Earnings To Watch

Earnings season may be starting to wind down, but it is still going to be a busy week of quarterly reports. Using our Earnings Explorer, we can see some of the more interesting companies scheduled to report this week.

For starters, RingCentral’s (RNG) came public in 2013 and its first EPS report was in November 2013. Since then, the stock has never missed sales estimates and only missed EPS forecasts once (Q3 2015). The stock also recently reported a triple play (beat in EPS and sales estimates while raising guidance) two quarters ago. Investors have historically reacted well to the company’s reports averaging a gain of 4.17%. Heading into Monday’s report, the stock has been strong with a gain of 0.5% on a weak day for the market and a bullish engulfing of Friday’s close at new all-time highs.

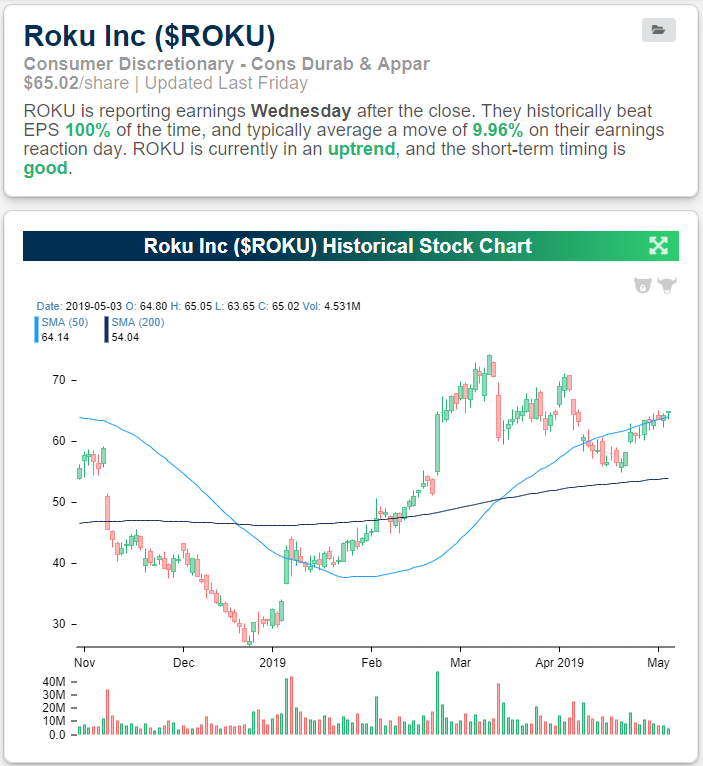

Roku’s (ROKU) streaming devices and services have become increasingly popular over the years and its popularity has shown in its earnings. Roku has beaten earnings and sales estimates each quarter since its first quarterly report in November of 2017. The stock has been pretty volatile in reaction to earnings, though, with an average move of 23.87%. Looking at just last quarter, the stock rose an astounding 25.23%, and the one before it fell by a similar degree (22.29%) in response to earnings. Fortunately for bulls, it has had a positive bias in reaction to earnings with an average gain of just under 10%. Looking at the chart of the stock this year, it has been in a solid uptrend but has recently faltered as it has been unable to make a new high since March.If the massive price movements in reaction to past reports are any indication, another solid jump on earnings could help to lift the stock at least closer to these previous highs (currently around 13% away from its March 11 peak).

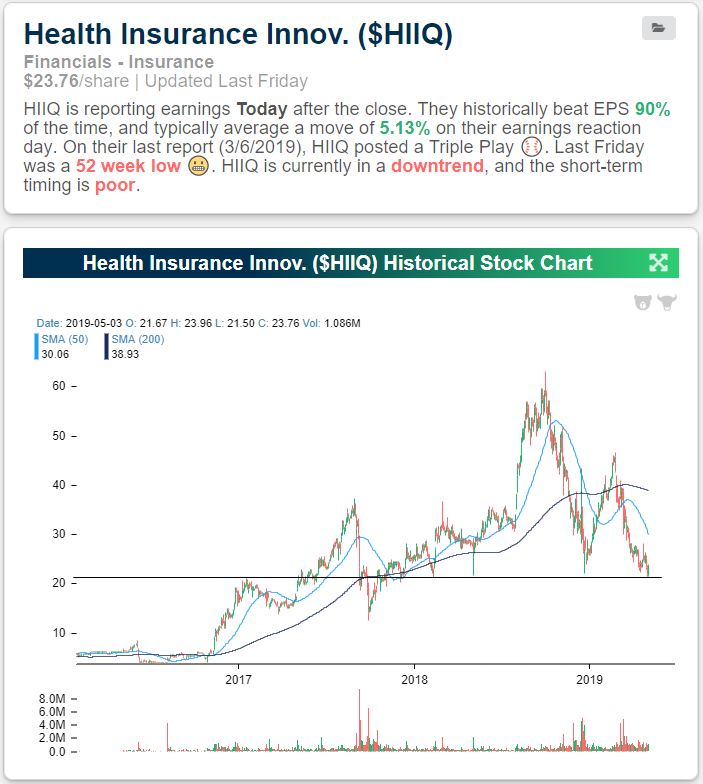

Health Insurance Innovations (HIIQ) may not be perfect as some other names, but the company still boasts a strong 90% beat rate for both sales and EPS. Last quarter, the company posted a triple play, the third one in its history and first since February 2018. While the stock averages a 5.13% gain on what has historically been solid earnings reports, the current trend is not great.HIIQ has fallen on hard times following last year’s volatility. It has been in a downtrend and has yet to retake last year’s highs like many other stocks. On Friday HIIQ, finished at a 52-week low. This low is a critical support level tracking back to early 2017 highs and lows throughout multiple points in 2018. In Monday’s trading ahead of earnings, like RNG, investors have been jumping on the stock. As of this writing, the stock is off of the day’s highs but still rallying around 12%.

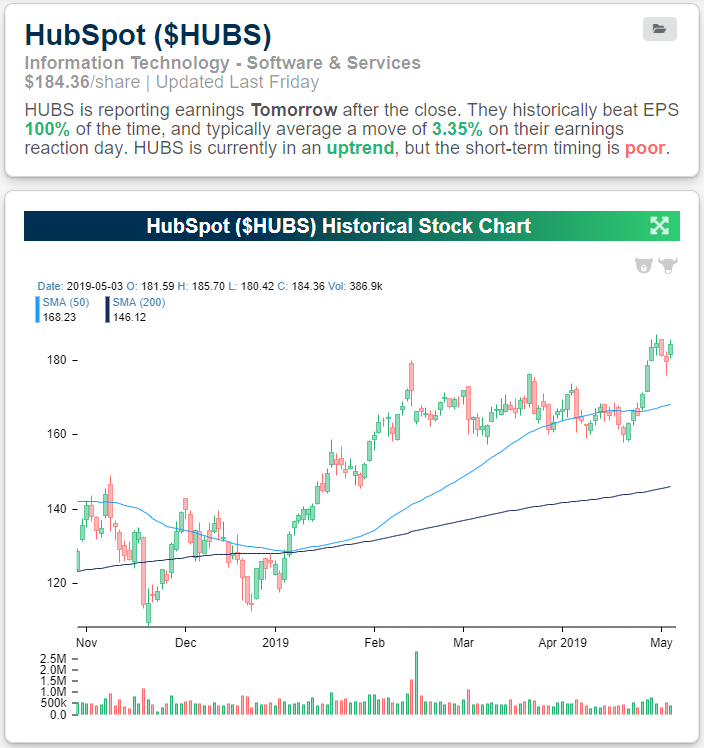

HubSpot (HUBS) has been flawless in its earnings history. On top of 100% beat rates for both earnings and EPS estimates, it has seen nine triple plays since its first report way back in 2014. The stock saw a solid rally from the start of the year through February but has had trouble making a break higher until a couple of weeks ago. In today’s trading, it is making another push towards a new 52-week high. With the stock averaging a gain of 3.35% in reaction to earnings, tomorrow’s report could act as a catalyst to bring it up to these levels.

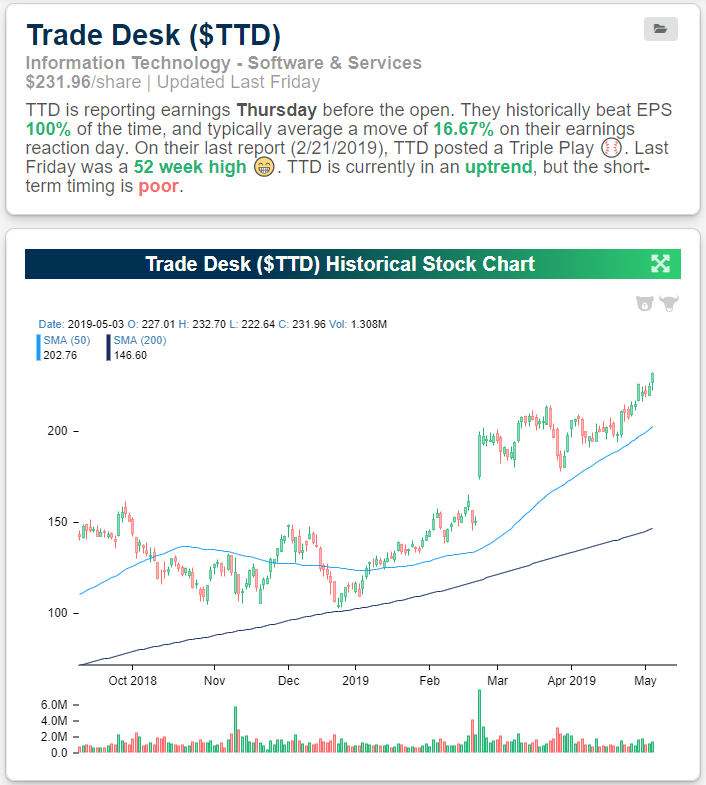

While HUBS has seen an impressive number of triple plays, Trade Desk (TTD) has perhaps been even more impressive. Of its 10 past reports, eight have been triple plays, and even in those two that weren’t triple plays, it topped EPS and sales estimates! Heading into its next EPS report this Thursday (5/9), the stock has a streak of five quarters of triple plays. The cherry on top: it has also averaged the second-best gain (16.67%) of all companies reporting this week. TTD certainly has an attractive earnings history with an uptrend to match. Of course, with such a strong history, expectations may be set high and any sort of miss could be met with an intensely negative reaction.

The Earnings Explorer tool is available to all Institutional clients, so if you are not currently ...

more