Easing Cycle Set To Begin Next Month; Historically, Equities React By Declining

It is early, but tech is beginning to lag. This is taking place even as the Fed is getting ready to begin an easing cycle. Historically, stocks tend to rally into this and then head lower.

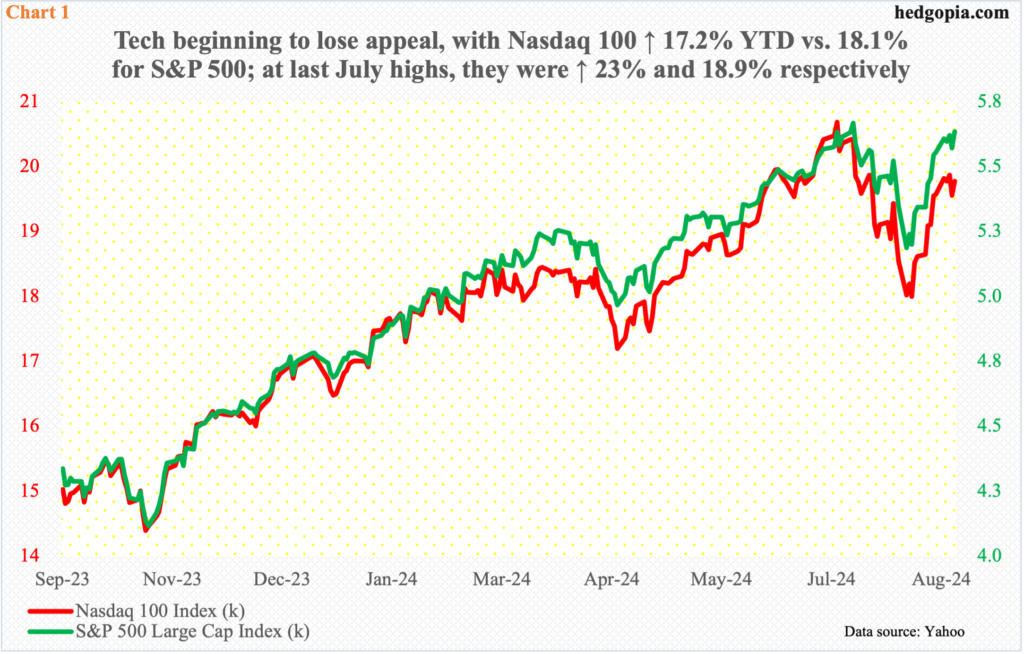

Tech is beginning to take a back seat. Last week, the Nasdaq 100 increased 1.1 percent. This compares with the 1.5 percent rise the S&P 500 put together (Chart 1). The tech-heavy index normally tends to outperform the large cap index.

The relative underperformance in recent weeks is beginning to adversely impact the Nasdaq 100’s performance for the year. With nearly eight months gone, it is up 17.2 percent, versus the S&P 500’s 18.1 percent rise. When the two indices peaked last month, they were up 23 percent and 18.9 percent for the year, in that order.

Viewing it the other way, the S&P 500 (5635) is merely 0.6 percent from its high (5670) from last month, even as the Nasdaq 100 (19721) is 4.9 percent from its (20691). The latter also is yet to fill a July 17th gap at 20200s, while the S&P 500 filled its at 5630s last week. Last but not the least, the Nasdaq 100 is just above its 50-day at 19502, with the average flattish; in contrast, in the case of the S&P 500, the average at 5488 is slightly rising.

If there is any commonality between the two, they are both beginning to lose momentum. The S&P 500 ended last week with the daily RSI in the low-60s, while the Nasdaq 100 finished its in the high-50s. When the indices peaked last month, the metric was well into the 0.70s, even hitting the low-80s at one point. This is particularly relevant for the S&P 500 as the index is within striking distance of its record high.

Importantly, the risk-off behavior evident in tech action – or a lack thereof – is taking place at a time when the Federal Reserve is beginning an easing cycle next month.

There were enough hints during last month’s FOMC meeting that a cut was forthcoming. This was confirmed last Friday when Jerome Powell, chair, told the annual Jackson Hole Symposium attendees that “the time has come for policy to adjust.”

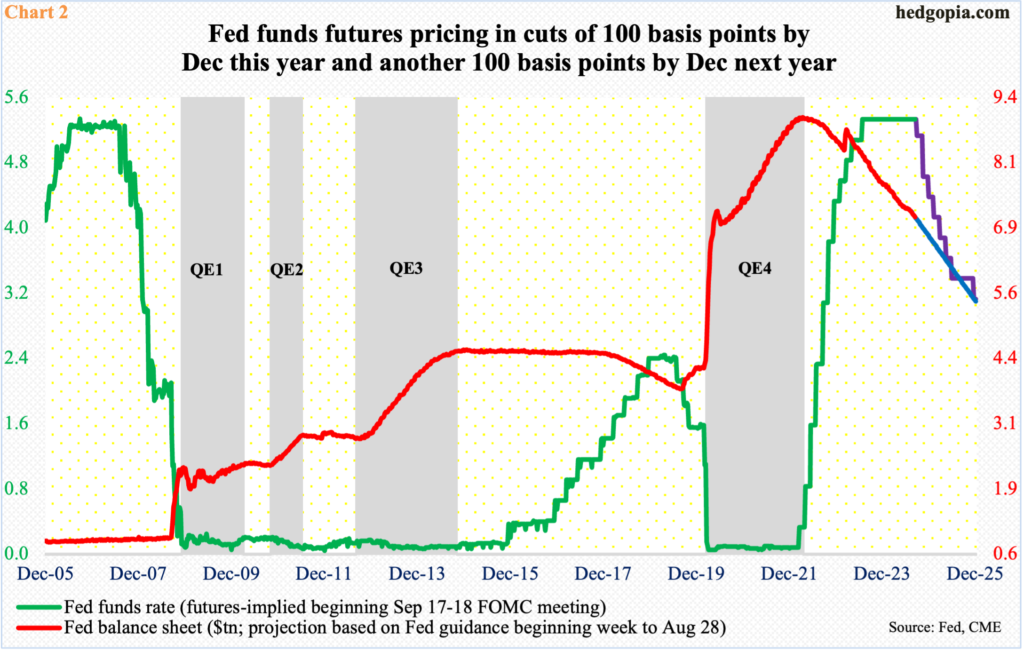

Since July last year, the fed funds rate has been left unchanged at a range of 525 basis points to 550 basis points. Earlier, the central bank began to tighten from zero to 25 basis points in March 2022.

As things stand, fed funds futures have priced in a 25-basis-point cut next month, slated for 17-18. And markets being markets, anytime there is macro data that suits – perceived or actual – their bias, they aggressively jack up easing expectations. These traders currently expect 100 basis points of cuts this year and another 100 basis points’ worth next year, ending 2025 between 300 basis points and 325 basis points (Chart 2).

A lot can happen between now and December 2025. Their projection is just that – projection. For context, late last year-early this year, they were expecting up to seven 25-basis-point reductions. But if the fed funds rate does indeed end next year 200 basis points lower, this will only have come at a time of economic pain. Further, the Fed in all probability would have stopped reducing its balance sheet, which is in progress currently.

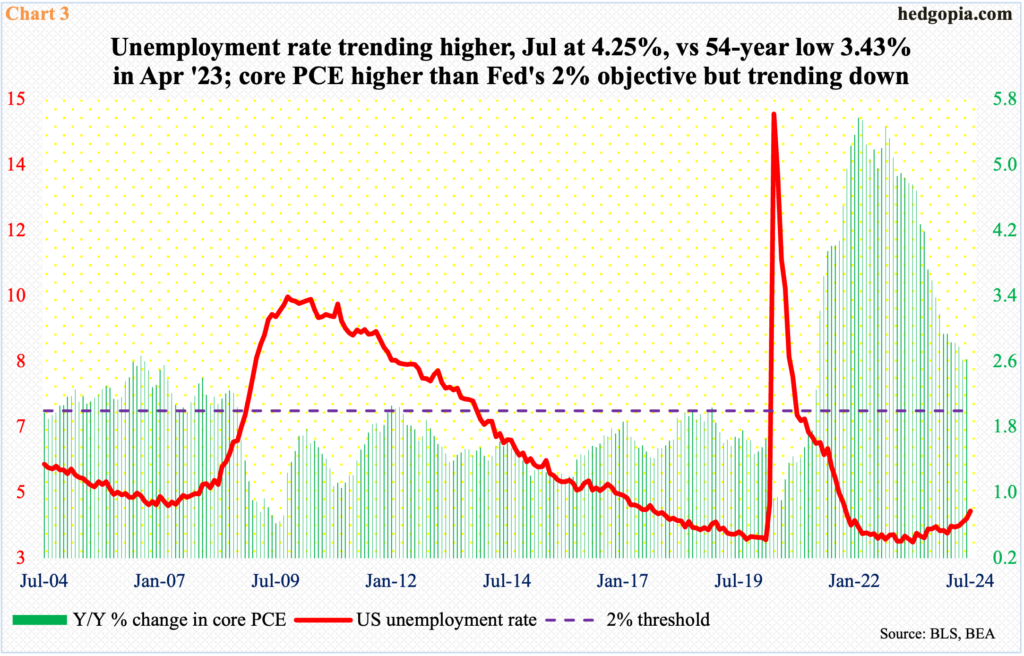

In this scenario, it will be interesting to wait and watch how Chart 3 evolves.

The Fed was forced to aggressively tighten as various measures of inflation reached decade-highs in 2022. Core PCE, which is the central bank’s favorite measure of consumer inflation, was rising at an annual rate of 5.6 percent in February that year. This was a 39-year high. The metric since has softened quite a bit. In the 12 months to July, core PCE rose 2.6 percent, which remains above the Fed’s stated goal of two percent.

The 525-basis-point tightening since March 2022 took time to filter through to the economy, but signs of deceleration are showing up. The unemployment rate reached a 54-year low of 3.43 percent in April last year. In July, it increased 20 basis points month-over-month to 4.25 percent. For the technically oriented, the red line in the chart looks like a saucer bottom, in which case it is headed higher in due course.

For a while, the Fed singlehandedly focused on taming inflation. Employment – its other mandate – was going gangbusters. Inflation is yet to reach the Fed’s goal but is trending in the right direction. Policymakers’ focus can shift to jobs.

Assuming the fed funds futures traders are playing their cards right, the jobs picture will only worsen in months and quarters to come. Otherwise, it does not make sense to expect the Fed to be loosening by 200 basis points over the next 16 months.

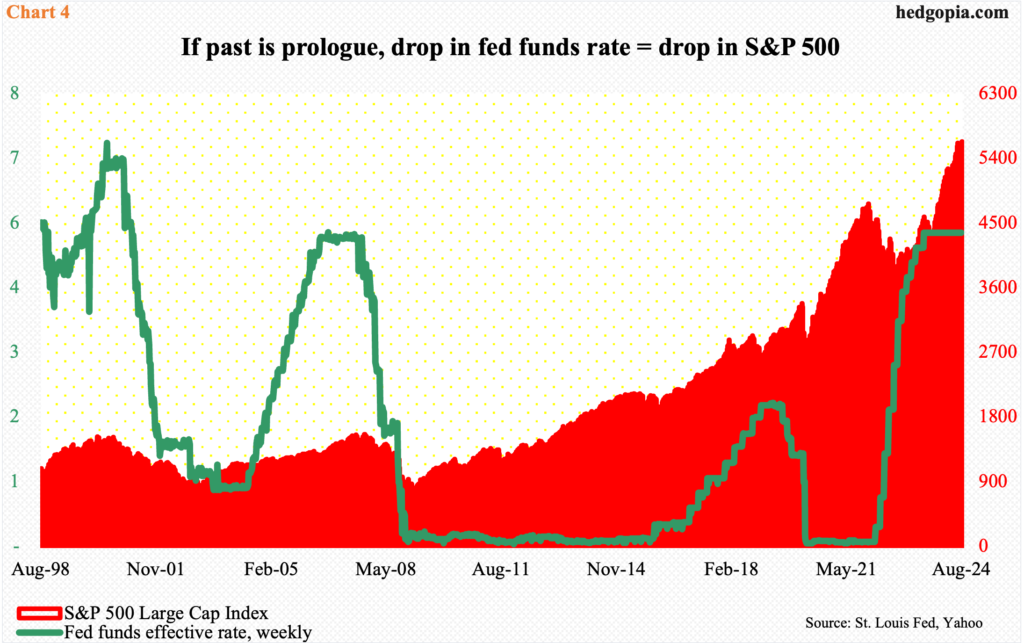

Historically, the S&P 500 has shown a tendency to rally into the beginning of an easing cycle and then take a breather (Chart 4). This could very well be occurring in the tech land. The sector inherently leads when investor mood is decisively risk-on, which was the case until not too long ago. This is changing as investors seek the protection of defensives. This will only pick up speed in the months and quarters to come.

More By This Author:

CoT: Peer Into Future Through Futures, How Hedge Funds Are PositionedIt Is Understandable Why Russell 2000 Remains Under Its Nov ’21 Record High

Projecting Futures Via the CoT Report - Eye On Noncommercials

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more