Danger Zone: Comcast (CMCSA)

Check out this week’s Danger Zone Interview with Chuck Jaffe of Money Life and MarketWatch.com.

Comcast (CMCSA: ~$51/share) is in the Danger Zone this week. The cable giant’s reign of power and profit growth is coming to an end. The stock is priced as if the good-ole days will continue and profits will continue to grow at a higher rate than I believe possible. The proposed merger with Time Warner Cable (TWC) is nothing more than a last ditch effort to consolidate market share and will hurt, rather than help, shareholders.

Economic Earnings Decline Is Leading Indicator

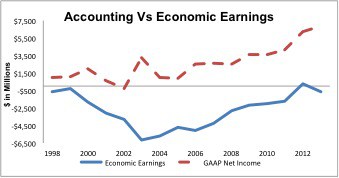

Figure 1 shows the disconnect between Comcast’s reported earnings and its economic earnings. With a bottom-quintile ROIC of just 6%, Comcast’s business is not as healthy as it may appear.

The company is in a very capital-intensive business, which means profits are very sensitive to margins. And margins are very sensitive to how the company prices its products.

When a company like Comcast loses pricing power, profits will drop quickly. It is easier to hide the loss of pricing power in accounting earnings than in economic earnings.

For example, $50 billion in total debt (40% of market cap), $32 billion in deferred tax liabilities and another $1 billion in pension underfunding help prop up EPS while real cash flows suffer.

Figure 1: Economic Earnings Lag Reported Earnings

Sources: New Constructs, LLC and company filings

The Beginning Of the End to Monopolistic Pricing Power

New online competitors like Netflix (NFLX), Hulu and Amazon (AMZN) along with offline competitors like Redbox are taking customers away from Comcast’s core cable TV business. Over the past fours years, CMCSA’s video customers have declined by 2% compounded annually.

Worse yet, CMCSA is losing its status as the only Internet provider in many areas. For a long time, that status allowed CMCSA to set monopoly-level prices on Internet services and then bundle in TV and voice to earn additional revenue. Now, Verizon (VZ) and AT&T (T) are offering internet services at very competitive prices in many areas where Comcast used to be the only game in town.

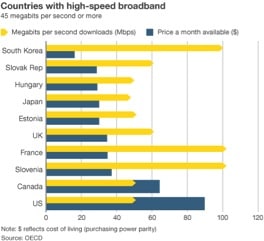

Longer term, Google (GOOG) looks like another very dangerous competitor. Google Fiber has been very popular in Kansas City, where it was first rolled out, and the company is looking at 34 potential new cities for expansion. Google Fiber offers much faster speeds at lower prices than either Comcast or Time Warner. Since Google has a vested interest in getting as many people using the web as fast as possible, they don’t have to worry about Fiber turning a profit. Already in Austin, where Fiber should be rolled out this year, Time Warner is boosting speeds without raising prices to avoid losing customers. Higher speeds at the same price means less pricing power and lower margins for Time Warner and Comcast.

Figure 2 shows just how much pricing power and profit margin CMCSA stands to lose in a more competitive market. In the rest of the developed world, download speeds are faster and prices are lower than in America. When more U.S. companies offer Internet services as cheap and fast as international companies, CMCSA will struggle to maintain its market share as well as its margins. The fact that both Comcast and Time Warner routinely rank at the bottom of customer satisfaction surveys suggests that many of their customers could move to other providers rather willingly.

Figure 2: Higher Quality and Lower Prices are Feasible

Source: OECD

Time Warner Acquisition Does Not Widen The Moat

Every problem I mentioned above is made worse by the acquisition of Time Warner Cable. For one, TWC has $26 billion in debt that CMCSA will now have to assume, increasing its debt load by about 50%. More liabilities mean less value for shareholders.

In addition, the acquisition will hurt Comcast’s already low ROIC. Combining TWC’s $26 billion in debt with the $45 billion purchase price, we get a total value of $71 billion for the acquisition. TWC’s 2013 after-tax profit (NOPAT) was $3.3 billion. If we divide the NOPAT CMCSA will acquire by the amount it’s paying, we get an ROIC of just 4.7%, which is below CMCSA’s already low 6% ROIC. CMCSA is overpaying for TWC’s cash flow.

The only way this merger can create value is if CMCSA expects to be able to achieve significant growth through synergies after the deal is finished. Currently, CMCSA management is guiding to $1.5 billion in pretax cost savings from the deal. While this sounds impressive, note that, as a condition of the deal, CMCSA must shed 3 million customers to appease antitrust concerns. At a NOPAT of ~$400/customer last year, that’s nearly $1.2 billion in after-tax profit CMCSA is sacrificing. Even if we assume CMCSA will be shedding their least profitable customers, the loss here should offset most of the projected gains from cost savings.

The only real winners in this deal appear to be CMCSA’s executives. As a stock for stock deal, it should boost all four metrics by which executive bonuses are calculated: revenue growth, operating cash flow, free cash flow, and operating profit. CMCSA executives will get large bonuses while shareholders will get a diluted stock with more liabilities on the balance sheet without any meaningful synergies. Ouch.

Priced For Growth

Whether or not the acquisition makes it past regulators, CMCSA shareholders are in trouble based on the current stock price. CMCSA’s valuation of ~$51/share implies that the company will grow NOPAT by 10% compounded annually for the next 13 years. It’s true that CMCSA accomplished that level of growth in the last decade, but, back then, the company had a rather wide moat around its business. Today, that moat is getting smaller every day as competitors like Verizon, AT&T, and Google storm the gates.

A more modest expectation for 6% NOPAT growth compounded annually for 15 years implies the stock is worth ~$35/share. Considering the weak competitive position of Comcast that scenario seems like big stretch to me.

Investors shouldn’t value CMCSA based on its past. The era of high profit growth and monopoly pricing power is over.

The Time Warner deal is a smokescreen for the fact that Comcast faces many problems to which it does not have an answer. The market already understands that CMCSA has overpaid, which is why the stock is down 5% since the acquisition was announced. And the price will drop further as the market catches on to the larger competitive issues that Comcast faces.

Avoid These Funds

Investors should avoid the following ETFs and mutual funds, as they allocate heavily to CMCSA and earn my Dangerous-or-worse rating.

- Fidelity Select Portfolios: Multimedia Portfolio (FBMPX): 9.3% allocation to CMCSA and a Dangerous rating.

- ICON Funds: ICON Consumer Discretionary Fund (ICCAX): 7% allocation to CMCSA and a Dangerous rating.

- Legg Mason Partners Equity Trust: ClearBridge Aggressive Growth Fund (SAGYX): 6% allocation to CMCSA and a Dangerous rating.

- iShares U.S. Consumer Services ETF (IYC): 5.1% allocation to CMCSA and a Dangerous rating.

- ProShares Ultra Consumer Services (UCC): 5.1% allocation to CMCSA and a Dangerous rating.

David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.

Comments

No Thumbs up yet!

No Thumbs up yet!