Don't Overlook These Basic Materials Stocks It's Time To Buy

Image Source: Pexels

Tech stocks have continued to roar this year with the Nasdaq now up +42% in 2023 but diversification can be healthy for the portfolio and a few basic materials stocks are standing out at the moment.

Added to the Zacks Rank #1 (Strong Buy) list this week here are three basic materials stocks that investors shouldn't overlook right now.

Centrus Energy (LEU)

Soaring +65% this year, Centrus Energy’s stock is worthy of investors' consideration as a supplier of enriched uranium fuel for commercial nuclear power plants. Centrus also provides contract work services for the U.S. Department of Energy and its contractors.

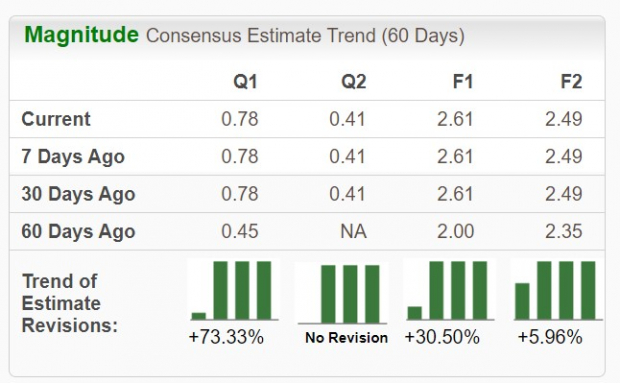

Despite this year’s impressive rally, Centrus’ stock still trades at a reasonable 20.1X forward earnings multiple and annual earnings estimates for fiscal 2023 have soared 30% over the last 60 days from projections of $2.00 a share to $2.61 per share. Plus, FY24 EPS estimates are up 6% in the last two months and its noteworthy that Centrus most recently crushed its third quarter earnings expectations by 100% in November with earnings coming in at $0.52 per share compared to estimates of $0.26 a share.

Image Source: Zacks Investment Research

Ryerson (RYI)

Steel producer and metal distributor Ryerson Holding Corporation has seen its stock rise a modest +8% in 2023 but there is deep value that suggests more upside. Through its subsidiaries, Ryerson purchases, processes, and distributes various forms of stainless steel, aluminum, carbon, alloy steel, nickel, and red metals.

Trading at a very reasonable 9X forward earnings multiple, Ryerson’s FY23 earnings estimates have jumped 18% over the last 60 days with FY24 EPS estimates up 5%. Making Ryerson’s stock more attractive is that the company offers a generous 2.28% dividend yield which it has increased nine times in the last five years and is nicely above the Zacks Steel-Producers Industry average of 1.99% and the S&P 500’s 1.39%.

Image Source: Zacks Investment Research

Sylvamo (SLVM)

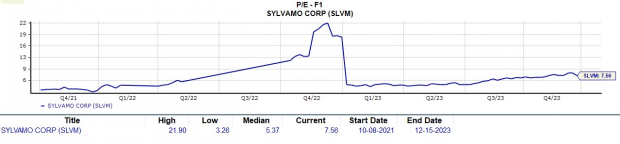

Lastly, paper producer Sylvamo Corporation’s stock looks attractive with annual earnings estimates for fiscal 2023 up 5% over the last 60 days while FY24 EPS estimates have risen 6%. Sylvamo’s stock is virtually flat for the year but is up +48% in the last three years which tops the S&P 500’s +27% and the Nasdaq’s +17%.

To that point, Sylvamo has a unique niche in transforming renewable resources into papers for education, communication, and entertainment. Plus, Sylvamo’s stock trades at just 7.5X forward earnings with the rising EPS estimates offering further support and the company has a global footprint that includes mills in North America, Europe, and Latin America. It’s also noteworthy that Sylvamo offers a very respectable 2.56% annual dividend yield that is below its industry average of 4.52% but comfortably tops the S&P 500’s average.

Image Source: Zacks Investment Research

Takeaway

Positive earnings estimate revisions have become very appealing for these basic materials stocks considering their reasonable P/E valuations. This is reason to believe that Centrus Energy, Ryerson, and Sylvamo’s stock could have a nice amount of upside especially as market sentiment remains higher.

More By This Author:

3 Highly Ranked Retail Stocks To Buy At Year's EndMicron To Report Q1 Earnings: What's In The Cards?

PepsiCo Dips More Than Broader Market: What You Should Knowzac

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more