Disney - Compelling Long-Term Investment In 2019 And Beyond

Challenging Market Resiliency:

Stocks are entering 2019 in a bear market territory and posted its worse quarter since the Great Depression after imploding in Q4 of 2018. Disney (DIS) has been a diamond in the rough given the negative backdrop albeit down from its 52-week high by 8%. This stock has bucked the negative trend and has demonstrated its resilience during this time period. As this sell-off presents itself, long term investors may want to take advantage of this weakness and initiate a position in this high-quality company at a discount. All the initiatives that Disney has taken over the previous two years to restore growth appear to be coming to fruition, namely its Fox (FOX) acquisition and its streaming initiatives.

The Fox acquisition is complete now that the U.S. and China provided the green light for the combined entity thus Fox’s assets are now definitively being absorbed by Disney. As part of the contingencies, Disney is divesting its 39% Sky ownership stake that it acquired via the Fox acquisition to Comcast (CMCSA). This divestiture enables Disney to reduce its debt that was required to purchase the Fox media assets and will allow more investment into its streaming services such as Hulu, ESPN Plus and its Disney branded streaming service that will directly compete with Netflix (NFLX). The Fox acquisition brings a majority stake in Hulu (60% ownership) while its ESPN Plus launched earlier this year and has over 1 million subscribers in its early phases of being rolled out. Disney continues to dominate at the box office while posting great growth at its theme parks translating into a robust and durable revenue stream. The company is evolving to meet the new age of media consumption demands of the consumer via streaming and on-demand content. To this end, shareholders and analysts are beginning to resonate with Disney’s vision for future growth. This was reflected in its stock and had appreciated to a 52-week high prior to the market wide meltdown. Disney offers a compelling long-term investment opportunity in light of the recent weakness given its reinvention catalysts that will continue to bear fruit over the coming years.

Disney’s Quarterly Earnings – Top and Bottom Line Beats:

Disney reported fantastic fiscal Q4 2018 numbers that beat on both the top and bottom line, reporting revenue of $14.31 billion which beat by $580 million and EPS of $1.55 which beat by $0.22. The revenue growth came in at a double-digit clip, posting 12% growth year-over-year. Revenues were up across the board with Media Networks up 9%, Parks and Resorts up 9% and Studio Entertainment up 50% while Consumer Products & Interactive Media down 8%. Operating income followed with Media Networks up 4%, Parks and Resorts up 11%, Studio Entertainment up 173% and Consumer Products & Interactive Media down 10%.

“We’re very pleased with our financial performance in fiscal 2018, delivering record revenue, net income and earnings per share,” “We remain focused on the successful completion and integration of our 21st Century Fox acquisition and the further development of our direct-to-consumer business, including the highly anticipated launch of our Disney-branded streaming service late next year.”

-

Robert A. Iger, Chairman and Chief Executive Officer, The Walt Disney Company

Disney’s reinvention is already taking shape and growth is being restored with continued catalysts in its studio segment and streaming initiatives unfolding. This quarter marks the beginning of what I feel will be a string of subsequent quarters with robust growth.

Box Office Dominance and Streaming Growth:

Disney has dominated the box office over a multi-year stretch due to successes across multiple brands such as Star Wars, Marvel, Pixar and Disney Animation releases. Disney has held the most market share for the past three years by a wide margin. In 2016, 2017 and 2018 Disney’s studio captured 26.3%, 21.8% and 26% of the market share, respectively based on domestic box office gross. Disney’s studio is also the fastest to reach $1 billion in domestic box office gross and holds the three top fastest times. In 2016, 2017 and 2018 Disney achieved this mark in 128, 146 and 117 days, respectively which are the three fastest on record. In 2018, Disney’s studio was the fastest ever to $1 billion in box office gross (117 days) and has captured over a fourth of the market share at 26%.

Black Panther became the third highest grossing movie of all-time domestically with $700 million and ultimately grossing $1.35 billion worldwide and becoming the ninth highest grossing movie of all-time. Avengers: Infinity War posted the biggest domestic and international box office weekend of all-time with $258 and $630, respectively. Avengers: Infinity War became the fastest movie to gross over $1 billion worldwide and only the fourth movie to ever break through the $2 billion thresholds ultimately grossing $678.8 million and $2.049 billion worldwide. The recent release of The Incredibles 2 shattered box office records bringing in $180.7 million during its opening weekend debut, not only shattering the previous opening weekend record for an animated film, but finishing with one of the top ten openings of all-time for a film of any genre and surpassing $608.6 million domestically and $1.243 billion worldwide.

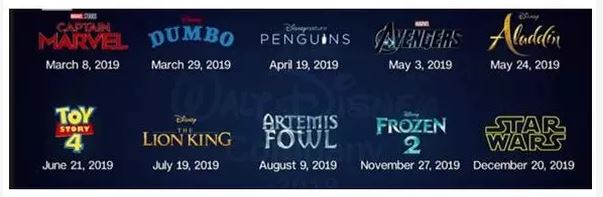

Thus far, Disney has the top three grossing movies domestically with Black Panther and Avengers: Infinity War and Incredibles 2 by a wide margin from the fourth highest grossing movie. Wreck It Ralph 2 brought in the second-highest Thanksgiving five-day gross of all-time with 84.5 million ultimately grossing $181.3 domestically and $355.5 worldwide. Mary Poppins Returns has already eclipsed $205 million in worldwide box office sales to cap off 2018. 2019 has highly anticipated releases that stand to rack in billions in box office receipts such as Captain Marvel (the first female lead for a Marvel film), Dumbo, Avengers 4, Aladdin, Toy Story 4, Lion King, Frozen 2 and Star Wars Episode 9. Disney is poised to defend its box office dominance again in 2019 for the fourth consecutive year (Figure 1).

Shifting the focus to Disney’s future of streaming, ESPN Plus was launched earlier this year in April to a mixed skeptical reception among shareholders and consumers upon its debut. Due to precipitous declines in ESPN viewership via traditional cable, Disney was cornered to remediate its ESPN business and evolve to the cord cutting consumer. Recently, Disney announced a key milestone for its streaming platform, reaching over 1 million paid subscribers. ESPN is Disney’s first inroads into the streaming arena offering a package of sports which include Major League Baseball (MLB), National Hockey League (NHL), college football, soccer, boxing and UFC for $4.99 per month. Disney has kept its ESPN Plus subscriber numbers a secret and would only state that its paid subscriptions were "strong" and that growth was surpassing expectations.

"Reaching one million paid subscribers is an important milestone for any video subscription service, but reaching this benchmark in such a short amount of time is an incredible testament to the teams from DTCI and ESPN who have worked tirelessly to bring this product to market and continually improve it since our April launch," said Disney Direct-to-Consumer and International Chairman Kevin Mayer.

Hulu's live TV service, which launched in May 2017, has over 1 million subscribers, roughly a year and four months after the debut of the streaming service. Collectively, Hulu has more than 20 million U.S. subscribers. Consumers are awaiting Disney's stand-alone streaming service in 2019, which will include Pixar, Marvel, Disney, Lucasfilm and National Geographic content. Collectively, Disney’s streaming initiatives are bearing fruit and as Bob Iger stated in a recent interview, its streaming efforts are a marathon, not a sprint (Figure 2).

Figure 1 – Disney’s 2019 movie release schedule with potentially eight films that could easily eclipse $1 billion in worldwide box office sales

Figure 2 – Disney’s most bold move yet, abandoning Netflix and offering a direct-to-consumer Disney branded Netflix alternative

Fox Acquisition and Sky Divestiture Approved:

China is the latest to approve the $71 billion Disney and Fox transaction and with a few other jurisdictions pending such as Brazil. As these jurisdictions move on a rolling approval basis, this huge deal could close in the spring of 2019. The Department of Justice approved the Disney’s $71 billion acquisition for Fox thwarting Comcast’s (CMCSA) desperate attempts for the Fox assets. The government’s approval came with conditions that Disney must divest all of Fox’s 22 regional sports networks. Disney and Fox easily gained approval by shareholders on their $71.3 billion acquisition during the shareholder voting that was held in July. Disney will expand its moat and acquire properties such as Avatar, the X-Men movies, Titanic and TV shows such as The Simpsons and This Is Us. The acquisition also gives Disney the cable networks FX and National Geographic; a controlling stake in the streaming service Hulu, which has more than 20 million subscribers.

Comcast prevailed in a winning bid for UK broadcaster Sky as Fox agreed to divest its Sky ownership. This divestiture enables Disney to reduce its debt that was required to purchase the Fox media assets and will allow more investment into its streaming services such as Hulu, ESPN Plus and its Disney branded streaming service. This presents some complications with the blended ownership of Hulu since Comcast owns 30% of the streaming service.

Bloomberg Intelligence analysts Geetha Ranganathan and Paul Sweeney note that Disney will have 60% ownership of Hulu. The analysts say Hulu might finally be rid of the “messy ownership structure that has plagued it all along” and Comcast could still choose to sell its 30% interest. Buckingham Research analyst Matthew Harrigan says his firm doesn’t think it “makes sense” for Comcast to hold onto its Hulu position just to block Disney from having 90% ownership. Harrigan says there can be multiple winners in the direct-to-consumer market and that it will prove “essential” for Comcast and Sky to “work amicably” with Disney, particularly Disney’s DTC products like Disneyflix and ESPN. Harrigan notes that both Comcast and Disney have to compete with the likes of Netflix, Amazon and Apple, so it “makes no sense” for Comcast to be an albatross to Disney.

Conclusion:

Disney has a very strong and robust film line-up for 2019 with the possibility of over a half dozen films that stand to rack in over a billion dollars at the worldwide box office. Captain Marvel sets the pace in 2019 followed by Dumbo, Avengers 4, Aladdin, Toy Story 4, Lion King, Frozen 2 and Star Wars Episode 9. Disney is poised to defend its box office dominance again in 2019 for the fourth consecutive year. Disney reported robust double-digit growth in its most recent quarter and has demonstrated resilience in the midst of a broader market sell-off in Q4 of 2018. Disney has held up strongly on the heels of its streaming growth initiatives and the Fox acquisition despite the negative market sentiment. Streaming via Hulu, ESPN Plus and direct to consumer Disney branded streaming service are major catalysts moving into 2019. Disney posted robust growth at the box office and theme parks with its Media Networks remediation plan gaining strength in the backdrop. The Fox acquisition brings in properties such as Avatar, the X-Men movies, Titanic and TV shows such as The Simpsons, cable networks FX and National Geographic. Divesting its Sky stake enables Disney to decrease its debt load to acquire Fox’s media assets and make further investments in the streaming arena. Disney has been one of only a handful of stocks that has held up respectably in the face of a down market and given better market conditions investors may reward Disney with a higher multiple and further share appreciation. Disney offers a compelling long-term investment opportunity for the long term investor at an attractive valuation.

Disclosure: The author does not hold shares of Disney however may engage in options trading with the underlying security. The author has no business relationship with any companies mentioned in ...

more