NICE: An Israeli Technology Firm With A Bright Future

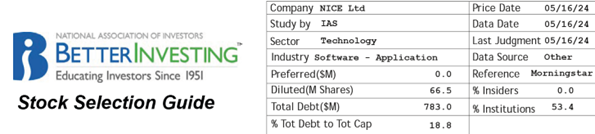

NICE Ltd. (NICE) helps businesses improve customer service, drive performance through data analysis, ensure compliance, and fight financial crime. Founded in 1986 as Neptune Intelligence Computer Engineering and renamed in 1991, the firm has built a customer base over the years of 25,000 organizations in more than 150 countries, including more than 85 Fortune 100 companies.

In 2023, 84% of sales were to the Americas region; 10% to Europe, the Middle East, and Africa; and 6% to Asia Pacific. NICE splits its business into Customer Engagement (CE) and Financial Crime and Compliance (FCC) segments.

Customer Engagement, 83% of 2023 sales, includes applications that manage real-time customer interactions over the telephone, in person, and through digital routes such as email and messaging. These applications serve call centers, back-office operations, and retail branches across business markets including communications, banking, insurance, health-care, and government.

The Financial Crime and Compliance segment provides solutions for real-time and cross-channel fraud prevention, anti-money laundering, brokerage compliance, and enterprise-wide case management. NICE applications monitor millions of financial transactions daily, enabling customers to mitigate the risk of financial crime, improve compliance, and reduce operational costs. Customers include some of the world’s largest financial institutions and regulatory authorities.

Shares have been weak lately. With headquarters in Israel, investors are concerned about a wider Middle East conflict. However, the company is global with substantial operations in the United States, Europe, and Asia Pacific.

Further, investors must be puzzled by the surprise decision of CEO Barak Eilam, age 49, to step down at the end of 2024 after 25 years with the business, the last 10 as CEO. The firm’s growth runway supported by AI looks promising. A CEO leaving a successful business without explanation isn’t going to be viewed positively by the market, at least in the short term.

Analysts expect NICE to grow non-GAAP EPS at an average annual rate of 15%. But the firm should be able to grow GAAP EPS more rapidly as amortization and employee stock compensation charges recede.

Five years of 18% GAAP EPS growth multiplied by a capped high P/E of 35 generates a high price of 443. If achieved, this would represent annual compound growth of 17% for the shares. 2023 GAAP EPS of $5.11 multiplied by a capped low P/E of 25 generates a potential low price of 138. We model the upside/downside ratio as 3.8 to 1.

Recommended Action: Buy NICE.

More By This Author:

F5, Inc.: A Tech Stock With The Right Blend Of Conservative And Aggressive AttributesStocks Seeing Relentless Buying Pressure; Bonds Are Not

General Electric: The Re-Constituted And Re-Invigorated Dividend Play

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more