Dissecting The S&P 500 – Should You Invest?

Image Source: Unsplash

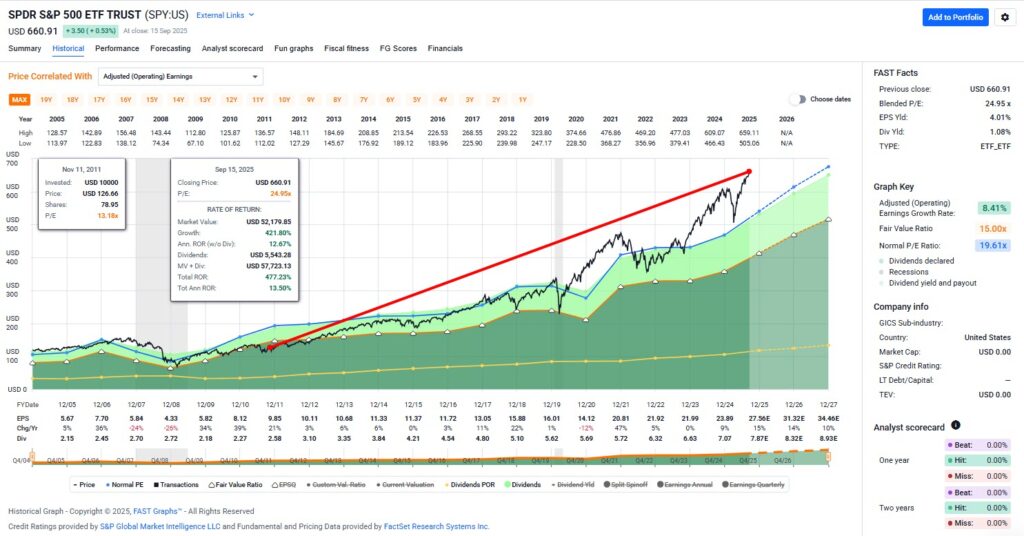

Should You Invest? The S&P 500 is often recommended as the default choice for individual investors. While it has delivered strong long-term results, today’s valuations and concentration raise important questions about whether it suits every investor’s goals.

(Click on image to enlarge)

Key Observations on the S&P 500 – Should You Invest?

- Earnings Growth: Since 2005, S&P 500 earnings have grown ~8.4% annually, but with major setbacks during the financial crisis and COVID.

- Fair Value vs. Current Valuation: An 8.5% growth rate implies a fair P/E of ~15. The index currently trades near 24x earnings, with an earnings yield of only 4%.

- Dividend Yield: At just ~1%, the S&P 500 does not provide meaningful income compared to high-quality dividend stocks yielding 3%+.

- Volatility: Investors must be prepared for large drawdowns, such as a 49% decline in 2007–09 and a 20%+ drop during COVID.

Concentration Risk

- The top 10 companies make up 35–40% of the index.

- Seven are tech-related (Apple, Microsoft, NVIDIA, Amazon, Alphabet, Meta, Tesla, Broadcom).

- This concentration magnifies gains during rallies but also heightens risk in downturns.

- Similar concentration levels have historically preceded higher volatility, such as during the dot-com bubble.

(Click on image to enlarge)

Valuations of Market Leaders

- Apple: Still strong, but growth slowing; P/E near 30.

- Microsoft: Excellent fundamentals, but richly valued.

- NVIDIA: AI leader with lofty expectations; extreme valuation risk.

- Amazon: Attractive cash flow growth, but no dividend.

- Tesla: Highly volatile, with very low earnings yield.

- Broadcom: Historically valued lower; current multiples inflated by AI hype.

- Meta & Alphabet: Good long-term records but trading above fair value.

- Berkshire Hathaway: A non-tech heavyweight, but growth prospects muted.

Where to Find Value

- Select S&P 500 constituents still offer attractive valuations:

- Citigroup: Earnings yield above 7%.

- Cigna: Trading below fair value, offers solid income.

- Raymond James & Duke Energy: Reasonable yields and growth potential.

Key Takeaways

- The S&P 500 is not a “one-size-fits-all” investment.

- Current valuations suggest muted returns going forward.

- Income-focused investors will find little yield in the index.

- Index concentration increases risk, particularly tied to tech.

- Selective stock-picking within or outside the index may provide better value and more dependable income.

Final Thought:

The S&P 500 has been an excellent investment at times, but today’s market calls for caution. Instead of blindly following the index, investors should focus on valuation, earnings power, and suitability for their personal goals. As Warren Buffett says, “Price is what you pay. Value is what you get.”

Video Length: 00:40:45

More By This Author:

Can Managed-Healthcare Stocks Prescribe A Cure For Their Ailing Earnings?

Why Buying Overvalued Stocks Is Risky: Invest Smart, Buy Low Instead

5 Small & Mid Cap Growth Stocks At A Reasonable Price

Disclosure: Long RJF, C, CI, AAPL, AMZN, AVGO, GOOG, GOOGL, META, MSFT, NVDA, TSLA

Disclaimer: The opinions in this article are for informational and educational purposes only and should not ...

more