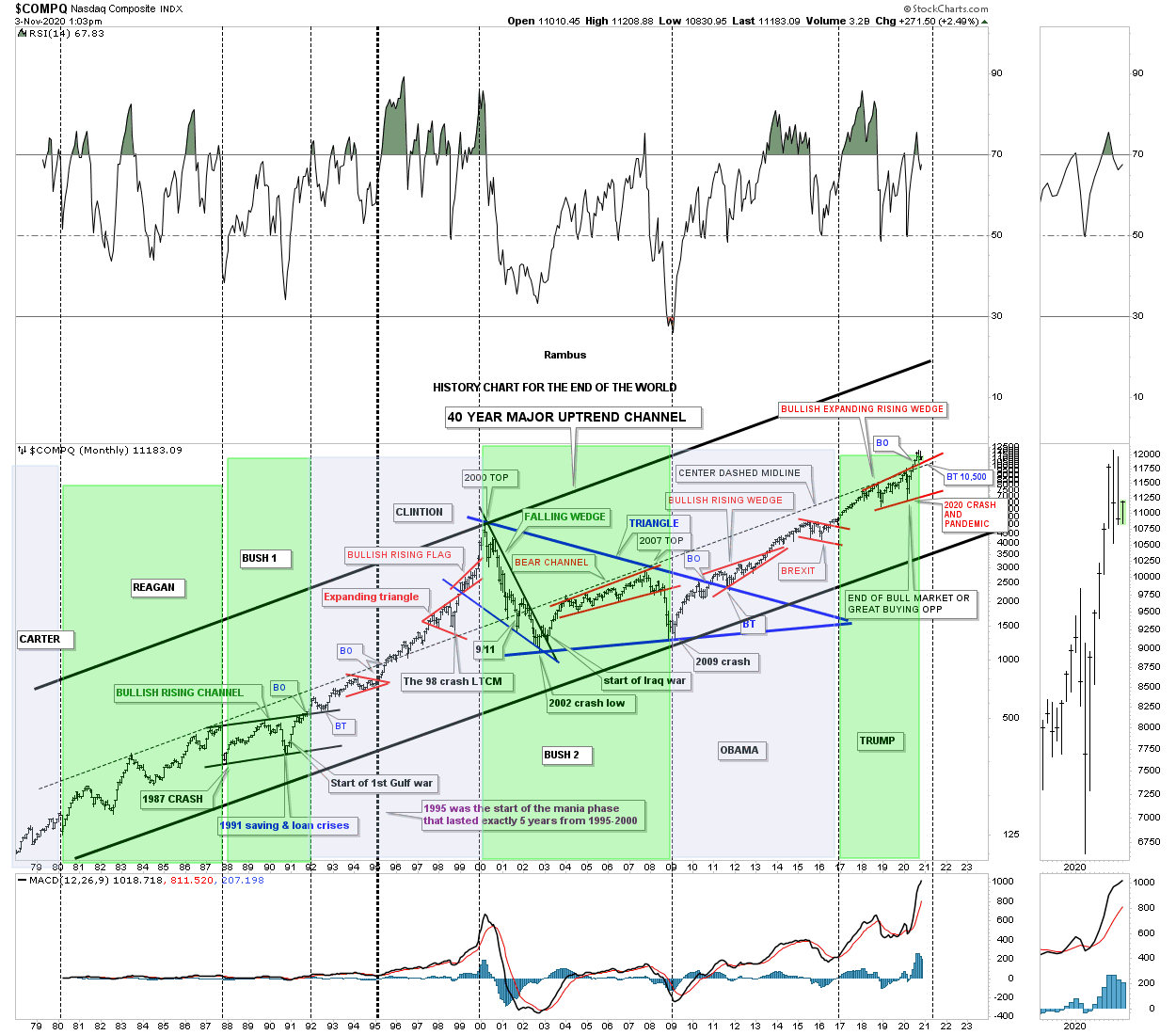

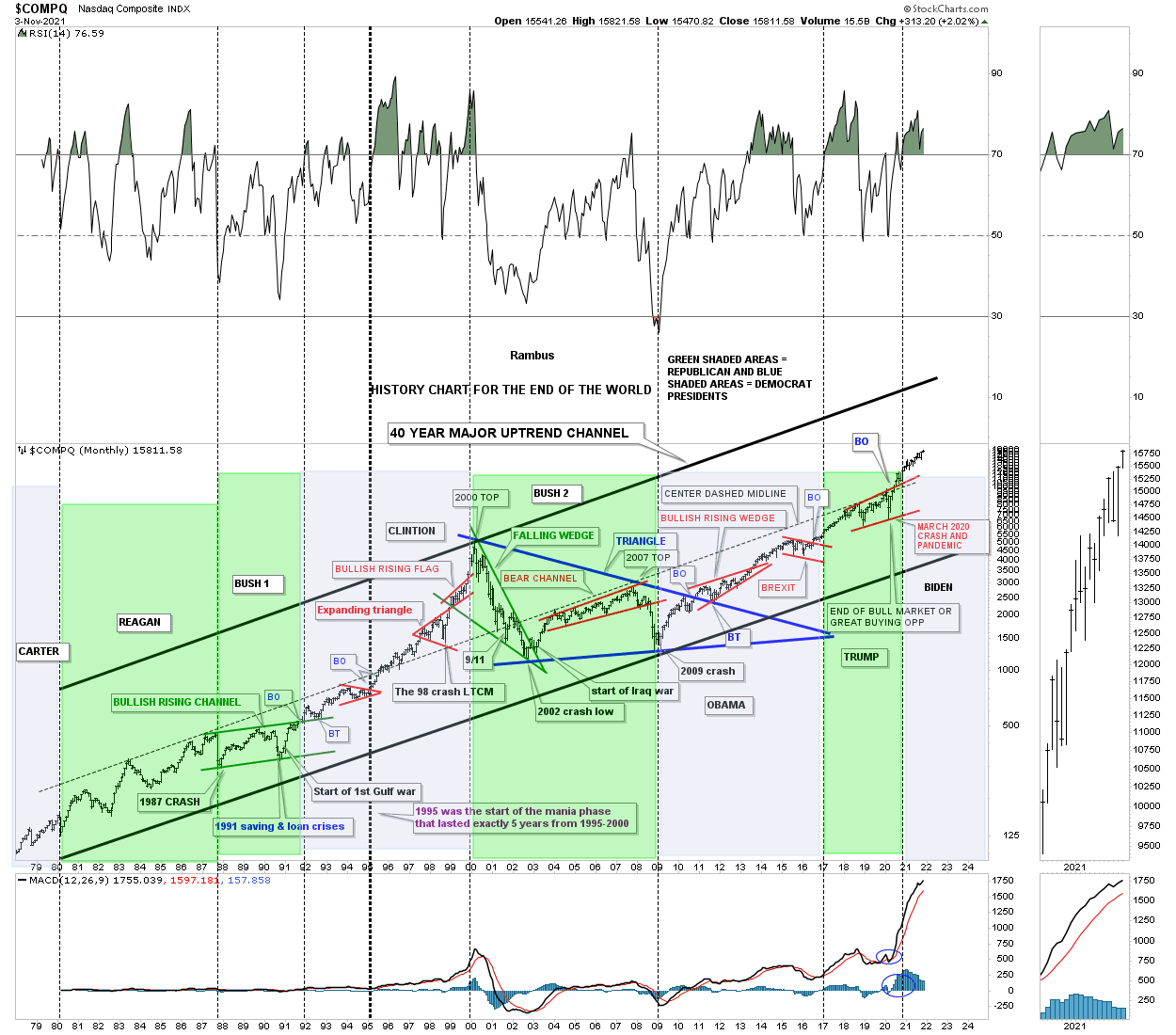

For those that have been with Rambus Chartology for a while know about this long term monthly chart that goes all the way back to the late 1970s which I call, The End of the World History Chart. It is a satirical look at all the important lows that felt like the end of the world if you were trading back then. Every time there is an end of the world type of event I just add it to the chart to see what happens. The 2020 crash was the latest end of the world event in which I stated, “end of the bull market or a great buying opportunity,” shortly after the low was in place.

The center dashed midline has been holding resistance for the last 20 years or so. I can’t tell you how long I’ve been waiting for the breakout above that 20-year center dashed midline which I believe could lead to a rally up to the top rail of the major uptrend channel similar to what we saw back in 1995. When the center dashed midline gave way back in 1995 that was the beginning of the parabolic rise into the 2000 secular bull market top which took five years to complete. It is simple, above the center dashed midline is bullish and below is bearish, everything else is noise.

I recently added the presidential cycles to this chart so you can see how the COMPQ responded to a Republican or Democratic president. I won’t go into detail as it is pretty self-explanatory. The green shaded areas show what the market did when a Republican was in office and the blue shaded areas show what the stock market did during a Democratic president.

I’m going on record right now with my prediction on what the stock market is going to do if a Republican or Democrat is elected. One year from today the stock market is going to be higher whether a Republican or Democrat is elected. We are not going to see the end of the world or the end of our Democracy regardless of who is elected.

My cup has been and still is half full regardless of all the conspiracy theories that are so widespread right now which probably seems pretty naive to many of you. We are entering into a technological revolution that is just being born that is going to change the world in ways we can’t even imagine yet whether we like it of not. I’ve touched on it a time or two in the past and nothing has changed my outlook on what is about to take place over the next 5 to 10 years.

For those that want to fight the last battle and expect the world to come to an end be my guest. I’m going to look to the future which is not going to be perfect by any stretch of the imagination, and welcome change which is the lifeblood of being a human being.

November 3, 2020:

(Click on image to enlarge)

November 3, 2021:

(Click on image to enlarge)

Disclosure: None. If you'd like more information about the additional free trading education mentioned in ...

more

The end of the world hype is very very real, one could say as real as it is with semi’s. here are the next — $ON manufacturer & seller of semiconductor components for the EV market. ER beat, upbeat outlook. curling off support. a big move on the way. getting in cheap on $OSS maker of specialized high-performance edge computing modules & systems for AI, defense, finance, & entertainment applications. look at this daily. reversal is taking off & pay attention to $RMBS provider of chips & intellectual property closed acquisitions of AnalogX & PLDA, bolstering Silicon IP business & CXL Memory Interconnect Initiative. incredible chart & big volume recently

The end of the world is just getting started imo. but you're missing these setups — check out $KLAC this pennant holds up. multi-day runner w another bullish flag. $AVGO is in play. caught the beginning sub $419 low floater that's going to stay on my port for a while. $BX A+ setup. IPO for BXSL & $50b deal closed with AIG & $MANA.X is gaining momentum with all the room in the metaverse to reverse. such high PT’s being given. as demand for this new asset class expands, you'll see more demand for digital real estate, thus driving up the value. still holding. coiling up really tight here after another gap up. watch for this to get some volume. solid upside potential. fresh PR out today. Sources everywhere...