Dividend Watch: Three Companies Boosting Payouts

Image Source: Pixabay

Several companies have been delivering positive news to shareholders lately, including announcements of higher dividend payouts.

A company opts to raise its dividend when confident in its current standing and cash-generating abilities.

Of course, it also reflects the company’s commitment to returning value to shareholders, which is undoubtedly encouraging.

Three companies — Advanced Drainage Systems (WMS - Free Report), Taiwan Semiconductor (TSM - Free Report), and Northrop Grumman (NOC - Free Report) — recently declared dividend hikes. For those with an appetite for income, let’s take a closer glance at each.

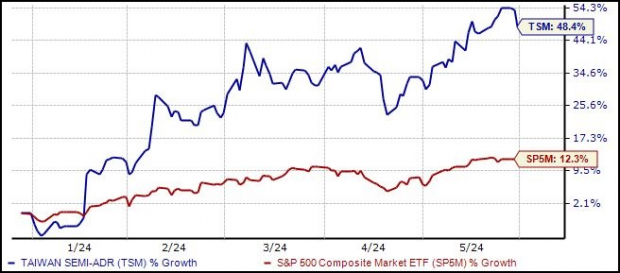

Taiwan Semiconductor

TSM posted better-than-expected results in its latest release, exceeding the Zacks Consensus EPS estimate by nearly 7% and posting sales 2.7% ahead of expectations. Earnings grew 5% year-over-year, whereas revenue jumped 13% from the year-ago period amid hot demand.

Shares popped following the release, adding to already impressive year-to-date gains. Up 50% in 2024, shares have widely outperformed relative to the S&P 500.

Image Source: Zacks Investment Research

The company announced a 10% boost to its payout, bringing the quarterly total to $0.45/share. TSM’s commitment to increasingly rewarding shareholders has kept it a favorite among income-focused investors seeking technology and semiconductor exposure.

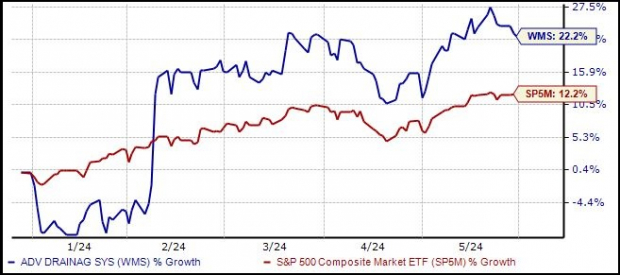

Advanced Drainage Systems

WMS shares have also delivered a considerably strong performance in 2024, gaining 22% in value compared to the S&P 500’s 12% gain. Better-than-expected results have aided the move, with the company exceeding the Zacks Consensus EPS estimate by an average of 30% across its last four releases.

Image Source: Zacks Investment Research

The company recently unveiled a 14% boost to its quarterly payout, bringing the quarterly total to $0.16/share. WMS has long displayed a shareholder-friendly nature, boasting a 12% five-year annualized dividend growth rate.

In addition, WMS is expected to continue its steady growth, with Zacks Consensus estimates suggesting 5.6% earnings growth on 5% higher sales in its current fiscal year (FY25). Peeking ahead to FY26, consensus expectations presently allude to a further 17% expansion in earnings paired with a 7% sales climb.

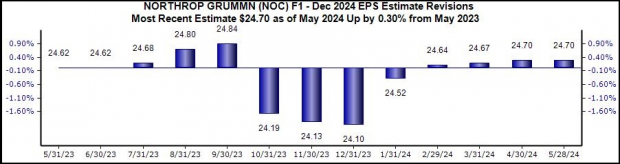

Northrop Grumman

Defense titan Northrop Grumman recently unveiled a 10% boost to its payout, upping the quarterly total to $2.06 per share. NOC shares haven’t fared as well year-to-date, down roughly 4% and underperforming relative to the general market.

Zooming out further, NOC shares have lagged the S&P 500 over the last two years, down 2.2% compared to a 33% move from the S&P 500. Still, the company has been seeing positive earnings estimate revisions for its current fiscal year, providing fuel for shares to move higher.

It’s reasonable to expect NOC shares to see a turnaround story if positive earnings estimate revisions continue to hit the tape.

Image Source: Zacks Investment Research

Bottom Line

Dividends soften the blow from drawdowns in other positions, provide more than one way to reap a return from an investment, and allow maximum returns through dividend reinvestment.

And all three companies above – Advanced Drainage Systems, Taiwan Semiconductor, and Northrop Grumman – have recently boosted their payouts.

More By This Author:

Bear Of The Day: Cracker Barrel Old Country Store

Should You Buy Stock Splits?

3 Big Winners From Earnings Season