Early Warning Wednesday: It's Complicated

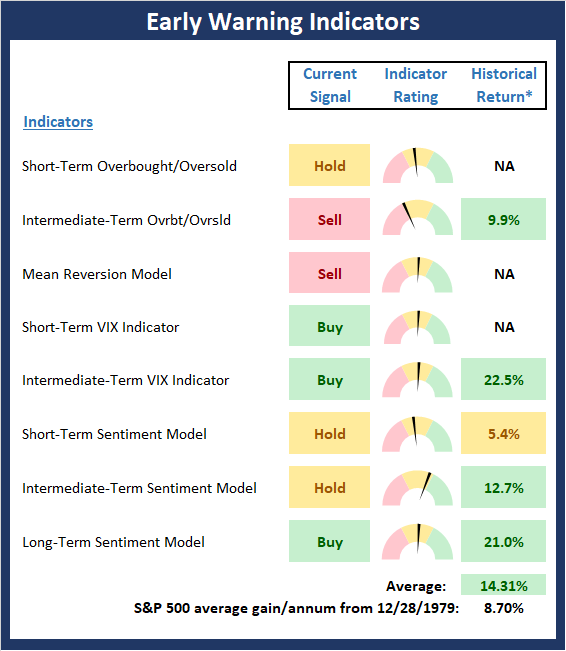

Since it's Wednesday, it's time to review our Early Warning indicator boards.

The Process

Once we have identified the state of the big-picture environment, the current trend, and the degree of momentum behind the move, we then look at the potential for a countertrend move to develop. This batch of indicators is designed to suggest when the "table is set" for the trend to "go the other way."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

My Take

The Early Warning board continues to be a mixed bag, as neither team appears to hold an edge at the present time. This probably sounds a little odd given that a great many analysts consider the current market to be very overbought. However, the current situation is complicated.

From my seat, it is important to recognize that we are dealing with a bifurcated market in which the major indices (save the NASDAQ) have been stuck in a trading range, while the NASDAQ Composite and NASDAQ 100 indices have been on an impressive roll and are indeed overbought - and due for a rest.

So, while the table may be set for a pause in the NDX, the bulls would appear to have some room to run in the S&P 500, and especially in the indices that require an economic recovery to work such as the DJIA, Russell 2000, Midcaps, etc.

Stochastic Review

Over the years, I have found that reviewing the basic stochastics is perhaps the simplest way to determine when an index or security may be ripe to "go the other way" for a while. I like to keep it simple here by using a 14-day %K (with one-day smoothing) and a three-day %D. It's not fancy, but it tends to be an effective tool that I rely on.

S&P 500 - Daily

In the chart above, it is clear that the stochastics remain in overbought territory. However, it appears that a "good overbought" condition is developing. As opposed to a traditional overbought condition, which tends to lead to countertrend moves, a "good overbought" condition is where a market "gets overbought and stays overbought."

The bottom line is I see this as a "rally continuation" sign, which tends to have bullish tendencies. So, unless the bears can get something going quickly, my take is that we now have a "good overbought" condition on our hands.

Disclaimer: Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Disclosure: At the time of publication, Mr. Moenning held long positions in ...

more

The market would like to run as more money moves out of other investments and into stocks. That said dividend stocks with little growth are oversold. Who knows when they will recover. In the meantime the rush to trend buying continues with names like #Tesla, #Microsoft, #Netflix, etc. $TSLA, $MSFT, $NFLX

All good picks! Especially in this market.