Election Effect: How Presidential Votes Shape Stock Markets Long And Short Term

Image Source: Pixabay

Election Effect: How do elections impact stock markets?

One of the most often asked questions Professor Nathan Mauck and myself, Chuck Carnevale, are getting from investors is what is going to happen after the election? Elections are big deals and they bring a lot of investor anxiety – election effect!

We both agreed to the reality that politicians don’t run the economy, and they certainly don’t run the individual stocks that investors invest in. Now, policy decisions can have an impact on how good or how fast the company is able to grow, or how good the economy is going to be, interest rates, etc., but in the long run you hire companies that have good management so they can navigate through troubled waters.

(Click on image to enlarge)

What we have decided is let’s go ahead and do a video and try to bring to you some of the realities of what really happens in the short run during a political event. Remember, investing is a long game. Politics and election results may have a short-term impact, but in the long run it’s all about the fundamentals of the business you invest in.

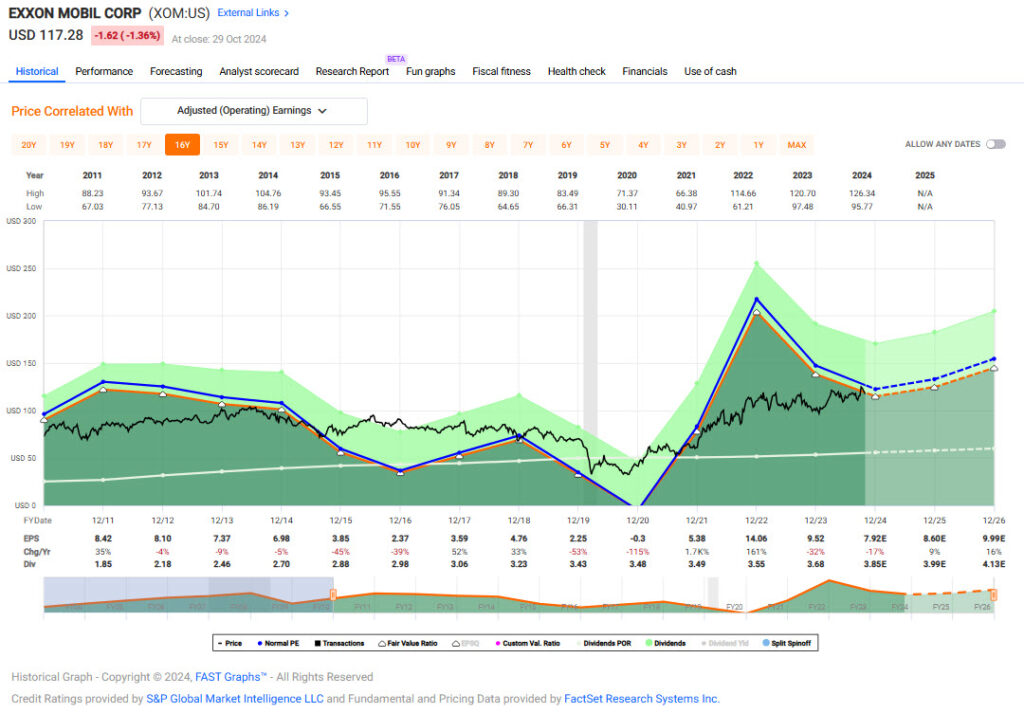

FAST Graphs Analyze Out Loud Video – SPDR S&P 500 ETF Trust (SPY), Apple Inc (AAPL), Broadcom (AVGO), JP Morgan Chase & Co (JPM), Exxon Mobil Corp (XOM), UnitedHealth Group (UNH).

Video Length: 00:18:19

More By This Author:

What the Earnings Miss Means For Elevance’s Future

Market Moves: The Long-Term Impact Of Earnings Announcements

Disney And Nike: Key Lessons In Valuation And Risk Management

Disclosure: Long AAPL, AVGO, JPM, XOM.

Disclaimer: The opinions in this article are for informational and educational purposes only and should not be construed as a recommendation to buy or sell ...

more