Driven Brands Holdings: A Potential Turnaround Worth Targeting Amid Year-End Selling Pressure

Image Source: Unsplash

While most investors hold winning stocks, every investor has losers, too. It’s just a natural part of investing. But rather than throwing in the towel and waiting for a fresh start next year, investors can look to convert this year’s losers into assets and winners. One name I like here is Driven Brands Holdings (DRVN), counsels Bruce Kaser, editor of Cabot Turnaround Letter.

This year, many widely held stocks have turned out to be losers. While mega-cap tech stocks have surged, nearly half of the stocks in the S&P 500 have posted negative returns year-to-date, and one in five has tumbled by 25% or more. Small-cap stocks almost across the board have had a rough year: The Russell 2000 small-cap index has gained only 3%, with a broad swath of small-cap stocks sliding sharply.

One way to capitalize on losers is by buying down-and-out shares produced by artificial year-end selling pressure. Each year, we sort through the market’s year-to-date losers to find the ones most likely to bounce sharply.

Although our investing approach focuses on underlying business fundamentals and share valuation, we, too, can be tempted by the attractive risk/return trade-off that can come with year-end selling driven by artificial pressures.

Driven Brands Holdings (DRVN)

Driven Brands is a case in point. It owns and franchises a range of auto service businesses including Meineke Muffler, Maaco (car painting), CarStar (glass replacement), and Take 5 Car Wash. The company has over 4,800 locations in 14 countries.

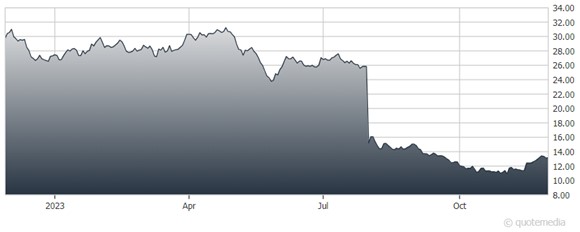

Its CEO is a successful former chief operations officer at Burger King. Driven Brands’ shares have tumbled 50% since the company announced weak results this past August. Major problems include weak performance and the outlook for its car wash business, which produces about a third of total company profits. It has also had difficulty integrating and adding new glass services stores.

The surprise exit of the CFO this past summer has also weighed on investor confidence. Bears worry that the company will be plagued by slowing consumer spending, rising competition in the car wash operations (which would seem to be a low barrier-to-entry business), and general difficulties in running a sprawling multi-franchise company.

But the bull case is encouraging: The business is high margin and generating fast growth, capital spending is low, the glass segment integration issues seem highly likely to be resolved, and the company is selling 29 problematic car wash locations.

My recommended action would be to consider buying shares of DRVN.

About the Author

Bruce Kaser has more than 25 years of value investing experience in managing institutional portfolios, mutual funds, and private client accounts. He has led two successful investment platform turnarounds, co-founded an investment management firm, and was principal of a $3 billion (AUM) employee-owned investment management company, New Generation Research.

Prior, Mr. Kaser led the event-driven small/midcap strategy for Ironwood Investment Management and was senior portfolio manager with RBC Global Asset Management where he co-managed the $1 billion value/core equity platform for over a decade. He earned his MBA degree in finance and international business from the University of Chicago, and did his undergraduate studies in finance with honors from Miami University (Ohio).

Mr. Kaser is now chief analyst of Cabot Undervalued Stocks Advisor.

More By This Author:

Meta Platforms: Capitalizing On Digital Ad Spending Growth, AI-Driven ImprovementsGranite Ridge Resources: An Energy Firm With Interests In Over 2,500 Wells And A Generous Yield

What is the Early Holiday Sales Data Telling Us? Plus: Watch Gold

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.