Zumiez Q2 Preview: Rebound Quarter Inbound?

Image: Bigstock

The Zacks Retail and Wholesale Sector has struggled in 2022, losing more than 20% in value and widely lagging behind the S&P 500.

Image Source: Zacks Investment Research

Zumiez (ZUMZ - Free Report), a company in the sector, is scheduled to unveil Q2 earnings on Thursday, Sept. 8 after the market close. Zumiez is one of the leading global lifestyle retailers. Its distinctive brand offerings and diverse product selection have carved a niche in the rapidly changing apparel industry.

Before we get into how the company stacks up heading into the report, let’s take a look at another big retailer’s quarterly results, Lululemon (LULU - Free Report).

Lululemon

Lululemon designs, manufactures, and distributes athletic apparel and accessories for women, men, and female youth. The company targets the high-end consumer market. Lululemon had a strong quarter – the company reported quarterly EPS of $2.20, enough to exceed the Zacks Consensus Estimate of $1.86 by 18% and reflect a stellar year-over-year uptick of 33%.

Quarterly sales came in hot at $1.9 billion, exceeding expectations of $1.8 billion by nearly 6% and penciling in a rock-solid 30% year-over-year uptick. Further, the company’s gross margin improved by an impressive 25% year-over-year to $1.1 billion. LULU’s substantial results were fueled by strong business momentum, leading to rock-solid quarterly metrics and a heavily improved operating margin.

In addition, the company provided uplifting guidance – management now expects net revenues of $1.8 - $1.81 billion for Q3 2022, representing a year-over-year uptick of more than 20%. Clearly, it was a strong quarter for the company, and it tells us that retailers operating in high-end markets have had much higher success than others in 2022.

Now, onto Zumiez.

Zumiez

Zumiez shares have struggled heavily in 2022, down nearly 50% and vastly underperforming the S&P 500.

Image Source: Zacks Investment Research

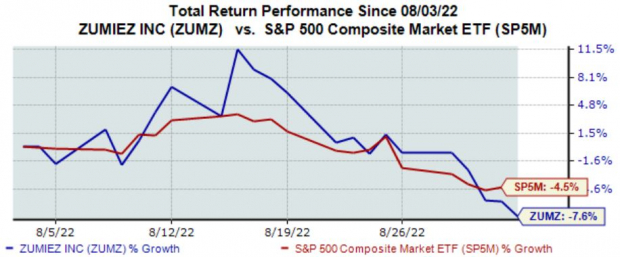

Over the last month, ZUMZ shares have continued on their downward trajectory, decreasing nearly 8% in value and lagging the general market in this timeframe as well.

Image Source: Zacks Investment Research

The poor price action tells us that bears have had a firm grip on shares all year long.

Zumiez shares trade at rock-solid valuation levels, further displayed by its Style Score of an A for Value. The company’s forward earnings multiple resides at a low 7.4X, nowhere near its five-year median of 13.4X and representing a steep 70% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

A singular analyst has lowered their earnings outlook over the last 60 days, with the Zacks Consensus EPS Estimate of $0.47 penciling in a steep 53% year-over-year drop off in quarterly earnings.

Image Source: Zacks Investment Research

The company’s top-line is also undergoing some turbulence – the Zacks Consensus Sales Estimate of $230 million reflects a 13% drop in quarterly revenue year-over-year.

Zumiez has primarily reported bottom-line results above expectations, exceeding the Zacks Consensus EPS Estimate in seven of its last ten quarters. However, the company has most recently posted back-to-back EPS misses.

Quarterly revenue has also typically come in above expectations, with ZUMZ penciling in six top-line beats over its last ten quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, it’s worth noting that shares have moved downwards following back-to-back quarterly releases.

Putting Everything Together

As we can see from lululemon's (LULU - Free Report) quarterly results, the high-end consumer market is in great shape. The company beat top and bottom-line estimates and even provided inspiring guidance.

Zumiez doesn’t cater to the high-end market nearly as much as LULU does, an essential factor to remember. Zumiez shares have tumbled year-to-date and over the last month, signaling that the bears have been in control. Still, the company’s shares often trade at solid valuation levels, with its forward P/E ratio residing nicely beneath its Zacks Sector Average and five-year median.

A singular analyst has lowered their quarterly outlook, and estimates reflect a year-over-year decrease in earnings and revenue. ZUMZ has primarily exceeded quarterly estimates, but it has posted back-to-back bottom-line misses. Heading into the print, Zumiez (ZUMZ - Free Report) carries a Zacks Rank #4 (Sell) with an Earnings ESP Score of -20%

More By This Author:

Broadcom Inc. Q3 Earnings and Revenues Beat EstimatesBear Of The Day: Monster Beverage

Three Great Mutual Funds For Your Retirement

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more