Diversification, Equity And Indices

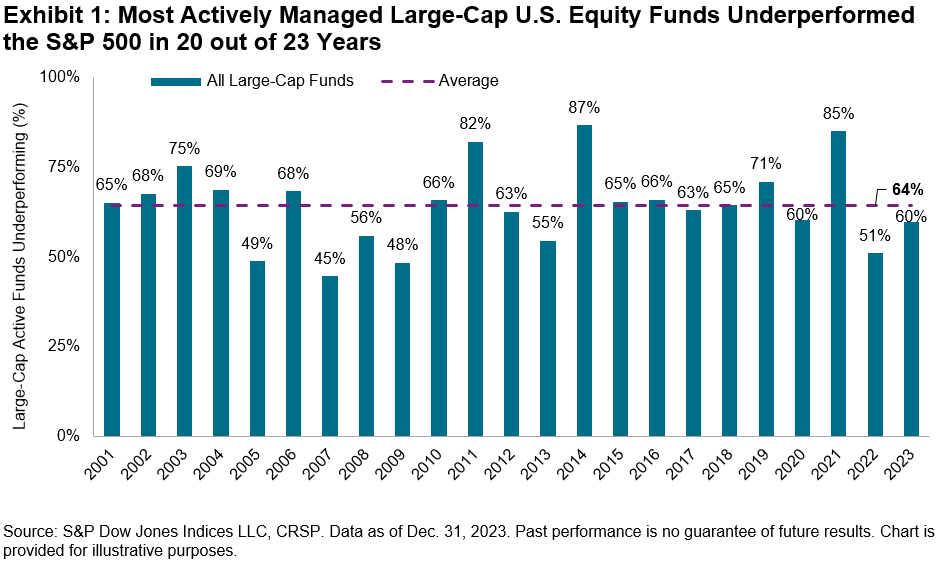

The results of S&P DJI’s latest SPIVA U.S. Scorecard are in: Most large-cap active managers underperformed the S&P 500® for the 14th consecutive year in a row. 60% of active large-cap funds underperformed the S&P 500 in 2023, slightly better than the long-term average of 64%, and a relatively benign result considering the dominance of the U.S. equity market’s largest stocks.

(Click on image to enlarge)

The current environment characterized by large-cap dominance can help add a unique perspective that can offer fresh insights into these results. Market concentration concerns in the U.S. have been prevalent, with the weight of the largest five companies in the S&P 500 rising from 19.5% a year ago to 25.2% as of the end of February, reaching levels we haven’t seen since the early 1970s. Parallel to the increase in market concentration, the S&P 500 Equal Weight Index has suffered accordingly, underperforming the S&P 500 by 17% in the 12-month period ending Feb. 29, 2024, its worst 12-month relative performance since its launch more than 20 years ago.

The simultaneous increase in concentration, underperformance of Equal Weight and majority underperformance by active managers is not surprising, as when the largest stocks outperform, the market becomes more concentrated in those names, leading to the outperformance of cap-weighted indices versus their equal-weighted counterparts. Consequently, active managers generally face challenges in keeping pace with the market-cap weights of the largest companies.

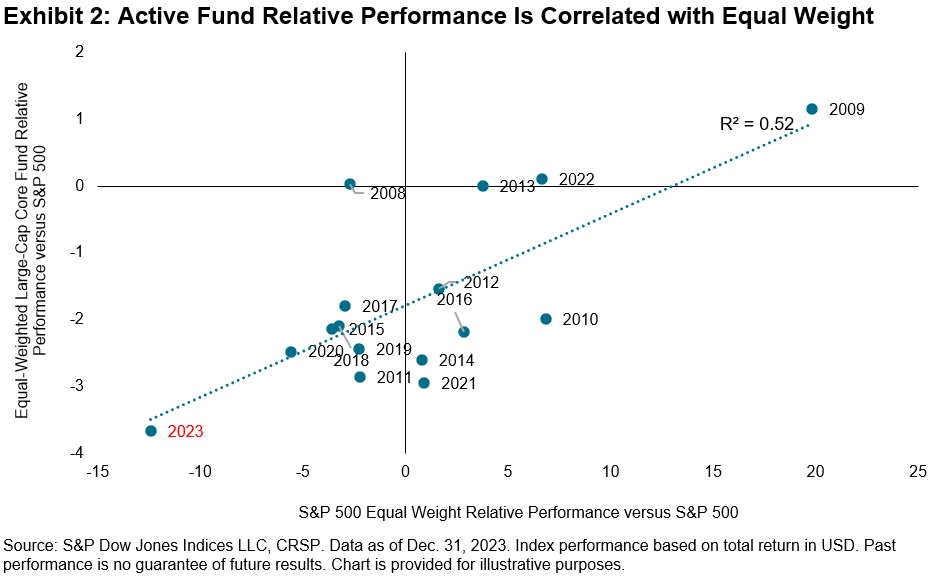

Germane to concentration concerns, the ability to diversify away from capitalization weights via regular rebalancing is often touted as one of the benefits of active management. As a result, we might expect the relative returns of active managers to mirror that of Equal Weight, and that is exactly what we observe in Exhibit 2, which shows a strong linear relationship historically between the equal-weighted average excess return of funds in the U.S. Large-Cap Core category versus Equal Weight’s excess return relative to the S&P 500.

(Click on image to enlarge)

Given their similarities, a natural question one can ask is how have active funds performed when compared to Equal Weight? 2023 was a notable outlier, with 68% of domestic equity funds outperforming Equal Weight, perhaps not coincidentally aided by the index’s severe decline, with similar occurrences in 2007, 2008 and 2020. However, beating Equal Weight as a benchmark has proven to be difficult over the long term. Exhibit 3 shows that a majority of all actively managed domestic U.S. equity funds underperformed the S&P 500 Equal Weight Index in 16 of the last 20 years, with an annual average underperformance rate of 65%.

(Click on image to enlarge)

The data is evident that it has been very challenging historically to consistently outperform the benchmark, regardless of whether it is cap weighted or equal weighted. To dig deeper into how active managers across asset classes and geographies fared, we invite you to explore the results of our SPIVA U.S. Year-End 2023 Scorecard.

More By This Author:

Measuring The Global Water Opportunity Set

Australian Mid Caps: A Sweet Spot For Diversification And Historical Outperformance

The February 2024 Rebalance Of The S&P 500 Low Volatility Index