Draft Kings Looking To Resume Higher After Completing The Pullback

The Draft Kings, Inc. ticker symbol: DKNG is a digital sports entertainment and gaming company engaged in providing online sports betting. Online casinos, daily fantasy sports product offerings, Draft Kings Marketplace. Retail sports betting, media and other gaming product offerings. consumption. It operates through the following segments: Business-to-Consumer (B2C) and Business-to-Business (B2B). The business-to-consumer segment includes sports betting, iGaming and DFS product offerings, as well as media and other consumer product offerings. The Business-to-Business segment includes the design and development of gaming software. The company was founded by Jason D. Robins, Matthew Kalish, and Paul Liberman on December 31, 2011 and is headquartered in Boston, MA.

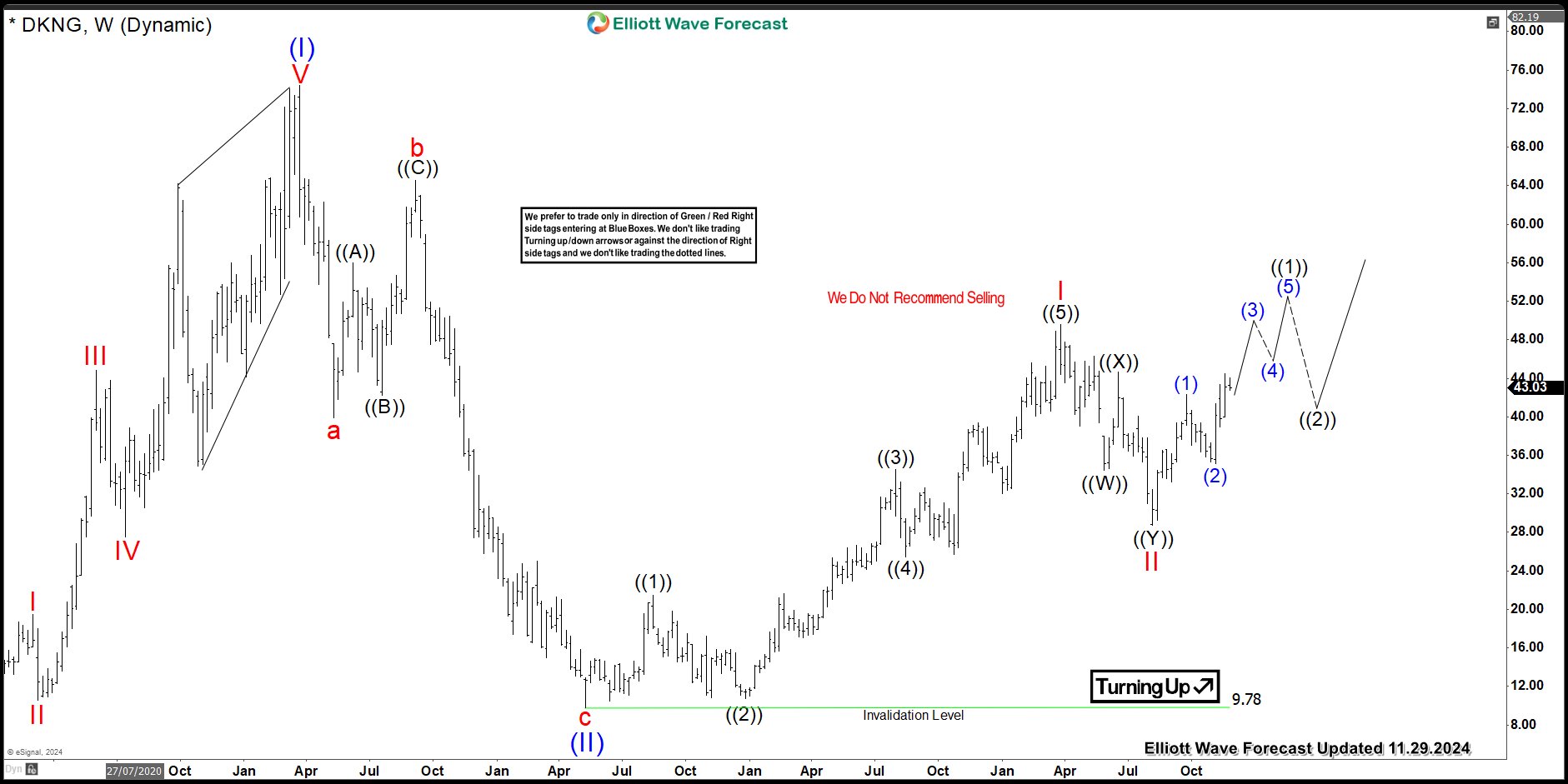

In this blog, we will look at the technical analysis on DKNG. In which, the super cycle degree wave (I) ended at $74.38 high and made a 3 wave pullback against all time lows within wave (II). The internals of that pullback unfolded as zigzag correction where wave cycle degree wave a ended at $39.93 low. Wave b bounce ended at $64.58 high and wave c ended at $9.78 low. Thus completed wave (II) pullback. Up from there, the stock made a 5 waves rally & ended cycle degree wave I at $49.57 high. Down from there, the stock made a 7 swings lower pullback and completed wave II pullback at $28.69 low. Near-term, as far as dips remain above $28.69 low and more importantly above $9.78 low expect stock to resume the upside.

DKNG Weekly Elliott Wave Analysis

(Click on image to enlarge)

If you are looking for real-time analysis in Stocks & ETFs then join us with a 14-Day Trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry.

More By This Author:

Elliott Wave View: Nasdaq ETF Looking For More Downside

Elliott Wave View: Oil Short Term May See More Downside

Tesla Stock : Elliott Wave Forecasting The Rally

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more