Dividend Investors, Take A Bite Of Apple

Apple (AAPL) has become a dividend payer over the last two years with a dividend pushing the $2.30/sh mark annually, and a yield just over 2%. We see Apple becoming another legendary dividend stock over time, perhaps even joining the ranks of the Dividend Aristocrats in another two decades. When looking at the aristocrats' dividend histories, we often think it would have been nice to have held the stock near the beginning of the dividend increases to capture the maximum compounding effect; now is your chance to do that with Apple.

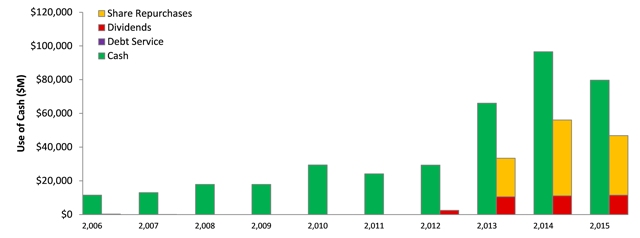

Use of Cash: the use of cash test provides a visual overview of the various cash uses that a company has been allocating cash towards. It shows the relative size of the cash uses versus the outstanding cash balance available to the company. It is a quick and simple way to view how the company has used its cash over the past 10 years, and is indicative of what the company may do in the next 10 years with its cash reserves. We examine dividend payments to all shareholders (including payments to preferred dividend holders) as well as net repurchases which includes equity issued via stock option plans etc… as well as interest payments on debt, this offers a more wholesome view of how the company allocates capital.

Apple has an extremely clean use-of-cash profile as a result of a massive cash pile, huge cash flows, and limited debt service charges. The company's interest expense is just starting to gear up, as the company raised debt to begin capital allocation.

At the end of Q3 Apple was 71% thru its quarter of a trillion dollar capital return program, allocated so far as $127B in share buybacks and $50B in dividends.

Apple has completed about $127B of share repurchases over the past three years, or about 15% of its equity value, now standing at $585B. You can thank Mr. Icahn for this, or curse him if you think the company could have deployed that cash in a more meaningful way. After all, it takes a lot of R&D expenditure to make a self-driving-electric-flying car.

The other use of cash has been four years of dividend increases, which, relative to the staggering cash flow levels that Apple generates, is still very small. Good news for those looking for future dividend growth, and who isn't?

Over time, debt service will become a real use of cash and a burden to cash flows, although even $85B in debt seems very manageable when your average interest rate is only ~2%.

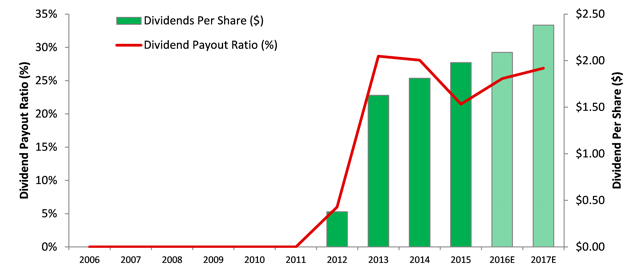

10-Year Dividend Yield and Payout Ratios: Higher dividends are great but not if they come at the expense of dividend sustainability. Assessing the payout ratio is a key metric in determining the sustainability of a dividend, and is calculated as dividend per share dividend by earnings per share (DPS/EPS).

Apple is a new player in the dividend space with a recent track record of only four years, but it didn't take them long to gear up the dividend increases, which we think are easily headed for at least 10 years of consecutive increases, so dividend growth investors can still get in at the early stage growth period of the dividend cycle.

Following Apple's most recent dividend increase the company now pays $2.28/sh annually, for a dividend yield of 2.1%, a solid yield compared to many tech companies who tend to favor spending on growth, or simply don't have the profitability to have the luxury of a dividend - looking at you Amazon (AMZN).

Over the past few years Apple's dividend has been in the 25% to 30% payout ratio range, which is very low and indicative that future dividend increases are likely, even if earnings do not move higher. We anticipate Apple's annual dividend will surpass the $2.50/sh mark over the next few years as less money is spent on repurchases.

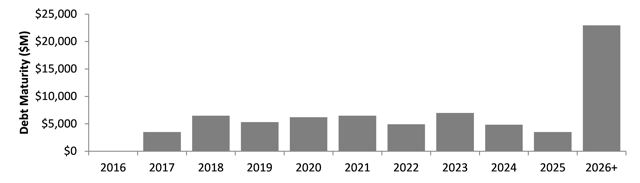

Credit risks: One of the largest risks to dividend sustainability is a leveraged company facing large debt payments and/or putting its credit ratings at risk, which would lead to higher interest charges. We like to view the long-term outlook of debt repayments for risks/opportunities in a company's capital structure.

Apple is a fairly new debt issuer on the scene; following some less than gentle poking by Mr. Icahn, the company began allocating capital in earnest. The result has been to move from a substantial net cash position to a position of low leverage. This is good news for investors as a 100% equity capital structure is rarely optimal, especially when debt is cheap.

Speaking of cheap debt, Apple has issued about $85B of it, with interest rates ranging from under 1% to around 3%. Even the company's most expensive tranche, $4B of debt due in 2046 still bears a sub-5% interest rate.

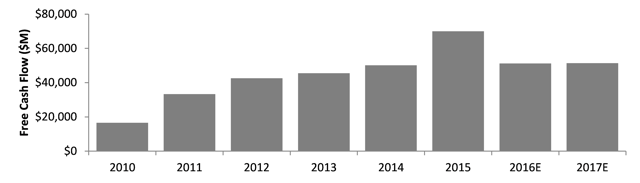

Over the next decade Apple's debt repayment requirements are nicely termed out, with about $5B to $7B due each year, beginning in 2017. Viewing the companies FCF chart below, we can see clearly that FCF will easily cover these debt repayments by 8x to 10x, if Apple decided to pay them off.

Of course refinancing debt is the much more likely candidate for Apple, as is raising additional debt for more capital allocation purposes. For a company that offers as strong returns as Apple, they should be backing the truck up on sub-2% debt, and investors should cheer them all the way.

Apple now has a Net Debt/EBITDA of only 0.3x, which indicates the company could borrow another $120B before reaching, a still conservative, 2x multiple. Interest coverage is a moot point for the company, and the company's credit rating is flawless.

(

Summary: Apple has spent the last few years allocating swaths of capital, soon to be a quarter of a trillion. That figure is huge, especially when compared to Apple's market cap of about $585B. While most of that money has been directed towards repurchases, which will likely ebb and flow over time as the company increases/decreases R&D spend and taking the new products to market. But we only expect to see upward momentum when it comes to the company's dividend; the current dividend level is only a ~30% burden on cash flows. A much higher dividend could be supported even without earnings growth. We would like to see Apple take on another $120B of low-interest debt to support further repurchases (or make a couple of large deals), while the dividend remains a percentage of earnings. Apple's illustrious history of dividend growth has just begun, the stock is reasonably valued (8.6x EV/EBITDA and 13.1x P/E), and dividend investors (and other investors) would be wise to consider having a bite of Apple.

more

Enjoyed this, would like to see more by you.

Most of Apple's debt is in US dollars and most of its cash is in foreign currencies. I think many can see the potential problems that can arise from that, especially since it has no intention of ever reversing this. One needs to discount such facts before buying purely on cash and debt ratios.