Dow Stocks Are Falling, 3 Dow Stocks To Sell

Yesterday, I said that there is "(much) more downside to come!" I also mentioned that for a decade, people have been "buying the dip", but, now, you might need to "sell the pop".

Wednesday started with buyers trying to prop up the markets. But, two hours into the trading, things started to fall apart again. Tech stocks once again led the way. AAPL -5.18% and MSFT -3.32%, both big components of Dow, dragged the blue-chip index lower. I mentioned yesterday that the Dow was only 13% down from its recent high, compared to SPX's 20% and Nasdaq's 27%. The Dow is starting to crumble under tremendous selling pressure.

AAPL

(Click on image to enlarge)

AAPL has fallen directly to soft support, at around $145. If the $145 level does not hold, it is looking to fall down to $130.

MSFT

(Click on image to enlarge)

MSFT finished at $160.55, above soft support at around $155. Below this support, MSFT could drop to $140.

After the market, BROS tumbled another -37% on top of already falling -16% during regular hours. BYND dropped more than -20% on top of -14% during the day. Both companies reported worse-than-expected quarterly reports. These restaurant and food stocks made me think of MCD, which has actually held up pretty well.

MCD

(Click on image to enlarge)

MCD stock traded down to $220 back in early March. After a dramatic recovery, in March and April, it is under selling pressure again. We could see this visit in the March low.

After 3 days of brutal selling, the dip-buyers are starting to pause. Without buyers trying to catch the bottom, stocks are likely to continue to slide. As I mentioned yesterday, SDS and VXX are cheap ways to hedge against a falling market.

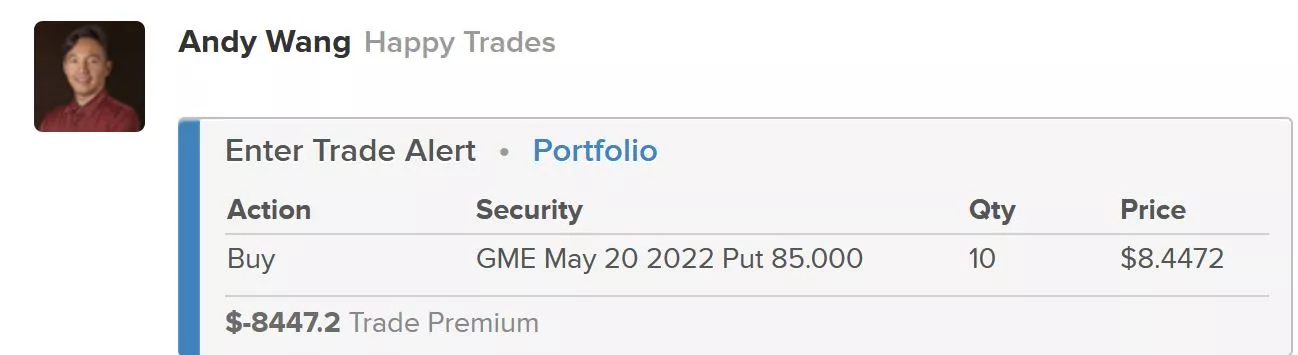

I'm also trading AMC and GME puts. These stocks have risen up as Meme stocks in a bull market. But, in a bear market, they will crumble fast. AMC is about to fall below $10, and perhaps the fall will start to slow. But, GME is still trading above $80 - this could easily get halved within a month.

Good morning and HappyTrading! ™

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no ...

more