Elliott Wave View: Nasdaq ETF Looking For More Downside

Image Source: Pixabay

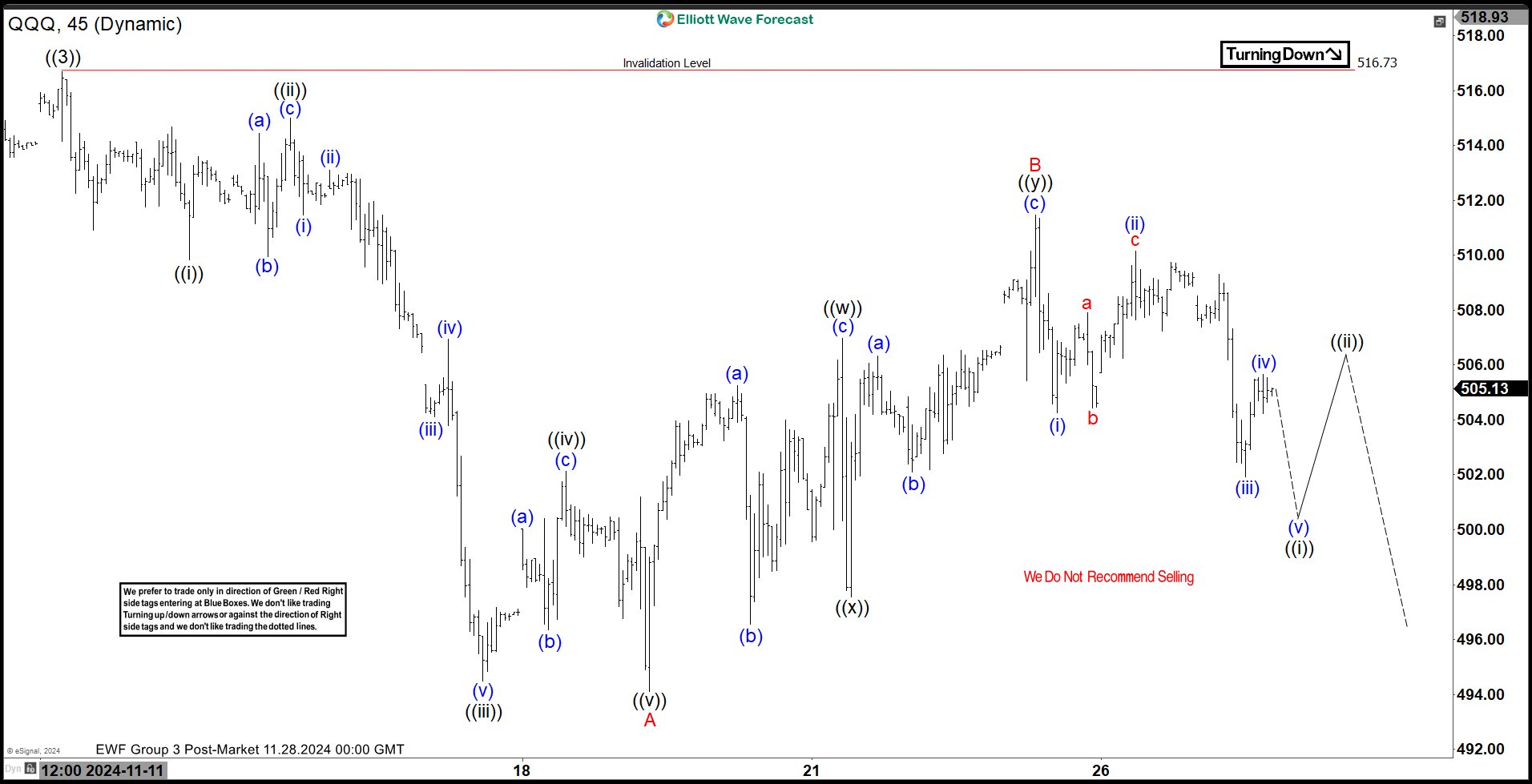

Rally in Nasdaq ETF (QQQ) from 10.13.2022 low is in progress as a 5 waves impulse. Up from 10.13.2022 low, wave ((1)) ended at 296.88 and wave ((2)) ended at 259.73. The ETF extended higher and ended wave ((3)) at 516.73 as 45 minutes chart below shows. Wave ((4)) pullback is in progress and the current decline is unfolding as a zigzag. Down from wave wave ((3)), wave ((i)) ended at 509.83 and wave ((ii)) rally ended at 514.98. Wave ((iii)) lower ended at 494.49 and wave ((iv)) rally ended at 502.14. Final leg lower wave ((v)) ended at 494.11 which completed wave A.

The ETF then rallied in wave B with internal subdivision as a double three Elliott Wave structure. Up from wave A, wave (a) ended at 505.25 and wave (b) pullback ended at 496.56. Wave (c) higher ended at 506.96 which completed wave ((w)). Pullback in wave ((x)) ended at 497.56. The ETF extended higher in wave ((y)). Up from wave ((x)), wave (a) ended at 506.34 and pullback in wave (b) ended at 502.1. Wave (c) higher ended at 511.45 which completed wave ((y)) of B. The ETF has turned lower in wave C. Near term, as far as pivot at 516.67 high stays intact, expect rally to fail in 3, 7, 11 swing for further downside.

Nasdaq ETF (QQQ) 45 Minutes Elliott Wave Chart

QQQ Elliott Wave Video

Video Length: 00:07:23

More By This Author:

Elliott Wave View: Oil Short Term May See More DownsideTesla Stock : Elliott Wave Forecasting The Rally

Gold Puts Buyers In Profit From The Blue Box

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more