Bullish Reversal Candles In Time For Santa

It has taken a while, but the 8-day decline has finally flashed reversal candlesticks across indices. Lead indices finished with 'bullish' hammers with spike lows marking increased demand. Indices are at or near support, strengthening the potential of the reversal.

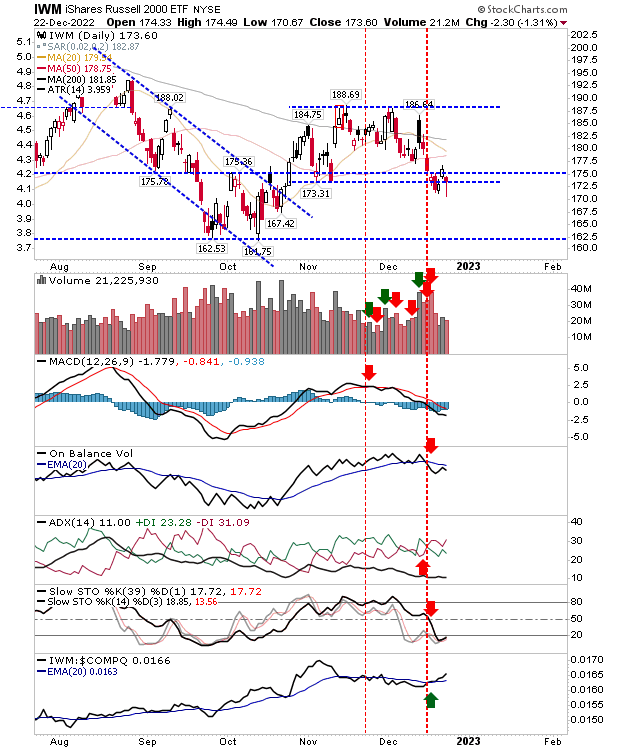

The Russell 2000 (IWM) had the longest spike low on oversold technicals. The index has the additional benefit of outperforming the Nasdaq and gaining ground on the S&P. Traders can measure risk:reward using a stop at the loss of today's low with a target of November's highs.

The Nasdaq is the index underperforming relative to both the S&P and Russell 2000. It finished the day having lost one level of support but found another - although it's running out of options to defend. Volume spun up to register as confirmed distribution, but the volume also increases the validity of the candlestick (as a launching point for a possible reversal).

The S&P also closed with a bullish 'hammer' on higher volume distribution, with the spike low of the 'hammer' cutting through support. The index is struggling a little at its 50-day MA but not enough to override the bullish potential of today's action.

If we are to see a Santa rally then today is a good day to start it. An end-of-day close into today's spike lows would negate the reversal potential of the hammer - although an intraday violation would be okay. So, let's see what tomorrow brings.

More By This Author:

Has The S&P Found Support?

Indices Feel Around For Support As Quad Witching Muddies The Water

Bulls Have The Dow Industrial Average To Appreciate

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more