CYS Investments: A Look Under The Hood

In this column, we discuss CYS Investments (CYS) which recently reported earnings. In this piece, we take a look under the hood and hone in on 3 critical metrics. First, we look at prepayments, which hurt net interest rate spreads and subsequently net interest income. We then focus on the net interest rate spread and finally take a look at book value.

Prepayments

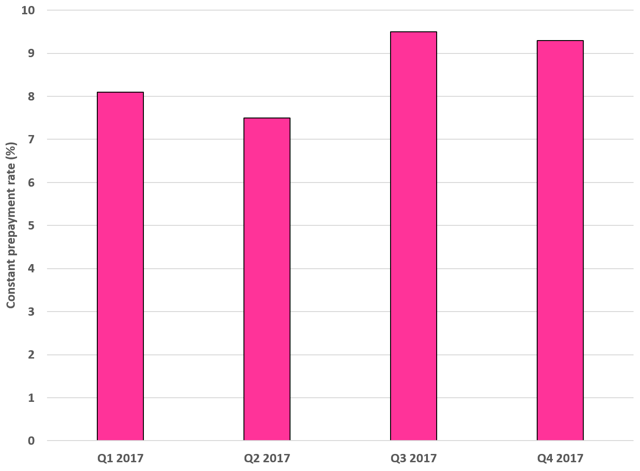

Several key metrics played a big role in these earnings figures. First, total interest income increased to $81.4 million. Total interest income had been on the decline for two years plus, but this was the fourth quarter in a row of improvement here on this metric. So that is definitely a positive. Prepayments were a strong reason for the declines we saw prior to 2017, so it is positive to see the trend reverse. Here is what the constant prepayment rate has looked like in 2017:

Source: SEC filings

We were slightly surprised that with prepayments rising that interest income rose in the latter half of the year but surmised this was because of portfolio re-weighting to higher-yielding assets. Prepayments certainly are way down from 2016. However, we realized that yields were actually down. The rise in interest income was instead due to an increase in average settled debt securities in total, while yields were lower. The prepayments helped weigh on yields, and the interest rate spread.

Net interest rate spread

The average cost of funds has been on the rise in the sector and here in Q4 it rose by 3 basis points for CYS. It came in at 1.43%, up from 1.39% in Q3. We want to point out that the first quarter in 2017 saw costs of funds of just 0.92%. These rises are due in large part to the Fed rate hike. Average yields were down as well. This is the classic double whammy. Average yields came in at 2.73%, down from 2.79%. With these moves in yields and costs, the spread was pressured. The spread, net of hedge including drop income, was 1.20% for Q4 2017. Let the record reflect that this is down 37 basis points compared to 1.57% in the first quarter of 2017. One good piece of news? Book value has been strong.

Book value

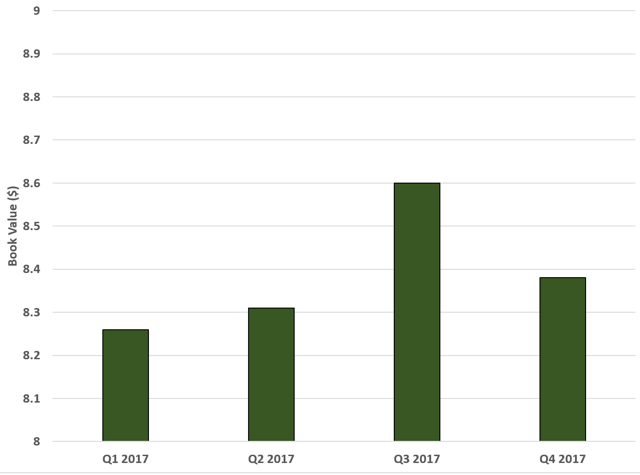

With the motion in rates at the end of the year, there were certainly adjustments made that will impact the company in 2018. The value of the company is stable overall for the year, but was volatile and is on the decline again. Take a look at the book value in 2017:

Source: SEC filings

This volatility is exactly one of the reasons we cautioned you to avoid the name. We were clear that a premium valuation on this name was inappropriate. The book value, while volatile, has been strong when we consider it was up $0.05 on the year. We suspect, however, that with interest rates rising, fair value on the portfolio will suffer in 2018. Be warned.

That said, we are less bearish now because, at $8.38 per share, and the stock at $6.60 at the time of this writing, the premium has been eradicated. So, a lot of downside has occurred, in part due to weakness in the sector overall. However, the Street is baking in continued weakness and we believe this is appropriate.

Quad 7 Capital has been a leading contributor with various financial outlets since early 2012. If you like the material and want to see more, scroll to the top of the article and hit ...

more