Dogs Of Major Indices

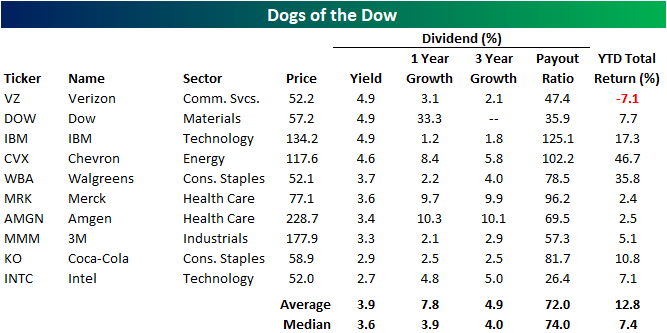

The Dogs of the Dow is a popular hands-off investing strategy that says to simply buy the 10 stocks in the Dow Jones Industrial Average with the highest dividend yield at the end of each year. As we approach the end of 2021, below is a look at the ten Dow stocks that would currently make up the Dogs of the Dow for 2022. As shown, Verizon (VZ), Dow (DOW), and IBM top the list with dividend yields of 4.9%, while Coca-Cola (KO) and Intel (INTC) have the lowest yields of the Dogs at just under 3%.On average, the 10 Dogs have a yield of 3.9%, and they’re only up 12.8% so far in 2021. Notably, every member of this list has increased or maintained their dividend over the last three years.

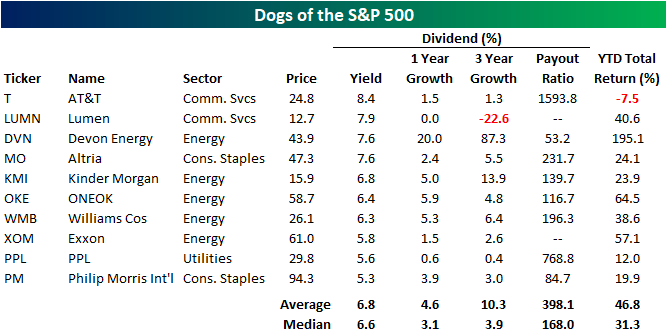

We thought it would be interesting to find the 10 “Dogs” of the S&P 500 and Nasdaq 100 as well. The table below shows the 10 highest yielding stocks in the S&P 500 at the moment. These ten stocks have an average dividend yield of 6.8%, and two of the ten are tobacco companies Altria (MO) and Philip Morris International (PM). It is worth noting that most of the members on this list have paid out more in dividends than they have taken in on a net income basis over the last twelve months, which seriously puts into question the sustainability of the dividend. And aside from AT&T (T) which is down 7.5% YTD, these stocks haven’t exactly been “dogs” when it comes to share-price performance recently. On a total return basis, these ten stocks have averaged a sizeable gain of 46.8% so far in 2021.

Below is a look at the ten highest yielding stocks in the Nasdaq 100 at the moment. While Nasdaq 100 names aren’t typically thought of as attractive dividend payers, these ten stocks have an average yield of 3.2% at least. That’s not much less than the average yield of 3.9% for the ten Dogs of the Dow.Kraft Heinz (KHC) is at the top of the list with a yield of 4.5%, but this stock has seen its dividend growth actually decrease over the last three years, and its payout ratio is pretty high at 85.1%. Four more names have yields between 3 and 4% — Gilead (GILD), Walgreens (WBA), American Electric (AEP), and Amgen (AMGN). Broadcom (AVGO) has the lowest yield of the 10 Nasdaq 100 Dogs, but it has increased its dividend by 23.6% over the last three years and by 10.8% over the last twelve months.

Click here to learn about Bespoke’s premium research services where you can get more in-depth ...

more