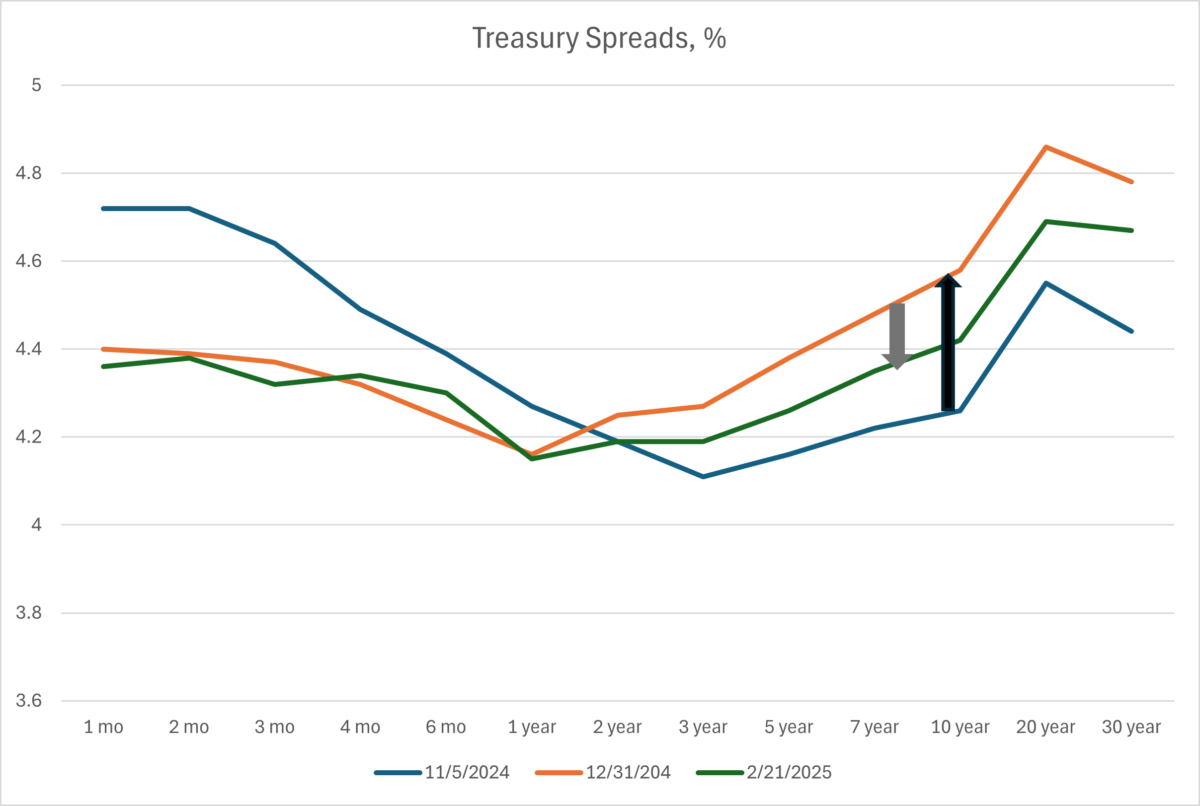

Dis-Inversion And Re-Inversion Over The Last 3 Months

Image Source: Pexels

Not sure what it means, but I suspect heightened growth anxieties for the 4-month to 3 year horizon.

Figure 1: Yield curve on 11/5/2024 (blue), on 12/31/2024 (orange), 2/21/2025 (green), %. Source: Treasury.

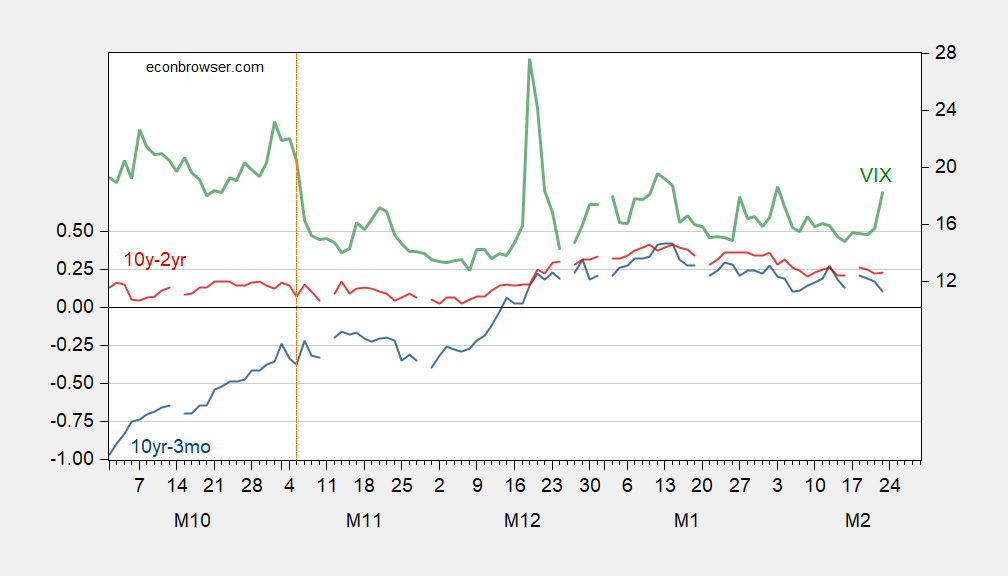

Here’re two conventional term spreads (neither of which have inverted), and the VIX.

Figure 2: 10yr-3mo term spread (blue, left scale), 10yr-2yr term spread (red, left scale), both %; VIX (green, right scale). Source: Treasury, CBOE via FRED.

More By This Author:

Consumer Expectations Crash, 1 Year Ahead Inflation Expectations Soar As 5 Year Ahead Hits RecordBringing Prices Down: A Progress Report

No Recession Until 2025Q4 (Assuming Reciprocal Tariffs w/Retaliation)

Comments

Please wait...

Comment posted successfully

No Thumbs up yet!