Edge Gains Help Pull Indices Away From Trading Ranges

It was a modest gain, but significant in that Tuesday's it helped push the rallies into spike highs from Monday - helping to weaken the bearish implications of yesterday's action. Volume was lighter, so there was no accumulation, but there was some technical improvement.

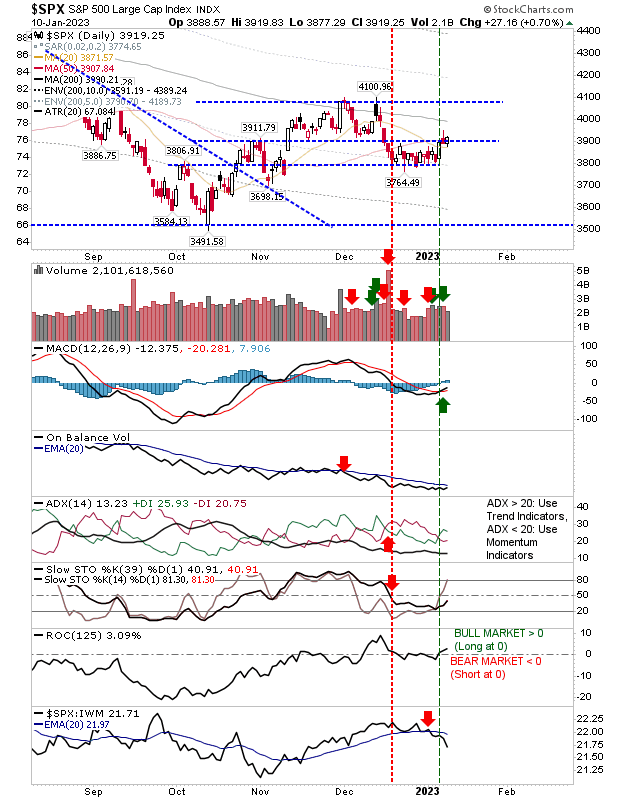

For the S&P, there was the MACD trigger 'buy', as relative performance against the Russell 2000 took a nose dive. The index is holding 50-day MA support and is well-placed to challenge the 200-day MA.

The Nasdaq is shaping more of a rounding bottom but remains challenged by 50-day MA resistance. Technicals are more bullish with 'buy' triggers in the MACD, On-Balance-Volume, and ADX, although momentum underperformance continues - not helped by been no longer oversold.

The Russell 2000 (IWM) enjoyed the best of the gains as it came to challenge its 200-day MA. It wasn't quite able to close above it, but it did build on 'buy' triggers in the MACD, On-Balance-Volume, and ADX, along with strong outperformance against the Nasdaq.

The Dow Industrials is also building a solid 'handle' in a cup-and-handle pattern. Interestingly, it's not as technically bullish as the Russell 2000, but it is outperforming Tech averages and is the closest index to building new all-time highs.

For tomorrow, we want to see indices build on the challenge of yesterday's spike highs and negate the bearish implications of these candlesticks. As a starter, I would want to see closes above leading moving averages before knocking out November resistances. Early action for 2023 is positive, but there remains much work to do.

More By This Author:

Post-Covid New Year Has A Sluggish Start For Markets

Bullish Reversal Candles In Time For Santa

Has The S&P Found Support?

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more