DC Gets Back To Work – New Highs With Defined Risk

Image Source: Pexels

The nonsense that was yet another government shutdown has apparently ended. While there has been bipartisan support to reopen the government for weeks, there are now the 60 votes required in the Senate. Focusing solely on the economy and markets, the great news is that the government will quickly gather and release a slew of economic data that was unable to be received during the shutdown. As such, markets will need some time to digest and may cause some short-lived volatility.

While no one asked my opinion, government shutdowns should not be legal. Congress should be forced to continue with the same spending levels until a new deal is reached. And federal workers should never, ever have to work and not receive pay. In the private sector, that would be grossly illegal. Furthermore, if shutdowns are allowed to continue, Congress should not be paid. One tone deaf Senator actually replied to a media question that he had a wife, kids, and a mortgage. He couldn’t possibly be expected to not receive his paycheck during the shutdown like others did. He questioned how he and his family could survive. Talk about obtuse.

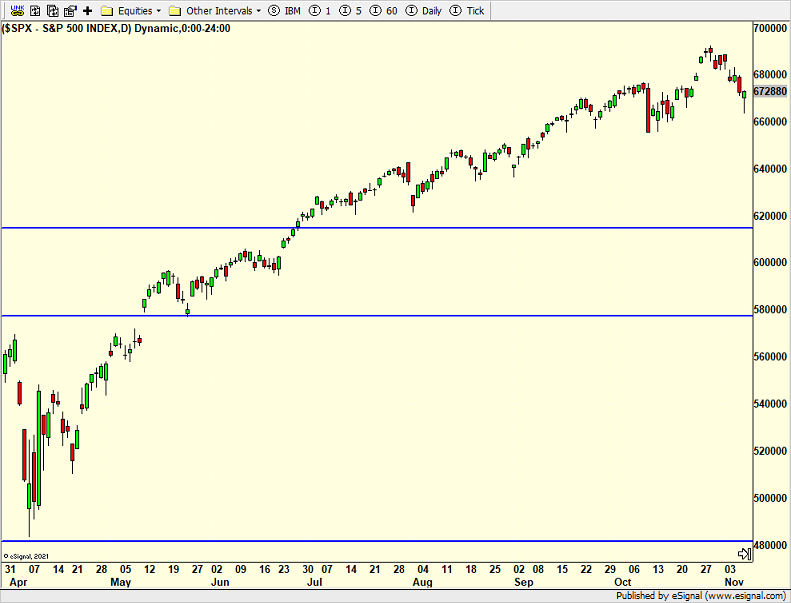

Coming into Friday, I thought the S&P 500 needed some more downside and that would continue into this week. Friday morning saw more weakness, which got down to the minimum level where I was comfortable seeing a pullback. That was roughly a 5% decline, which some of our models started buying. As always, you can see what we bought and sold at the end of this post.

I am not ready to declare that the year-end has begun, but we now have risk clearly defined. The major stock market indices are positioned for a rally to new highs. However, a close below Friday’s lowest point would likely usher in a quick decline to at least 6550. In other words, 100 points on the downside to know we’re wrong versus the upside of at least 200 points. That’s a risk/reward and trade I would engage in almost every single day.

On Friday, we bought TDAQ, XLU, XMMO, ORCL, more RSPU, and more TQQQ.

More By This Author:

Pullback Continues Into Next WeekModels No Longer All Bullish – A Look At The Indices

Fed To Cut Rates, Dow 50,000 But Bumpy First, Buying Silver & Gold

Disclosure: Please see HC's full disclosure here.