Cutting Your Way To Prosperity

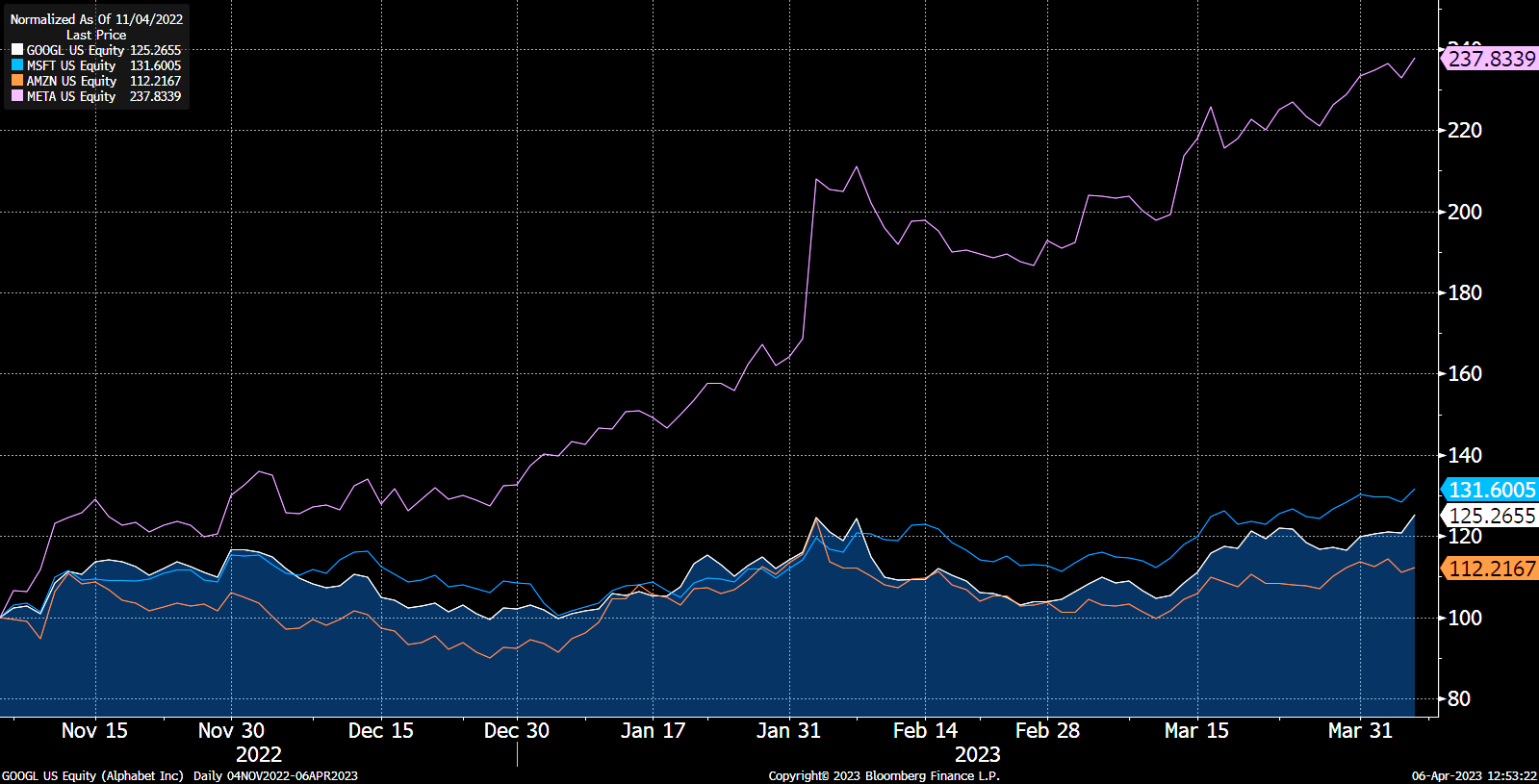

Having lived in Seattle for 40 years, I had a front-row seat as Microsoft, Amazon, Google and Facebook hired tens of thousands of young tech employees. In the period between 2010 and 2020, buildings were built, apartments were built and prosperity put the city on top of the world. From 2017-2020, more large building cranes were in operation in Seattle than in any other city in the U.S., even though Seattle only ranks 17th in the population today. As those employees were being hired and those buildings were being built, here is what those four companies did in the stock market:

(Click on image to enlarge)

Source: Bloomberg.

As you can see, the stock market celebrated hiring all of those folks with a vision of uninterrupted growth.

Now the hiring has become firing in the last six months and here is what those stocks did:

(Click on image to enlarge)

Source: Bloomberg.

Can the biggest tech companies cut their way to prosperity?

In a prior era, the 1980s and 1990s, a huge amount of physical and financial assets had accumulated on the balance sheets of large American companies. Corporate raiders and leveraged buyout firms (private equity firms) stepped in and forced better usage of those assets. However, by the 1990s most of the low-hanging fruit had been taken. Late in the era, a sculldugger of a CEO, Al Dunlap, took Sunbeam and other companies over the edge. The media quickly turned on the methodology and they suddenly joked that “you can’t cut your way to prosperity.”

Now let’s throw the Silicon Valley Bank, Signature Bank and First Republic Bank difficulties into the mix. There is a massive contraction in financing and confidence in the startup/younger tech companies as a consequence of these difficulties. Who are the vendors to these startup/up-and-comer companies? These entities are using cloud services and digital ads to get up and running and they are paying for that with venture capital. We believe that funding is drying up! We see a steady stream of bad news for the stock market as the light shines on this subject.

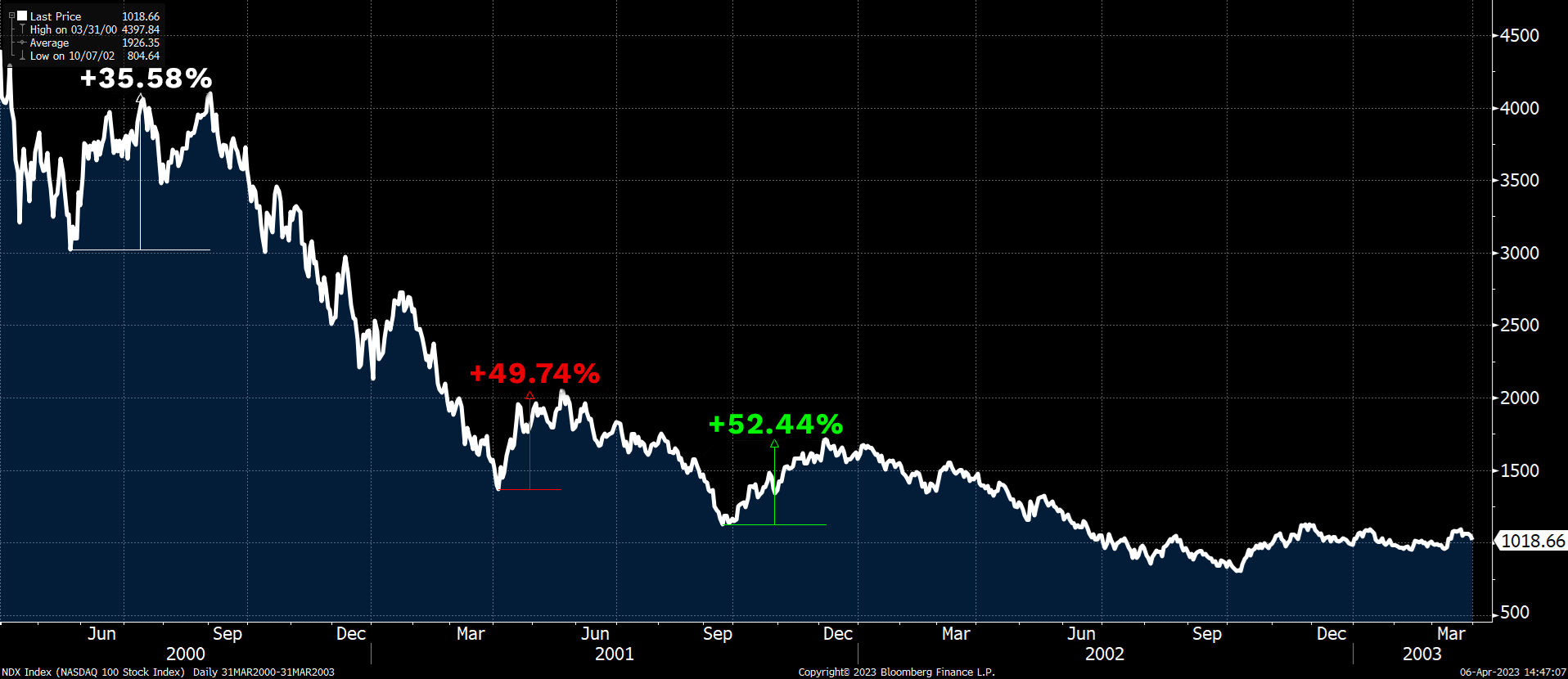

We were curious what the bear market rallies of the bear market that followed the DotCom Bubble from early 2000-2003 looked like. Here were the percentage gains in the Nasdaq 100 bear market rallies, where investors lost 81% from peak to trough:

(Click on image to enlarge)

Source: Bloomberg.

Here is the chart of what has happened since this bear market in the Nasdaq 100 started in November of 2021:

(Click on image to enlarge)

Source: Bloomberg.

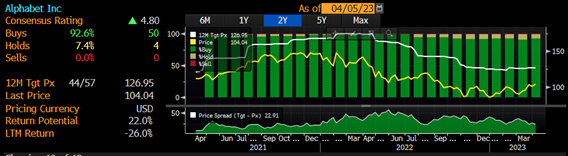

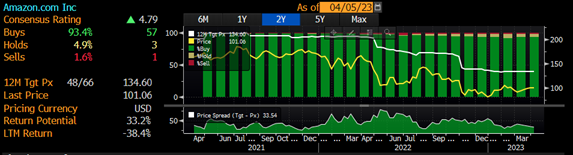

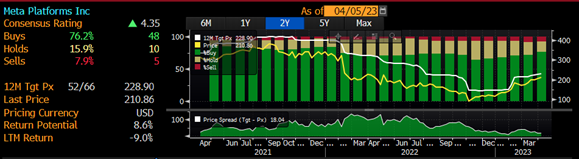

What must happen to make these stocks attractive to investors like us? First, their difficulties need to be exposed and scrutinized. Second, professional and individual investors need to sell the dips rather than buy them. Lastly, the analysts which follow these companies need to come off their nearly-universal bullishness as seen below:

(Click on image to enlarge)

Source: Bloomberg.

(Click on image to enlarge)

Source: Bloomberg.

(Click on image to enlarge)

Source: Bloomberg.

(Click on image to enlarge)

Source: Bloomberg.

Charlie Munger said, “This is the biggest financial euphoria episode of my career [75 years] because of the totality of it.” It would only make sense that this episode would die harder than any other prior euphoria episode. And, for that reason, fear stock market failure.

More By This Author:

Musings From Buffett’s Letter

Drilling For Oil On The NYSE

Happy Days Are Here Again

Disclosure: The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and ...

more