Dotcom Bubble It Ain’t – Anatomy Of A Sale

Lately, I have heard some of the higher profile pundits compare this market to 1999. That is total nonsense and garbage. I am embarrassed for them. Either they are lazy and ignorant. I was there during the lead up to the Dotcom collapse. I vividly remember losing clients in Q4 1999 for not embracing the new paradigm. Client thought I was stupid for owning a bunch of pharma stocks. Next week, I will pull out some charts to compare the two periods.

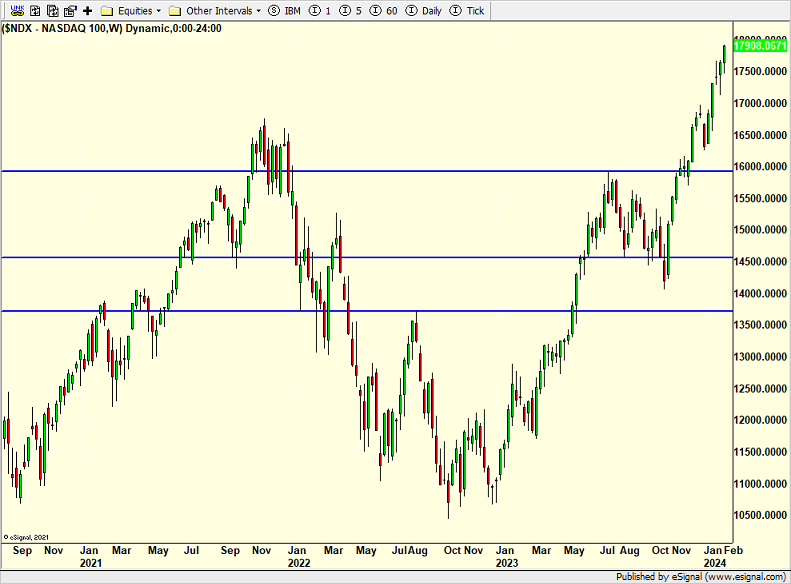

The NASDAQ 100 has been a monster, not only this year, all of last year as well. If you have owned it, what a great and fun ride it has been. If you haven’t, there have not been many easy opportunities to hop on board and that has to be frustrating. The weekly chart is below. The index still targets a good 10% higher from here. Eventually, the market will punish the late comers. It always does.

(Click on image to enlarge)

I received a few emails about why we sold some stocks recently. Among other sales, we sold Broadcom (AVGO) the other day. The chart is below. Those who follow the buys and sells I post at the end of each blog know we’re usually quick to exit when things go against us right out of the gate. After that I like to let things be and see if our thesis is correct.

If the case of Broadcom, I would say that we definitely bought it well in 2022. The stock has melted up several times, most recently since October. At the same time our other semiconductor positions largely followed the same path. That led to semis having a much larger weighting in our Unloved Gems portfolio.

Typically, we first sell our profits which sets the position back to its original weighting, something we did with Nvidia and Tesla more than once. Then, if we think something fundamentally changed in the stock we sell the stock. Also, like with Broadcom, the stock has rallied so far and so fast that it is unlikely to continue. We look for one to three reversal signs and then sell.

(Click on image to enlarge)

I heard that some rodent in Pennsylvania did not see his shadow so spring is here early. I’d like to get my hands on Phil and stuff him back into the ground. I see they are calling for temps in the 50s this weekend in New England. This really isn’t fair and I am not happy about it. Of course, when we lost heat in Vermont last weekend on Saturday and Sunday when it was 10 outside, I wasn’t thrilled. Just glad we had space heaters and warm clothes.

Finally, I had my annual physical this week. I shrunk. That’s what my doctor said. And I can look forward to some more shrinkage over the coming years. When I told him that I didn’t exactly have any height to spare, he reminded me that I was still taller than he was and always will be.

On Wednesday we sold EMB . On Thursday we bought TUR, ARCH, more TSLA and more ITB. We sold PCY and FUTY.

More By This Author:

But It’s Only 6 Stocks And It Looks Like The Dotcom BubbleHorrible Market Action But Bears Carried Out On A Stretcher

Sell The News, Buy The News, Scratch Your Head On The News

Please see HC's full disclosure here.