DHT Holdings: An Undervalued Shipping Play With A Large And Young Fleet

I am not optimistic about most stocks. In fact I’m quite bearish for the S&P 500. It is among the weird corners of the marketplace where I am seeking and finding interesting ideas. One example of such a corner is the shipping companies. All types of marine transportation whether it's tankers, bulkers or containers are really depressed right now because there's overcapacity.

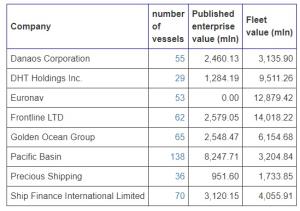

Using the beta of VLCCAnalyzer I find that DHT Holding's fleet is cheap compared to alternatives and I want to explore it to see if there's something there.

First thing I looked at analyst quotes:

The $0.03 per share mean estimate for the next quarter is not instantly enticing to say the least. Shipping rates are famously very volatile so a low current rate could be to our advantage. With the present low rates earnings are extremely depressed across the industry. There is little interest from companies to order new ships and in time this will drive the cycle to another extreme.

For illustrative purposes look at the earnings ceiling for DHT in earnings per share:

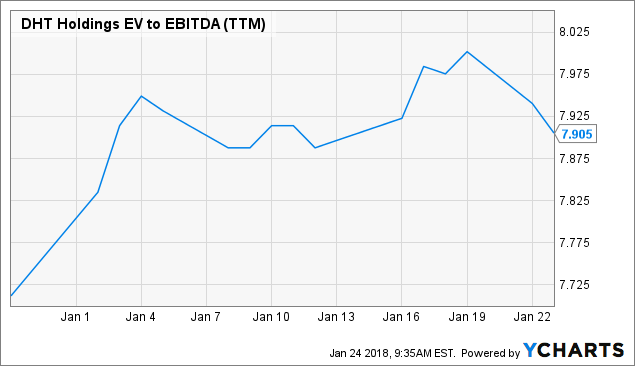

With the share price at $3.62 it's possible to purchase into this type of business when it's trading in 4x absolutely free cash flow or 7.9x EV/EBITDA, that is quite intriguing.

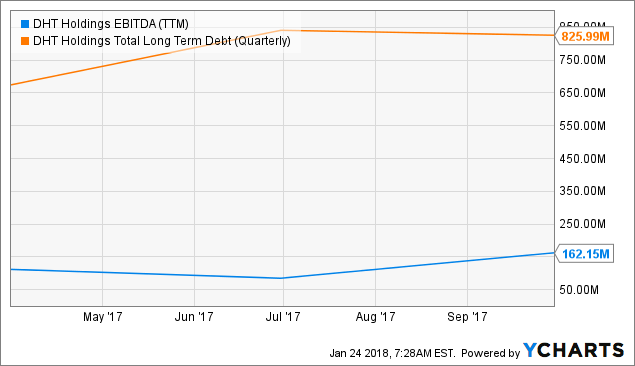

The secret to shipping is not to bankrupt. The industry is super competitive and to achieve competitive rates it is necessary to utilize debt. The debt further enhances volatility and the result is shipping investors experience excruciating ups-and-downs.

1) I like companies that keep a lot of ships on spot.

2) You want to be able to endure the downturns that always come. Either by selecting lowest cost operators or companies with relatively little debt or high quality assets. Preferably a mix of all three.

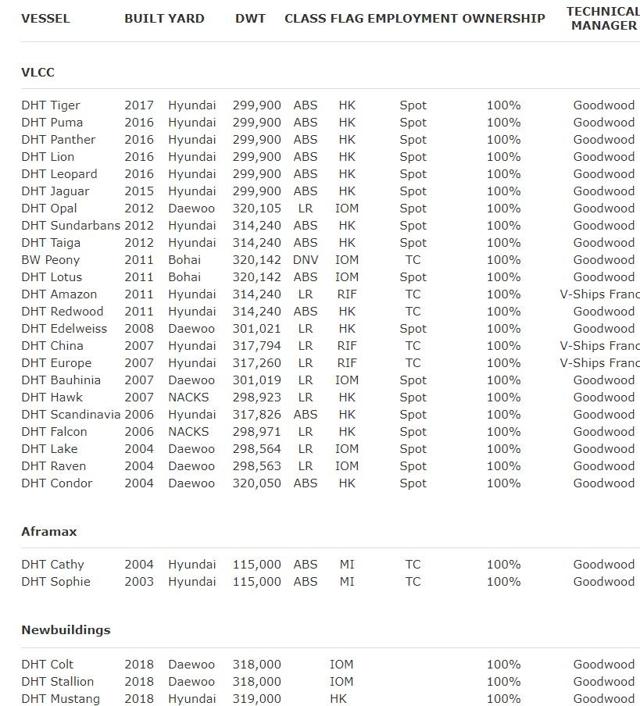

DHT's fleet is probably quite undervalued as VLCCanalyzer indicates a large discrepancy between Enterprise Value and its Fleet Value. In theory the larger this discrepancy is, the more attractive the opportunity. The fleet is indeed quite young and there are very few old vessels. Older vessels tend to be less fuel efficient. Currently the industry is undergoing changes that make fuel efficiency particularly important. Management also keeps a high number of vessels on spot prices which is quite advantageous:

Risk

DHT Holdings appears quite highly leveraged concerning debt to EBITDA but that is not unusual in this industry. Without debt you can’t really operate. Given where prices are it is not all that awful.

Together with the organization's comparatively low break-even prices the firm has a great prospect of getting through the next upturn.

Catalyst

For spot prices to spike up we need demand for shipping capacity from the market to go up or for capacity to go down. Demand is really hard to predict but capacity is a tiny bit simpler.

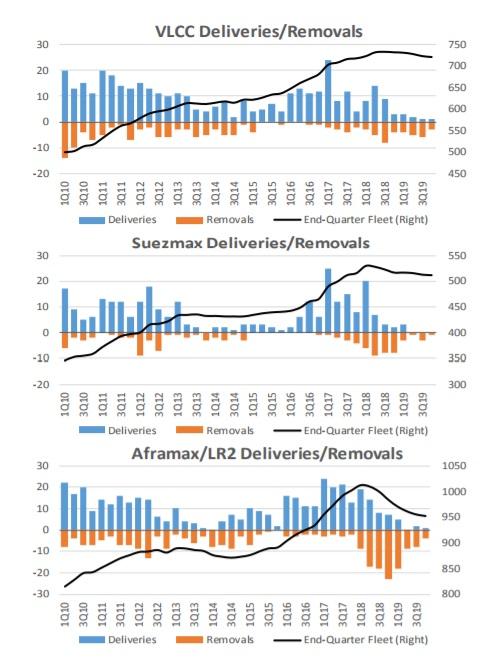

Let us look at this current graph from a current Hellenic Shipping News:

Fleets seem to be shrinking because of scrapping and relatively low levels of deliveries of newbuilds. It's surely possible scrapping will accelerate while it is not quite as likely to fall off.

Conclusion

This looks like a fantastic time to pick up a number of your favourite shipping businesses. DHT Holdings is surely a candidate because of its appealing fleet, very low valuation at 7.9x EV/EBITDA and possible catalysts for rate climbs.

I have been researching shipping for the last month and a half and I completely agree with your analysis. I personally see the tightening market in LNG carriers as a prime opportunity given the depressed prices of most stocks in the sector. What do you think of $LPG (Dorian LPG)?

I've barely been able to find anything on $LPG myself. Are you planning on putting together an article about it? Would love to read it.

I am planning on publishing an article describing the various oppurtunities in shipping, including $LPG

I love little known stocks. $DHT is new to me but I'll certainly be taking a closer look. Thanks for bringing it to my attention.