DocuSign Q2 Preview: Can Shares Find Any Relief?

Image: Bigstock

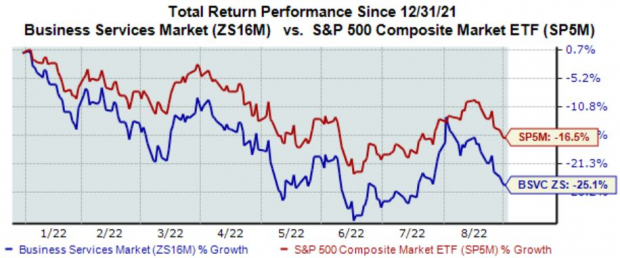

The Zacks Business Services Sector has been hit harder than most in 2022, down more than 25% and vastly underperforming the S&P 500.

Image Source: Zacks Investment Research

A company that’s gained widespread attention, DocuSign (DOCU - Free Report) is slated to unveil Q2 earnings on Thursday, Sept. 8 after the market close. DocuSign provides a fast, reliable way to electronically sign documents and agreements on practically any device from almost anywhere in the world.

Currently, the company carries a Zacks Rank #4 (Sell) with an overall VGM Score of a B. How does everything shape up for the company heading into the print? Let’s take a closer look to see.

Share Performance & Valuation

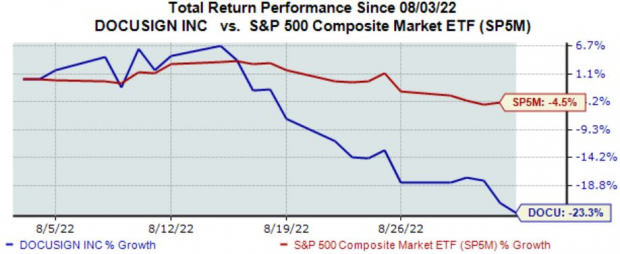

It’s been more than a challenging road in 2022 for DocuSign shares, down more than 60% and coming nowhere near the S&P 500’s performance.

Image Source: Zacks Investment Research

Over the last month, shares have continued on their market-lagging trajectory, decreasing by nearly 24% in value.

Image Source: Zacks Investment Research

It’s no secret that DOCU shares often trade at steep valuation multiples, typical of high-growth stocks. Still, the company’s 4.5X forward price-to-sales ratio is below its median of 13.2X since its IPO in April 2018 and represents a 34% discount relative to its Zacks Sector. DocuSign carries a Style Score of a D for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

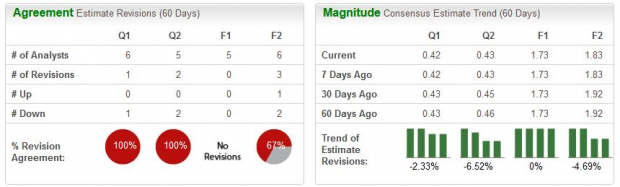

A singular analyst has lowered their earnings outlook for the quarter, with the Consensus Estimate Trend slipping roughly 2.3%. The Zacks Consensus EPS Estimate of $0.42 reflects an 11% drop-off in quarterly earnings year-over-year.

Image Source: Zacks Investment Research

However, the company’s top-line is in excellent shape – the Zacks Consensus Sales Estimate of $600 million pencils in year-over-year, top-line growth of a rock-solid 18%.

Quarterly Performance & Market Reactions

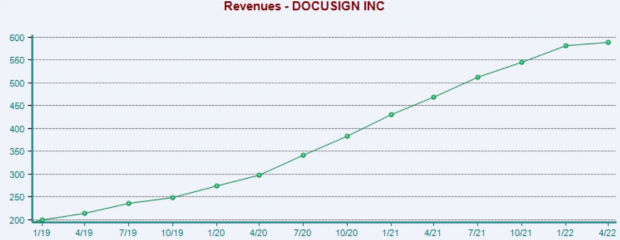

DOCU has primarily exceeded bottom-line estimates, with eight bottom-line beats over its last ten quarters. However, the company recorded an 18% EPS miss in its latest print. Top-line results have been impressive – DocuSign has chained together a staggering 17 consecutive top-line beats. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Day-traders who prefer the long side, beware – shares have moved downwards by double-digit percentages following each of the company’s three previous prints.

Putting Everything Together

The bears have had a firm grip all year long on DocuSign, with shares widely lagging the general market across several timeframes. DocuSign carries steep valuation levels, further displayed by its style score of a D for Value. Still, this is typical of stocks in large, growing markets.

One analyst has lowered their quarterly outlook; projections reflect a decrease in earnings, but a sizable uptick in revenue. Further, the company has consistently exceeded quarterly estimates, but the market hasn’t reacted well as of late following the last three prints. Heading into the release, DocuSign (DOCU - Free Report) carries a Zacks Rank #4 (Sell) with an Earnings ESP Score of -12%.

More By This Author:

Zumiez Q2 Preview: Rebound Quarter Inbound?

Broadcom Inc. Q3 Earnings and Revenues Beat Estimates

Bear Of The Day: Monster Beverage

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more