Musings From Buffett’s Letter

There were many good things to think about from Warren Buffett’s letter to shareholders which came out recently. In this piece, we’d like to drill down on two subjects that Buffett highlighted.

“Warren and I hated railroad stocks for decades, but the world changed and finally the country had four huge railroads of vital importance to the American economy. We were slow to recognize the change, but better late than never.”

The railroads were affected by the economy, but when it got down to four players, the behavior of the players and the position of the largest player became very favorable to Warren Buffett and Charlie Munger. The economic “importance” created strong economics for investing.

The home building industry has changed dramatically in the aftermath of the liar loans and investment mania of 2003-2006. Hundreds of thousands of houses were built into unfavorable demographics and the failure of prices in 2007-2009 poisoned the financial system. Never let a good crisis go to waste, a political strategist once said.

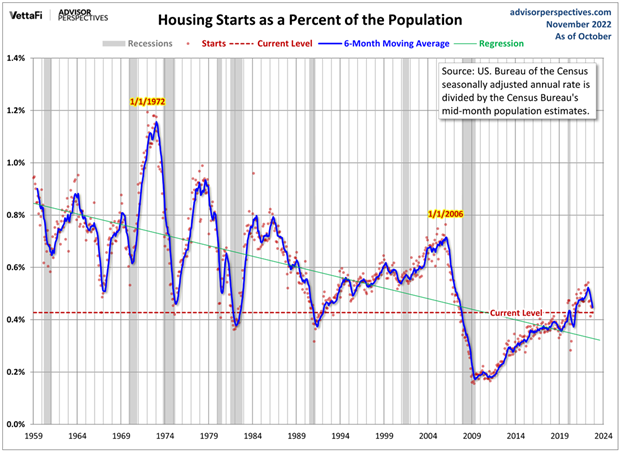

Out of that debacle came the biggest housing depression since the 1930s. We only built 310,000 homes in 2010 in a 300-million-person U.S. economy. As you can see below, this was a legendary low point in a home building divided by population:

Source: Source: Advisor Perspectives as of October 31, 2022.

The low point in home builds flushed the nation of small-time/Mom and Pop builders. The second thing it did was convince the largest builders, D.R. Horton (DHI) and Lennar (LEN), that NVR’s (NVR) strategy of buying lots in the late stages of development via options was superior to leveraging their own balance sheet to develop raw land. Eliminating the leverage in downcycles takes a great deal of cyclicality out of the equation.

We have been quick to recognize these changes in what used to be a horribly cyclical business. Horton had a 1% share of the market in 1994 as the nation’s largest home builder. Today, they will likely build over 10% of the homes and Lennar could hit 8%. Throw in NVR’s 2.5% market share and we build over one in five U.S. homes. A massive wave of Americans will go through the first-time home-buying phase in the next ten years and our home builders could feast on their demand. With the difficulty created by the Federal Reserve Board tightening and the dominance the home builders have with skilled laborers (mostly union), we expect these behemoths to gain market share as the industry fragmentation disappears as it did for the railroads.

“Patience can be learned. Having a long attention span and the ability to concentrate on one thing for a long time is a huge advantage.”

When Warren started his partnership, he had a huge competitive advantage via superior education at Columbia with Ben Graham and access to superior information. When computers made the information available to everyone, Warren and Charlie switched to the algorithm called experience. They made better decisions with the same information that everyone had and chose to make fewer total decisions while applying more capital to each idea.

Having spent nearly 43 years in the investment business on my part, and exposure to the business for my co-portfolio manager of nearly 20 years, we can look back on economic history, and our own actual experiences and make decisions. If we apply the kind of patience that Warren and Charlie have applied and recognize the “rhymes” with past situations, we believe we will avoid the mistakes caused by financial euphoria and thinking that “it is different this time!” Hopefully, we will help our investors avoid stock market failure in the process.

More By This Author:

Drilling For Oil On The NYSE

Happy Days Are Here Again

Recession Fear Investing

Disclosure: The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and ...

more