3 Big Winners From Earnings Season

Image Source: Pixabay

Earnings season is slowly winding down, underpinned by a strong performance from technology companies, especially Nvidia and Arista Networks. But it's not just all tech -- footwear maker Crocs showed strong earnings this quarter.

Nvidia (NVDA - Free Report), Arista Networks (ANET - Free Report), and Crocs (CROX - Free Report) all positively surprised investors, with shares of each enjoying buying pressure post-earnings.

In addition, all three sport a favorable Zacks Rank, reflecting bullishness among analysts. Let’s take a closer look at each quarterly release.

Nvidia Earnings Grow 460%

Nvidia was undoubtedly the most highly-awaited quarterly release in the 2024 Q1 cycle, and the company certainly didn’t disappoint, posting earnings and revenue growth rates of 460% and 260%, respectively.

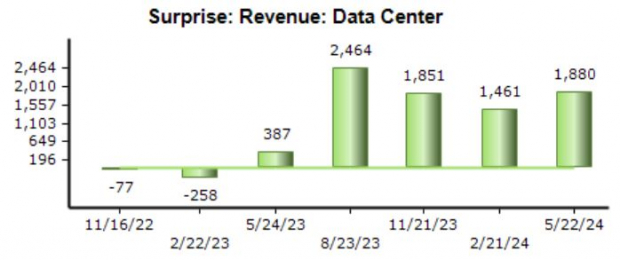

Data Center results remained the highlight of the release yet again, which included sales from its AI chips. Data Center revenue totaled $22.6 billion, yet again reflecting a quarterly record and up a remarkable 430% year over year.

The reported figure blew away our consensus estimate by nearly $1.9 billion, reflecting the fifth consecutive positive beat. Impressively, four of those last five beats have been in excess of $1.4 billion, fully reflecting the unrelenting demand.

Image Source: Zacks Investment Research

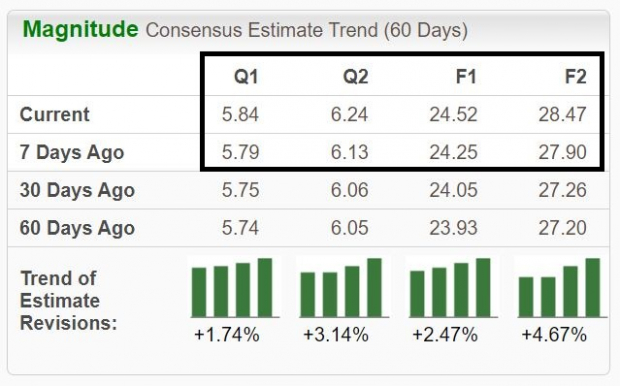

Nvidia’s sales growth has been the most bullish story in the market for some time now, with the company posting at least 100% year-over-year growth rates in each of its last four quarters. Analysts raised their expectations across the board following the release, with NVDA remaining a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Arista Networks beats earnings estimates

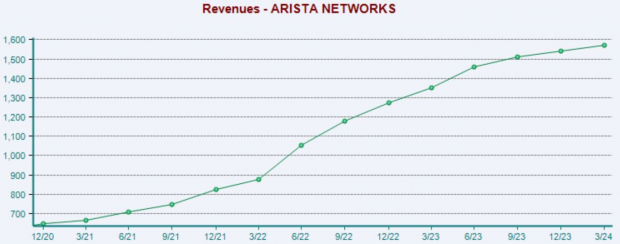

Also benefiting from the AI frenzy, ANET has consistently posted better-than-expected quarterly results recently, exceeding our consensus EPS estimate by an average of 15% across its last four releases. The company provides cloud networking solutions for data centers and cloud computing environments.

The company upped its current year (FY24) revenue growth guidance into a band of 12% - 14%, causing shares to soar post-earnings. ANET’s sales growth has been fantastic, with Q1 sales of $1.5 billion 16% higher than the year-ago period.

Image Source: Zacks Investment Research

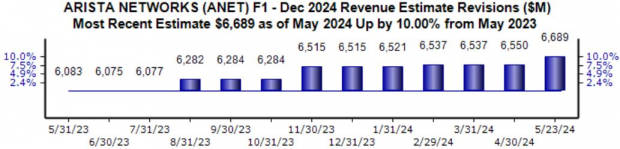

Analysts have adjusted their revenue expectations accordingly, with the $6.7 billion Zacks Consensus Sales estimate 10% higher over the last year and suggesting 14% year-over-year growth. The company is a Zacks Rank #2 (Strong Buy), with earnings expectations following the same trajectory.

Image Source: Zacks Investment Research

Crocs Sales Climb 10% YOY

Crocs have jumped back into style as of late, fully reflected by its latest set of quarterly results. The company’s Crocs brand posted $732 million in quarterly revenue, climbing 10% from the same period last year. HEYDUDE hasn’t fared as well, with quarterly sales down 18%.

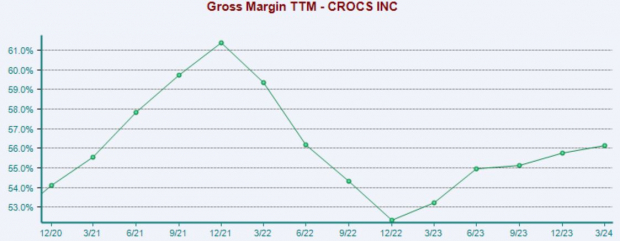

Concerning headline figures, the company crushed the Zacks Consensus EPS estimate by 34%. Recent margin expansion has aided the company’s profitability, with a 55.3% gross margin in its Q4 up from 52.5% in the same period last year.

Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

The results caused shares to melt higher post-earnings, up 60% overall in 2024 compared to the S&P 500’s 11.6% gain. CROX shares have been notably strong over the last five years, delivering a remarkable 46% annualized return over the period.

Bottom Line

Earnings season continues to slow, with the bulk of S&P 500 companies already delivering quarterly results.

And concerning positivity, that’s precisely what all three companies above – Nvidia, Arista Networks, and Crocs – have delivered.

More By This Author:

Nvidia Earnings: AI-Boom Remains Robust3 Top-Ranked Large Caps To Buy For Growth

Nvidia Earnings Loom: A Closer Look