Elliott Wave Technical Forecast: News Corporation

NEWS CORPORATION – NWS Elliott Wave Technical Analysis | TradingLounge

Overview:

Welcome to today’s Elliott Wave update on the Australian Stock Exchange (ASX), focusing on NEWS CORPORATION – NWS. Our current analysis shows that ASX:NWS is in a corrective phase. Typically, corrective waves are followed by motive waves, suggesting potential upside opportunities. This breakdown offers a detailed view of the technical structure and forecast.

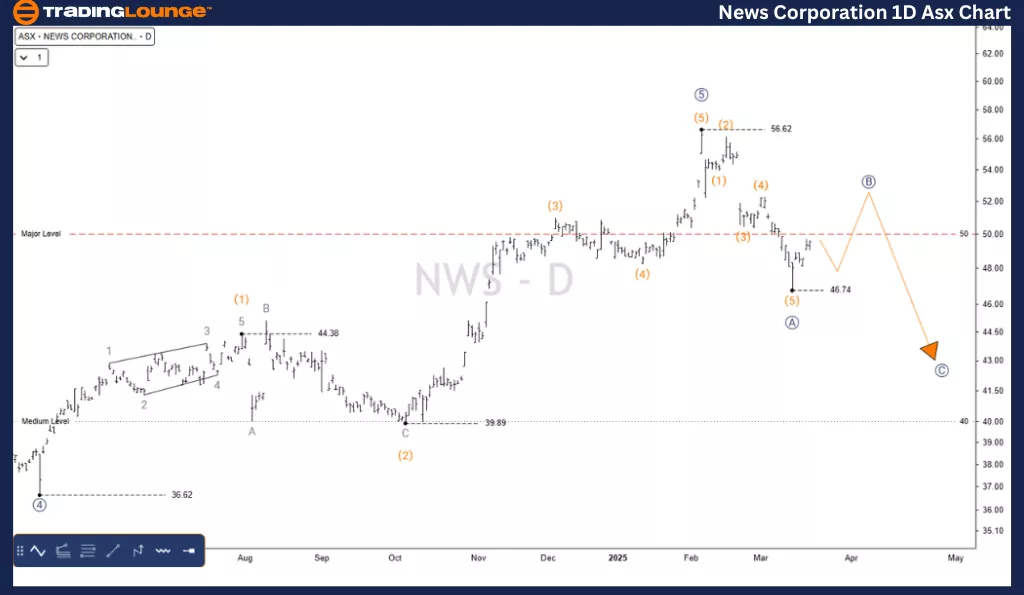

NWS – Elliott Wave Technical Analysis (1D Chart – Semilog Scale)

Function: Major Trend (Primary Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave (A) – orange of Wave ((B)) – navy

Details:

A five-wave sequence recently concluded around the $56.62 high. Currently, a corrective wave pattern is in progress, labeled as an ABC structure at the navy degree. This correction may push prices lower, with a potential target near $39.89.

Invalidation Point: $56.62

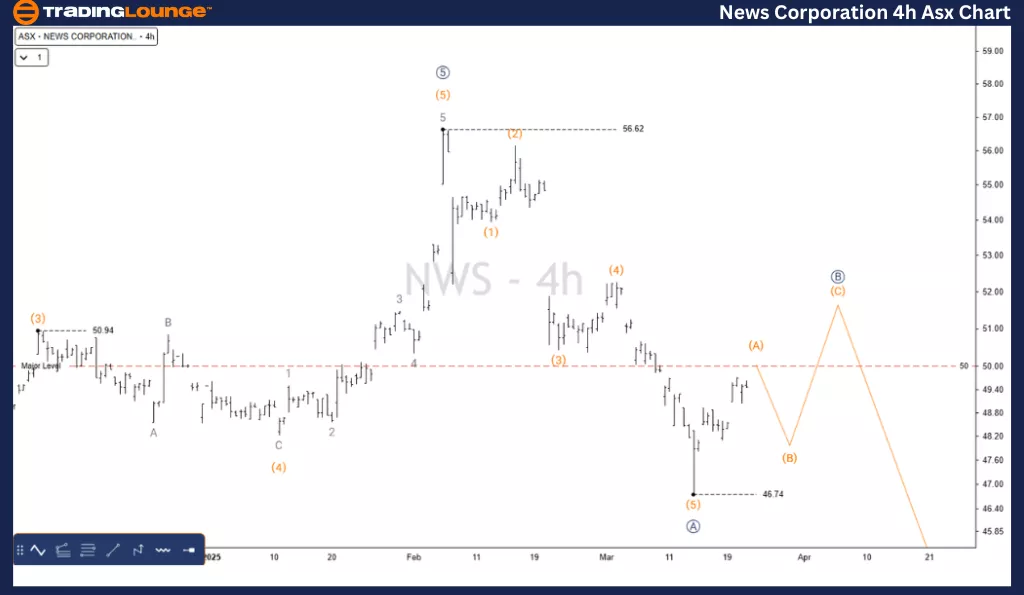

NWS – Elliott Wave Technical Analysis (4-Hour Chart)

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave (A) – orange of Wave ((B)) – navy

Details:

From the $56.62 high, the ((A)) navy wave has completed at the $46.74 low. The ongoing ((B)) navy wave is forming a Zigzag (A)(B)(C) pattern in orange. After a modest rise, the final (C) leg of the Zigzag is expected to move lower.

Invalidation Point: $46.74

Conclusion:

This analysis provides both the broader context and short-term forecast for NEWS CORPORATION – NWS. We highlight specific price levels that confirm or invalidate the wave structure to enhance forecast reliability. Our objective is to equip traders with a professional, data-backed perspective to navigate ASX trends confidently.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation)

More By This Author:

Elliott Wave Technical Analysis: Bitcoin Crypto Price News For Friday, March 21

Elliott Wave Technical Forecast: Newmont Corporation - Thursday, March 20

Elliott Wave Technical Analysis - Qualcomm Inc.

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more