Dividend Aristocrats In Focus: Carrier Global

The Dividend Aristocrats are an exclusive group of companies that have not only paid but also increased their dividend for at least 25 consecutive years. Carrier Global (CARR) is a recent addition to the Dividend Aristocrats list after it was spun off from Raytheon Technologies (RTX) following the merger of United Technologies and Raytheon.

Now that it is an independent company, investors should assess Carrier’s individual business model, future growth potential, and valuation. Moving forward, keeping the streaks going will be up to each individual company that has been spun off. This article will focus on Carrier.

Business Overview

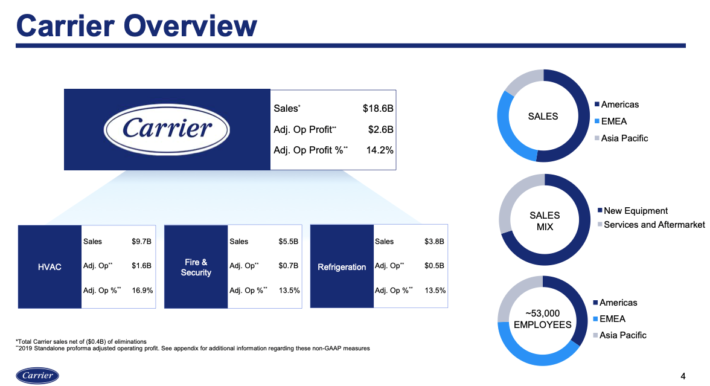

Carrier Global operates in three segments: Heating, Ventilating and Air Conditioning (HVAC), Refrigeration and Fire & Safety constituting 51%, 20% and 29% of sales respectively. The $13 billion market cap company generated $19 billion in sales last year and employs 53,000 people in 160 countries.

Here’s an overview of the business:

(Click on image to enlarge)

Source: Carrier Investor Meeting

You can see the nearly $19 billion in sales generated by the newly spun-off company, spanning across the HVAC, Refrigeration, and Fire & Safety segments. Additionally, roughly half of the business is done in the Americas with new equipment generating nearly three-fourths of sales.

While Carrier has not yet posted stand-alone results, it can still be helpful to see how the business has performed recently. For the quarter ending December 31st, 2020 Carrier recorded net sales of $4.5 billion, down -2.8% compared to Q4 2018, while adjusted operating profit equaled $689 million, a -4.8% decline.

For all of 2019, Carrier generated $18.6 billion in sales, down -1.7% year-over-year, and the segment’s adjusted operating income totaled $2.98 billion, down -2.6%, with a 16.0% operating margin.

On February 10th, Carrier provided a 2020 outlook. The outlook calls for slightly higher sales, driven by gains in HVAC and Fire & Security. Operating profit is expected to increase $25 million, to $75 million, while free cash flow is estimated in a range of $1.3 billion to $1.4 billion. Over the medium-term, the company expects mid-single-digit sales growth and high-single-digit adjusted EPS growth.

However, it is important to remember that this was prior to the widespread coronavirus outbreak, which could materially influence the business.

Growth Prospects

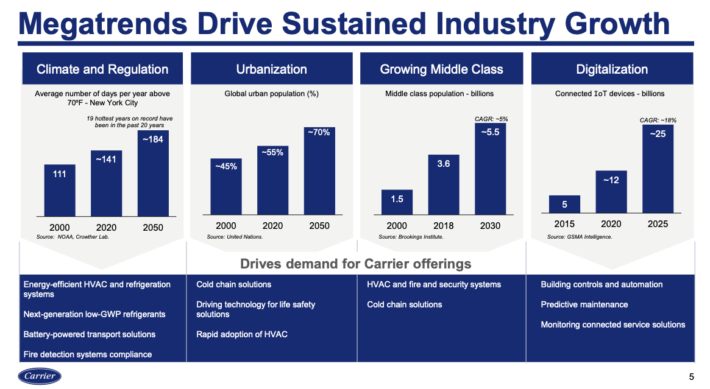

As mentioned above, Carrier anticipates mid-single-digit sales growth and high-single-digit earnings-per-share growth over the intermediate-term. This result can come about through a variety of trends currently taking place:

(Click on image to enlarge)

Source: Carrier Investor Meeting

These long-term growth avenues include the ongoing need for climate and temperature regulation, a trend towards urbanization, a growing middle class, and increased digitalization. Moreover, given the company’s number one or two position in the majority of its categories, Carrier stands a reasonable shot at capturing its fair share of industry growth over time.

Granted, the current coronavirus pandemic could create short-term concerns. Moreover, Carrier is now a more cyclical business given that it no longer shares results with three other successful and distinct segments.

Collectively we are anticipating 5% growth over the intermediate-term – slightly below the company’s medium-term expectations and UTX’s past history – reflecting current demand concerns and an increasingly cyclical business.

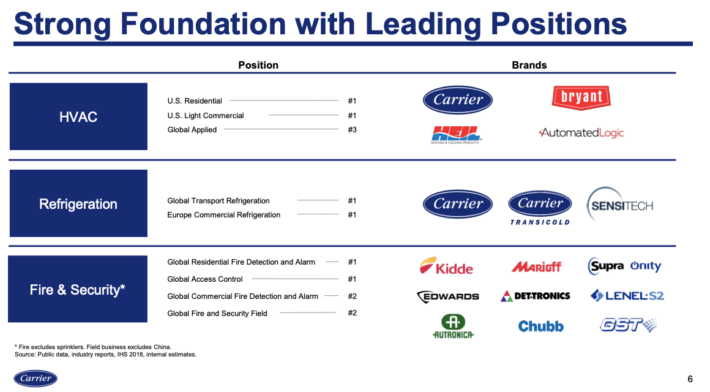

Competitive Advantages & Recession Performance

Carrier enjoys a competitive advantage in its namesake brand, along with a #1 industry position in U.S. Residential HVAC, U.S. Light Commercial HVAC, Global Transport Refrigeration, Europe Commercial Refrigeration, Global Residential Fire Detection & Alarm, and Global Access Control:

(Click on image to enlarge)

Source: Carrier Investor Meeting

While Carrier does not yet have a performance record as an independent company, United Technologies posted earnings-per-share of $4.90, $4.12, $4.74 and $5.49 during the 2008 through 2011 timeframe. Carrier carries increased risk during recessions but still should produce strong profits over full economic cycles.

Valuation & Expected Returns

We are forecasting $1.50 in annual earnings-per-share to start for the newly spun-off Carrier, based on the expectation of $16.5 billion in sales and an 8% profit margin. This could be too conservative if demand snaps back quickly – last year the company generated $18.6 billion in sales – but for now, we are remaining cautious until more information is available.

If this earnings-per-share number were to materialize and grow at 5% annually, this would imply $1.91 in earnings after five years, keeping in mind that this is one possibility out of a wide range of potential outcomes.

Therefore, if shares were to trade at 12 times earnings – below UTX’s 10-year average valuation of 16 times earnings, but reflecting the reduced growth, increased cyclicality, and short-term uncertainty – this would imply the potential for a future price of ~$23.

A dividend has not yet been declared, but if investors assume a 40% payout ratio, this implies a $0.60 per-share dividend. This would imply an attractive yield over 4%, but again investors should realize that a dividend has yet to be announced, and is at the discretion of the company’s board of directors.

Whether or not this appears attractive depends on the current share price. With shares trading hands near $14, this indicates the potential for 13%+ annualized returns based on the combination of earnings-per-share growth, dividends, and some multiple expansion.

Naturally, this could be too optimistic if earnings, growth or valuation multiple expansion do not materialize to the extent detailed above. Still, shares presently appear attractively valued based on somewhat subdued expectations.

Final Thoughts

After being spun off from United Technologies, Carrier stands as an independently traded “pure-play” business. The company enjoys strong brand names and a solid position in necessary and growing markets. Moreover, shares could be offering a compelling value proposition at present, given the potential growth, dividend history, and valuation.

However, as Carrier has yet to declare a dividend or report stand-alone results, we caution that these expectations could change materially in the quarters to come. Moreover, with the demand outlook up in the air in the short-term, we note the enhanced cyclicality of the business. Investors should closely monitor the company’s financial results in the upcoming quarters to help answer these questions.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

Good read, thanks.

Carrier global has dividends?

“However, as Carrier has yet to declare a dividend or report stand-alone results, we caution that these expectations could change materially in the quarters to come.”

Wouldn’t be surprised.