Does UnitedHealth Stock Have More Upside After Q3 Earnings?

Image Source: Pexels

UnitedHealth Group's (UNH - Free Report) stock hasn’t received the post-earnings rally that investors may have hoped for, but the medical giant was able to provide subtle signs that its operations are stabilizing.

Posting mixed but favorable Q3 results on Wednesday, UnitedHealth is striving to overcome a somewhat uphill battle that stems from regulatory scrutiny, leadership instability, and industry headwinds as it relates to rising medical costs.

While UnitedHealth stock has rebounded swiftly from a five-year low of $234 a share, UNH is still more than 40% from its 52-week high of $630.

Image Source: Zacks Investment Research

UnitedHealth’s Mixed Q3 Results

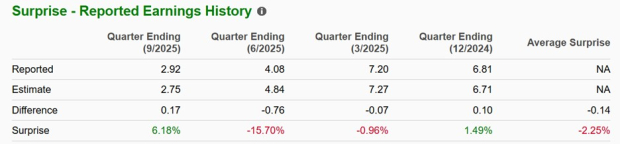

UnitedHealth’s adjusted Q3 earnings of $2.92 per share comfortably exceeded EPS expectations of $2.75 despite dropping from $7.15 in a tough to compete against prior year quarter. Optimistically, this marked UnitedHealth’s first earnings beat in three quarters, following misses in Q1 and Q2 due to lower Medicare funding and higher care costs, along with exchange losses in its health insurance plans offered through the Affordable Care Act (ACA).

That said, Q3 sales of $113.16 billion slightly missed estimates of $113.35 billion, although this was a 12% increase from $100.82 billion a year ago.

Image Source: Zacks Investment Research

UnitedHealth’s Raised EPS Guidance

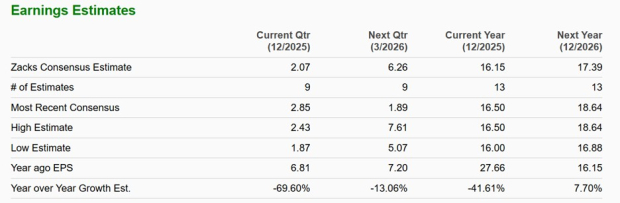

Signaling a more optimistic outlook, UnitedHealth raised its full-year adjusted EPS guidance to at least $16.25, up from a previous floor of $16.00. This also came in above the current Zacks Consensus of $16.15.

UnitedHealth CEO Stephen Hemsley emphasized “solid earnings growth” in 2026 and beyond, but warned of membership losses in Medicare Advantage and ACA plans. Notably, Hemsley previously headed UnitedHealth from 2006-2017, and was reappointed as CEO in May after his predecessor, Andrew Witty, resigned for personal reasons.

Based on Zacks' estimates, UnitedHealth's annual EPS is projected to rebound to $17.39 in fiscal 2026.

Image Source: Zacks Investment Research

UNH P/E Valuation Comparison

Despite the contraction in its bottom line, UnitedHealth stock still trades at a reasonable 22.7X forward earnings multiple. This is a slight discount to the benchmark S&P 500, and, as a long-time healthcare leader, UNH doesn’t trade at a stretched premium to its Zacks Medical-HMOs Industry average of 18X forward earnings, with some noteworthy peers being Cigna Group (CI - Free Report) and Humana (HUM - Free Report).

Image Source: Zacks Investment Research

UnitedHealth’s Appealing & Reliable Dividend

Appealing to long-term investors is that UNH offers a respectable 2.4% annual dividend yield that impressively tops the benchmark’s 1.07% average and its industry average of 2.11%.

It’s also noteworthy that UnitedHealth is a dividend aristocrat, raising its dividend for at least 25 consecutive years (34). Over the last five years, UNH has an intriguing annualized dividend growth rate of 12.91% and its 35% payout ratio suggests there is plenty of room for more dividend hikes in the future.

Image Source: Zacks Investment Research

Bottom Line

Prioritizing profitability, UnitedHealth is starting to show confidence in its earnings trajectory, which may help UNH shake off the turbulent volatility it saw earlier in the year. For now, UNH lands a Zacks Rank #3 (Hold) as more upside will largely depend on what is hopefully a positive trend of earnings estimate revisions (EPS) for FY26.

More By This Author:

2 Intriguing Stocks To Watch After Exceeding Quarterly Expectations: AGYS, W

Buy The Mag 7 Laggards As Earnings Approach?: AMZN, AAPL

Visa Tops Q4 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more