Buy The Mag 7 Laggards As Earnings Approach?: AMZN, AAPL

Image Source: Pexels

With most of the quarterly results from the Mag 7 set to roll in this week, the pressure on the group is tilting toward Amazon (AMZN - Free Report) and Apple (AAPL - Free Report).

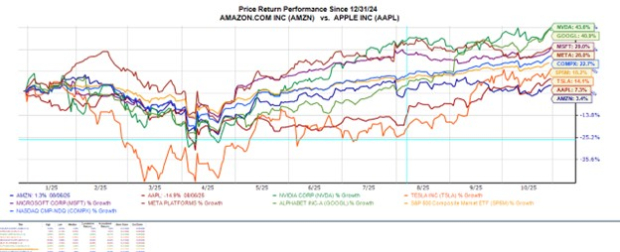

Set to release their quarterly reports after-market hours on Thursday, October 30, Amazon and Apple have been the laggards of the Mag 7 stocks this year.

Along with Tesla (TSLA - Free Report), Amazon, and Apple stock have trailed the broader indexes' YTD returns, with the rest of the group outperforming, led by Nvidia’s (NVDA - Free Report) gains of more than +40%.

The appetite for loftier gains from Amazon and Apple stock is certainly setting in amid hopes that AI can give these tech giants another boost.

Image Source: Zacks Investment Research

What Wall Street will be Looking For

Amazon’s Cloud Services & Retail Performance

Outside of enhancing its retail performance, analysts will be anticipating updates on how Amazon’s AI investments are translating into cloud growth and profitability. As the largest global cloud provider ahead of Microsoft’s (MSFT - Free Report) Azure and Alphabet’s (GOOGL - Free Report) Google Cloud, Amazon’s AWS revenue is thought to have increased 17% during Q3 to more than $30 billion.

Notably, AWS has been Amazon’s most profitable business segment, with cloud computing and cloud infrastructure services now accounting for nearly 20% of the e-commerce giant’s top line. Overall, Amazon’s Q3 sales are expected to spike 12% to $177.88 billion, with Q3 earnings expected to rise 10% to $1.58 per share.

iPhone 17 Sales & Apple Services Growth

Reporting results for its fiscal fourth quarter, Wall Street will be paying close attention to how trade tensions with China may potentially impact Apple’s outlook. However, enhanced AI features in the iPhone 17 are helping to offset tariff concerns and increased competition from Chinese competitors like Huawei and Xiaomi, with China being Apple’s largest market outside of the U.S.

Driven by the release of the iPhone 17 in September, Apple’s Q4 sales in China are thought to have increased 4% to more than $18 billion. Optimistically, Apple’s Services segment (App store, iCloud, subscriptions) is thought to have expanded 13% during Q4, pushing annual services revenue to over $100 billion for the first time. As a whole, Apple’s Q4 sales are expected to be up 6% to $101.19 billion, with quarterly EPS expected to rise 5% to $1.73.

Amazon & Apple Valuation Comparison

Although Amazon and Apple have been the laggards among the Mag 7 in 2025, they are in the middle of the pack in terms of price-to-forward earnings valuation at just over 30X. Tesla commands the highest P/E premium among the group, followed by Nvidia and Microsoft, with Alphabet and Meta Platforms (META - Free Report) having the cheapest valuations in this regard at under 30X.

That said, Amazon has the most reasonable price to forward sales multiple of 3.4X, with Apple’s 9.1X being third behind Alphabet’s 8.7X.

Image Source: Zacks Investment Research

What the Zacks Rank Suggests

Attributed to its more exhilarating EPS growth and a positive trend in EPS revisions for fiscal 2025 and FY26, Amazon stock currently sports a Zacks Rank #2 (Buy). Apple shares, on the other hand, land a Zacks Rank #3 (Hold) as FY25 and FY26 EPS revisions are slightly down in the last 30 days despite steady bottom line expansion in the forecast as well.

More By This Author:

Visa Tops Q4 Earnings And Revenue EstimatesAmerican Airlines Vs. Ford Motors: Which Is The Better Value Stock After Q3 Earnings?

Is Meta Platforms Stock A Smart Buy Before Q3 Earnings Report?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more