Meta Platforms: Capitalizing On Digital Ad Spending Growth, AI-Driven Improvements

Image Source: Pixabay

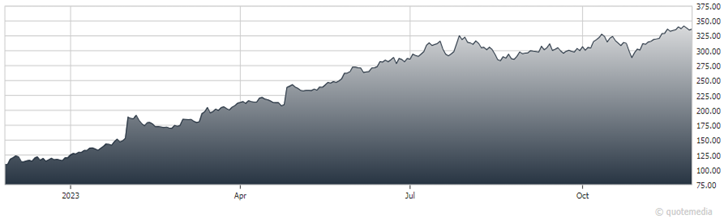

We are looking for digital ad spend to grow by a high-single-digit percentage pace in 2024 and 2025. Social media spend has seen a big recovery, largely on easier comparisons. Meanwhile, Meta Platforms’ (META) growth acceleration has been nothing short of stellar in 2023, elaborates Angelo Zino, analyst at CFRA Research.

We currently forecast digital ad growth of 9% in 2024 and 8% in 2025, which would be a sharp deceleration from historical trends, given a more mature landscape (with digital ad now two-thirds of global ad spend).

Although macro trends remain a major risk, we would highlight that slowing end-market trends in areas like autos, retail, and travel should lead to higher ad spend to stimulate demand. However, we would highlight that if we get to more extreme conditions (e.g., sharp revenue declines from advertisers), that will ultimately result in sharp budget cuts.

We have several reasons to be optimistic on the long-term trends for digital ad spend, maybe most notably the fact that GenAI will help significantly improve targeting/measuring capabilities for advertisers. Greater traction from Chinese vendors (e.g., Shein and Temu), easy comps in the first half of 2024, as well as a very important 2024 election and the Summer Olympics, are all reasons that 2024 could be another good year for digital ad spend.

Meta Platforms (META)

Meta is recovering from an ugly 2022, when it and the rest of the social media space had to contend with the lingering effects of Apple’s (AAPL) privacy changes, a shift from long form to short form video, and unfavorable currency moves.

We believe META will once again post a Q4 ad growth rate of +20% as these headwinds have largely been alleviated and, in some cases, will be tailwinds looking ahead. For instance, Reels is now running at a +$10 billion revenue run rate ($3 billion a year ago) and should continue to see significant monetization in 2024 and 2025.

We think social ad spend is growing at a low-teens percentage pace, with META taking share over smaller competitors given the higher ROI that advertisers can generate with new AI capabilities that the company is leveraging, especially as budgets tighten and customers need to be more selective.

My recommended action would be to consider buying shares of META.

About the Author

Angelo Zino has been an analyst at S&P Capital IQ Equity Research since 2007. He analyzes, researches, and recommends equity investments within the technology sector, specializing in areas like hardware and semiconductors, as well as the telecommunications sector. In addition, he also has extensive coverage in the alternative technology arena (i.e. solar, LEDS, 3D printers).

Previously, Mr. Zino was a vice president and portfolio manager at North Fork Bank, investing accounts through the utilization of mutual funds and applying a black-box approach. Prior to that he was an analyst for the North Fork Bank Trust Department, recommending industrial stocks through fundamental analysis and technical analysis-driven models.

Mr. Zino received a MBA in finance from Hofstra University. He is a member of the CFA Institute and the New York Society of Security Analysts and also holds the Chartered Financial Analyst designation. He has been awarded Best on The Street honors by The Wall Street Journal in 2011, second place in alternative energy; 2010, first place in alternative energy; and 2009, fifth place in semiconductor equipment.

More By This Author:

Granite Ridge Resources: An Energy Firm With Interests In Over 2,500 Wells And A Generous YieldWhat is the Early Holiday Sales Data Telling Us? Plus: Watch Gold

IBM, V: Large Cap US Stocks With Leverage To AI, Global Growth

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.