3 Highly Ranked Retail Stocks To Buy At Year's End

As we start to round out the year, retail stocks may become more of a focal point for investors’ portfolios in 2024. To that point, a more dovish Fed is starting to allude to the notion that inflation will be easier on consumers going forward and a few Zacks Retail and Wholesale sector stocks are standing out.

Added to the coveted Zacks Rank #1 (Strong Buy) list last week here are three highly ranked retail stocks to consider in December.

Casey’s General Stores (CASY)

With its convenience stores continuing to pop up throughout the Midwest, investors should take notice of Casey’s General Stores' steady growth. This is especially true with the Zacks Retail-Convivence Stores Industry currently in the top 1% of over 250 Zacks industries.

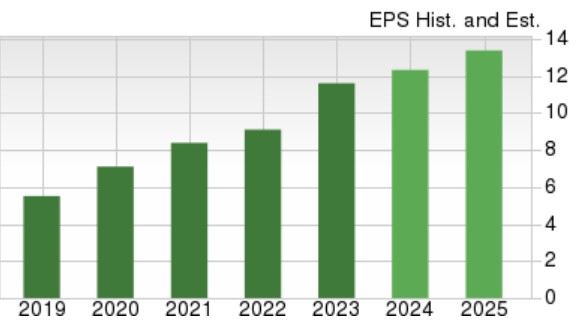

Correlating with such, annual earnings estimates for Casey’s current fiscal 2024 have risen 7% over the last 30 days while FY25 EPS estimates are up 4%. More importantly, Casey’s stock remains a very viable option in regards to growth with EPS now expected to expand 6% in FY24 and rise another 8% in FY25 to $13.37 per share. Notably, Casey’s stock has risen +21% in 2023 and is now up +52% over the last three years to top the S&P 500’s +26% and the Nasdaq’s +17%.

Image Source: Zacks Investment Research

Deckers Outdoor (DECK)

Deckers Outdoor’s niche as a leading provider of footwear and accessories for outdoor sports and other lifestyle-related activities has sustained the company’s robust bottom line. Now looks like an ideal time to buy Deckers stock with earnings estimates for its current FY24 and FY25 nicely up over the last 30 days as well.

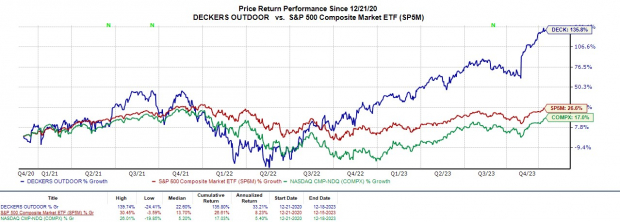

Furthermore, Deckers’ storied growth has continued as FY24 EPS projections of $23.49 per share would be a 21% increase from earnings of $19.37 a share in FY23. Even better, FY25 EPS is expected to expand another 13% with Deckers' stock soaring +77% YTD and now up +136% in the last three years.

Image Source: Zacks Investment Research

PDD Holdings (PDD)

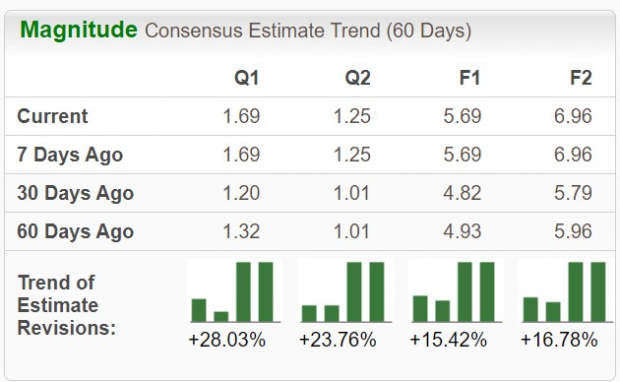

Rounding out the list, PDD Holdings also known as Pinduodou is one of the fastest growing e-commerce platforms in China. After a high global inflationary environment over the last few years, PDD Holdings is taking advantage of deflation in China as well. Taking market share from Chinese e-commerce giants like Alibaba (BABA) and JD.com (JD), PDD Holdings annual earnings are now anticipated to soar 43% this year to $5.69 per share compared to $3.98 a share in 2022.

Plus, FY24 EPS is projected to climb another 22% to $6.96 per share. It's also noteworthy, that in the last 60 days, FY23 and FY24 earnings estimates have climbed 15% and 17% respectively. PDD Holdings price performance over the last three years is virtually flat but shares have soared +81% in 2023 as the company’s earnings outlook continues to strengthen.

Image Source: Zacks Investment Research

Bottom Line

Rising earnings estimates are a reminder that the impressive price performances of these retail stocks should continue as 2024 approaches. The expansive growth of Casey’s General Stores, Deckers Outdoor, and PDD Holdings continues to support this as well making them strong investment options for 2023 and beyond.

More By This Author:

Micron To Report Q1 Earnings: What's In The Cards?PepsiCo Dips More Than Broader Market: What You Should Knowzac

Rivian's Collaboration With AT&T Positions It for Growth

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more