D: Should You Buy The Utility As An AI Power Play?

Image Source: Unsplash

Goldman Sachs sees data center power demand growing by 160% into 2030. But I think it’ll be more like 200% or more within the next few years.

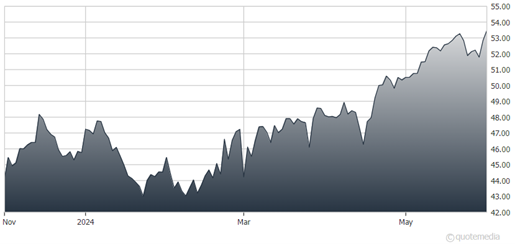

Dominion Energy Inc. (D)

If I had to pick, I’d take a hard look at Dominion because it’s got a lock on Virginia, which is currently home to 35%-40% of global hyperscale data center capacity, including facilities belonging to the biggies (Azure, AWS, and GCS).

The stock is down double digits from its high. But it pays a yield of nearly 5%. That is appealing as heck to dividend-hungry investors.

That said, my fav has roughly the same shareholder yield, but the dividend growth is considerably higher, stronger, and more consistent. Dominion could ride the AI hype wave, but then what? I want the stocks I buy to be there when I need ‘em.

You?

More By This Author:

Pending Home Sales Slump Amid Higher Rates, High Prices

NICE: An Israeli Technology Firm With A Bright Future

F5, Inc.: A Tech Stock With The Right Blend Of Conservative And Aggressive Attributes

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more